Helpful tips for your first time logging in to Atlantic Union Bank Online and Mobile Banking

In an effort to further assist in your transition from Sandy Spring Bank to Atlantic Union Bank (AUB), below are some helpful Online and Mobile Banking tips for your first login.

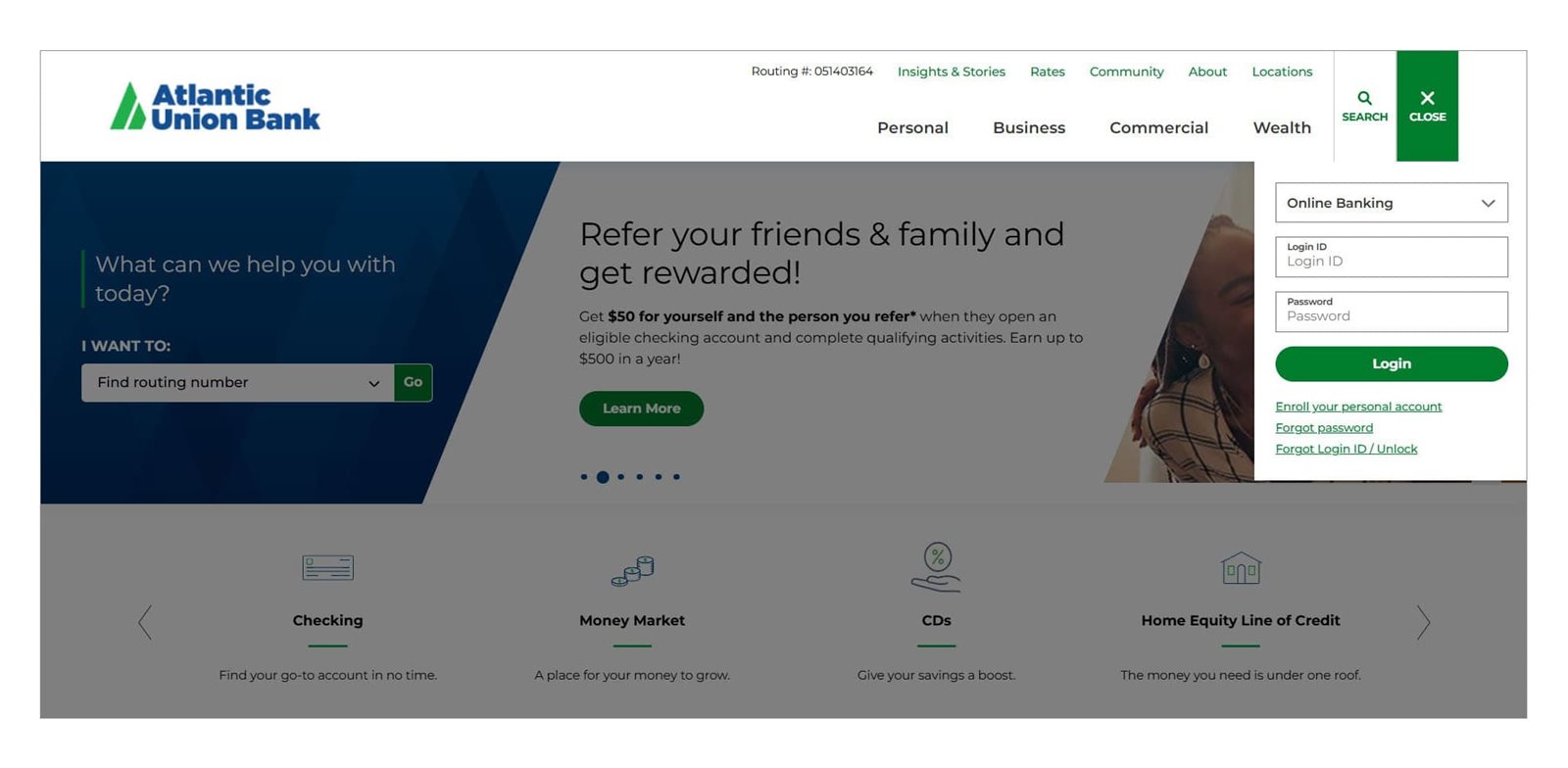

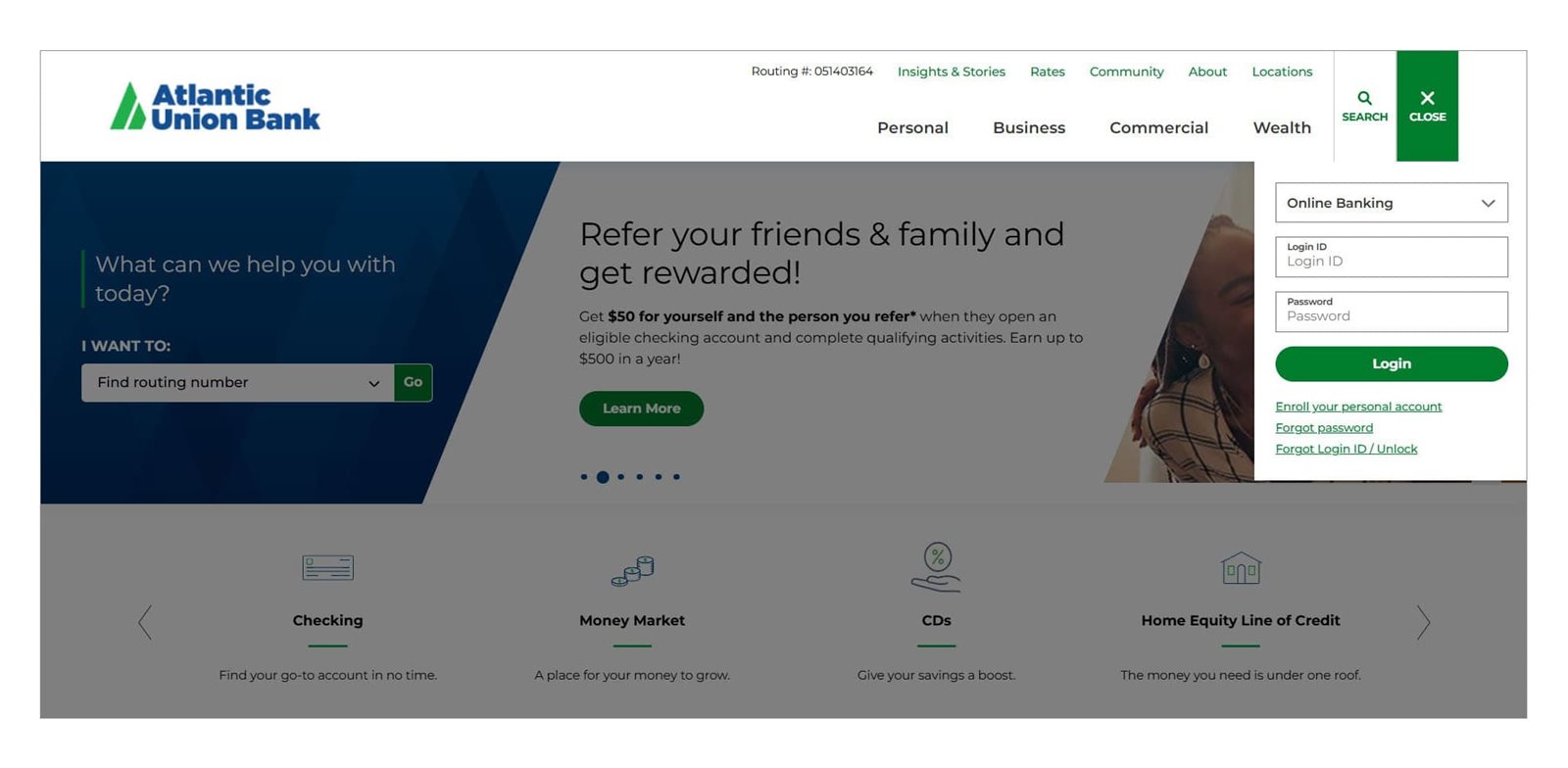

Logging in to Online Banking

- Go to AtlanticUnionBank.com and click LOGIN in the top right corner. Online Banking will automatically populate.

- Use your company ID, username and password and click “LOGIN”.

- For added security, you’ll then be asked to verify your identity by entering a one-time security code provided to you by email, text message or a phone call.

- Upon your first login, you’ll be prompted to change your password.

Be sure to confirm your contact information by October 10. To confirm,log in to Sandy Spring Bank's Business Online Banking (Desktop) and go to “Administration” and then “Self Administration” and then select “Personal Preferences” to confirm or edit.

If the phone number and email in the system are not current, you may have trouble logging in and will need to visit a branch or call into our Customer Care Center at 800.990.4828 to verify your identity and have your contact information updated.