Frequently Asked Questions

We don't want you to miss a beat while managing your accounts.

Below are the answers to Frequently Asked Questions (FAQs) about the transition to Atlantic Union Bank, as well as some details for your Atlantic Union Bank accounts. We're working to minimize, or avoid, any disruption to your normal routine.

Deposit Account FAQs

Personal Loan Account FAQs

Atlantic Union Bank Attn: Payment Processing

P.O. Box 71120

Charlotte, NC 28272-1120

For Online Bill Pay, please remember to update any automatic payments that are mailed to the bank to reflect this address.

Personal Online and Mobile Banking FAQs

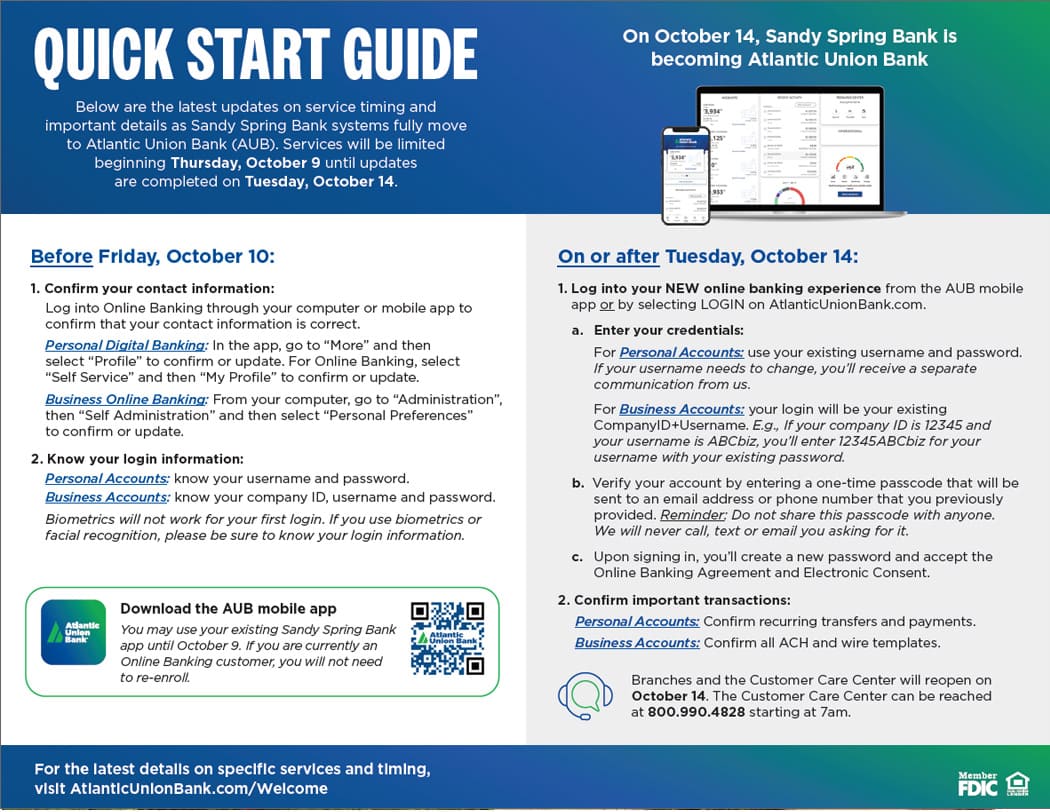

Log in to your Atlantic Union Bank Personal Online Banking account starting Tuesday, October 14.

To adjust your delivery preference, select "Statement Delivery Preferences" within the Service Center of your Online Banking.

You'll be able to access Online Banking starting Tuesday, October 14. Prior to this, please ensure your phone number and email contact information are current. This will help ensure a smooth log in experience.

From the web:- Go to AtlanticUnionBank.com

- Click the LOGIN box and select “Online Banking.”

- Enter your username and the password and click “Log In.” We will send you specific details about your username, if it needs to change, and your password as we get closer to welcoming you to Atlantic Union Bank.

Reach out to the Atlantic Union Bank Customer Care Center starting Tuesday, October 14, at 800.990.4828 Monday through Friday, 7am to 8pm ET, and Saturday, 7am to 5pm ET.

If you have logged into Online Banking, you may use the chat feature within Help and Support.

Business Loan Account FAQs

Starting October 10, please mail payments to:

Atlantic Union Bank

Attn: Payment Processing

P.O. Box 71120

Charlotte, NC 28272-1120

For Online Bill Pay, please remember to update any auto-payments that are mailed to the bank to reflect this address.

Business Online and Mobile Banking FAQs

Please update incoming wire instructions with the routing transit number for Atlantic Union Bank - 051403164. We will continue to accept wires using the Sandy Spring Bank routing transit number.

Incoming Foreign Wire Instructions

For incoming foreign wires, there is no immediate need to change your incoming foreign wire instructions, as your current incoming wire instructions will still work. However, we encourage you to update your incoming foreign wire instructions. Please follow this link for Atlantic Union Bank's wire instructions.

As Sandy Spring Bank (SSB) customers move to Atlantic Union Bank's Online Banking platform, your connectivity to Quicken and QuickBooks will be affected. If you are a Quicken or QuickBooks user, you will need to update the connections to your accounts in the associated programs to prevent any disruption.

Important Action Steps for Direct Connect Users:

Once your SSB Online Banking profile has transitioned to AUB’s Online Banking platform on 10/14/2025, complete the following three steps in order:

- Complete a login to your new Online Banking profile.

- Log into Quicken/QuickBooks and deactivate connections that are currently set up to pull bank feeds.

- Log into Quicken/QuickBooks to set up new bank feed connections and add accounts, as needed. When connecting your new bank feed, search for “Atlantic Union Bank” and select “Atlantic Union Bank” as the bank feed connection.

If you do not take action to deactivate your accounts from the existing bank feed connections, you may encounter errors and disruptions in syncing transactions.

NOTE: Do not attempt to reactivate Quicken or QuickBooks feeds until you have logged into AUB’s Online Banking platform.

NOTE: QuickBooks Desktop Users – If you receive a "Bank Feed Error", verify under Banking>Bank Feeds>Change Bank Feeds Mode>Company Preferences – in the Bank Feeds section – that "Advanced Mode" is selected.

Important Action Steps for Web Connect Users:

By 10/9/2025, complete a transaction update. Once your Online Banking profile has transitioned to AUB’s Online Banking platform on 10/14/2025, complete the following three steps in order:

- Log into your new Online Banking account.

- Export desired transaction data using appropriate file type, and save to local device.

- Log into Quicken/QuickBooks to import downloaded transaction files (.qfx or .qbo files)

For some helpful information to ensure your Quicken and QuickBooks reconnects successfully, visit our online Quicken and QuickBooks help page.

You’ll also need to download Symantec VIP if you use a soft token today.

Download iPhone® App

Download AndroidTM App

If you use a hard token, we’ll send you a new one.

To adjust your delivery preference, select "Statement Delivery Preferences" within the Service Center of your Online Banking.

Yes. To ensure a seamless experience:

- Review and update your RDC users and contacts. Confirm that all listed users are current and authorized.

- Communicate any changes to your Relationship Manager so updates can be made promptly.

- Stay informed. We are sending important communications throughout the integration process. Keeping your contact information up to date ensures you receive all relevant updates.

- Maintain open communication with your Relationship Manager for any questions or concerns.