Personal Banking

Welcome Sandy Spring Bank customers. We're glad you're here!

Helpful tips for your first time logging in to Atlantic Union Bank Online and Mobile Banking

In an effort to further assist in your transition from Sandy Spring Bank to Atlantic Union Bank (AUB), below are some helpful Online and Mobile Banking tips for your first login.

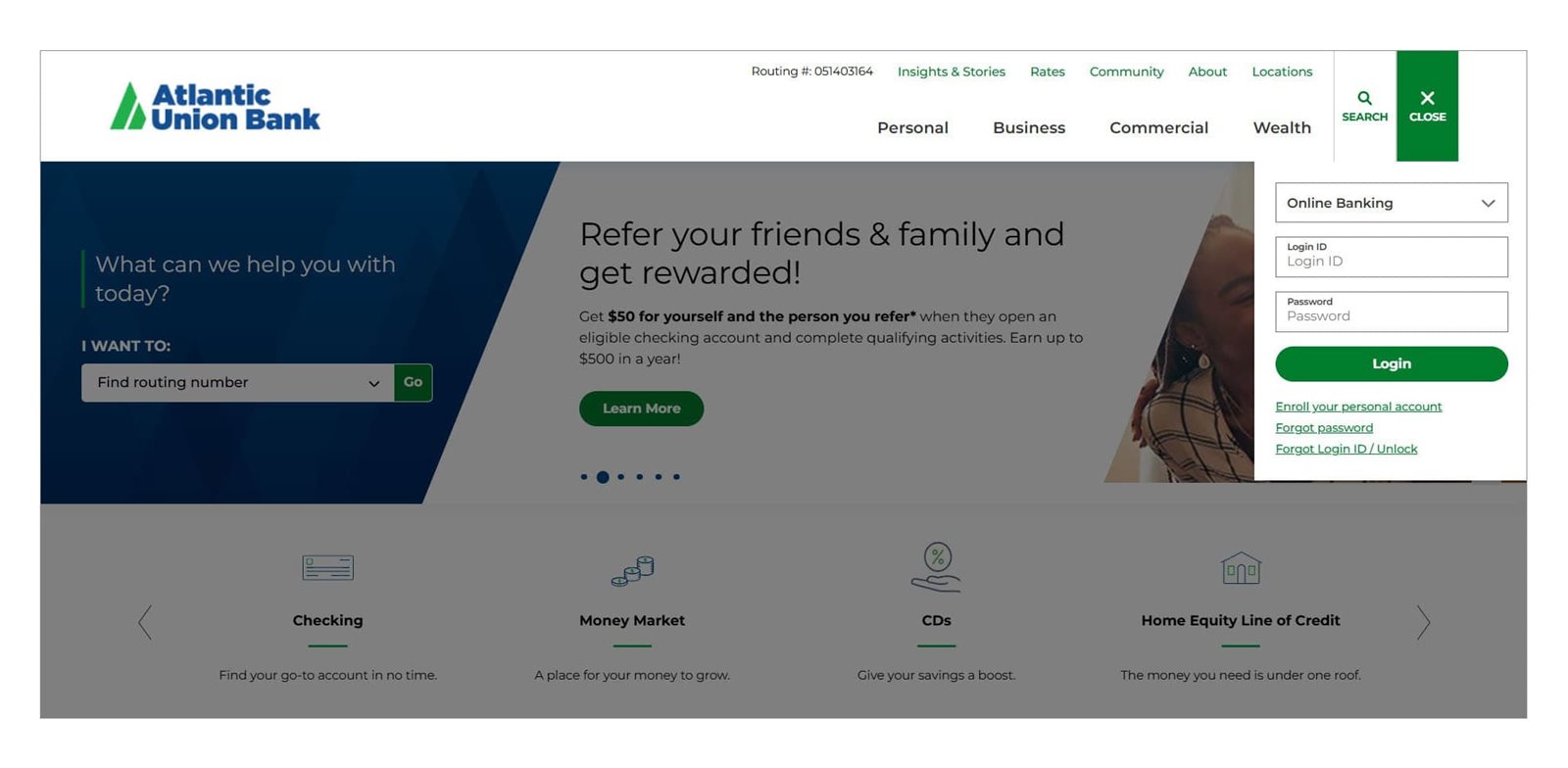

Logging in to Online Banking

- Go to AtlanticUnionBank.com and click LOGIN in the top right corner. Online Banking will automatically populate.

- Use your existing username and password and click “LOGIN”.

- For added security, you’ll then be asked to verify your identity by entering a one-time security code provided to you by email, text message or a phone call.

- Upon your first login, you’ll be prompted to change your password.

Be sure to confirm your current contact information by October 10. To confirm, log in to Sandy Spring Bank's Online Banking through your desktop or mobile app to confirm that your contact information is correct.

- For Personal Mobile Banking (app), go to "More" and then select "Profile" to confirm or update.

- For Personal Online Banking (Desktop), select "Self Service" and then "My Profile" to confirm or update.

If the phone number and email in the system are not current by October 10, you may have trouble logging in and will need to visit a branch or call into our Customer Care Center at 800.990.4828 to verify your identity and have your contact information updated.

Personal Banking Transition Checklist

We’ll do most of the work, but there are a few things you’ll need to take care of:

IMPORTANT INFORMATION ABOUT YOUR PERSONAL BANKING ACCOUNTS

Deposit Account Updates:

- Account numbers won’t change unless we contact you directly.

- You can continue to use your Sandy Spring Bank checks. Please contact us when you want to reorder.

- Starting October 13, begin using only your Atlantic Union Bank debit card.

- Routing number will change to 051403164.

- Direct deposit and automatic drafts will continue as scheduled.

- A final statement from Sandy Spring Bank will be mailed to you even if you're enrolled in electronic statements. Electronic statements will then begin again for your next statement cycle, if enrolled.

Frequently Asked Questions:

You must continue to use your Sandy Spring Bank debit or ATM card until October 13. You will receive a new Atlantic Union Bank debit card with information about how to activate it before the October systems conversion.

There may be some changes to your account. We’ve done our best to keep your experience very similar to what you have today. Details of your product changes are included in the Consumer Deposit Account Disclosure Guidebook and the Business Deposit Account Disclosure Guidebook. If you have a deposit account, you will receive a letter and Guidebook in the mail detailing the difference between your current Sandy Spring Bank account(s) and your new Atlantic Union Bank account(s). Your new account benefits and features are effective October 14, 2025.

In most cases, no. You may continue to use your account as you do today. If there is a change, you will be contacted directly. If you have a debit card, that number will change. More information will be shared closer to the conversion in October.

No, you may continue to use your Sandy Spring Bank checks until you run out. Contact Atlantic Union Bank when you are ready to reorder.

You don’t need to do anything except verify them. Existing direct deposit and automatic drafts will continue as scheduled unless your account number changes. You will be notified directly if your account number is subject to change.

No, you will not need to re-enroll. Current Online Banking users will be able to use Atlantic Union Bank’s Online Banking starting October 14. More information related to your first login will be sent closer to conversion in October.

Most usernames will remain the same. If your username must change, we will contact you via email and mail closer to the conversion in October.