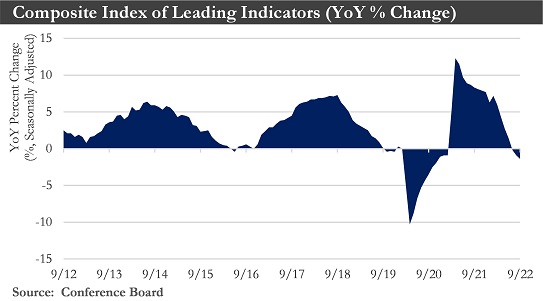

The current resilience in economic activity does not preclude an eventual recession. The Leading Economic Index declined in September and has continued to indicate the U.S. economy is headed for recession. Decades-high inflation, tighter policy, and recession concerns have weighed on consumers’ perceptions, but households have yet to meaningfully demonstrate these concerns in their spending decisions. Consumer spending has remained resilient, and the economy has not yet entered a recession, but the leading index indicates one is on the way.

However, it is less likely that a recession would start by the beginning of next year. A recession is now expected to begin in the second quarter, as the lagged effects of more restrictive monetary policy have affected consumption and weighed on the ability of firms to hire. An important consideration has been that the economic trade-off for growth has been the potential for a worse hit to households later. Consumers have increasingly relied on their balance sheets to spend with wage gains not keeping pace with inflation. The longer that lasts, the larger the deterioration in household finances.

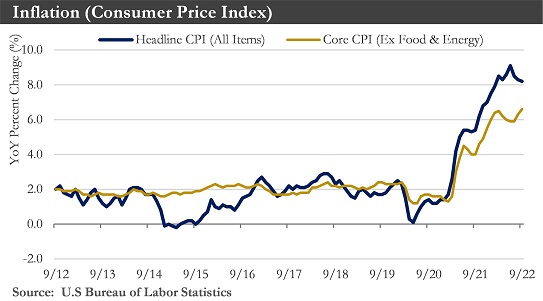

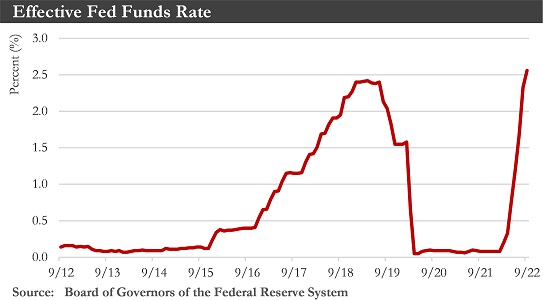

Persistently high inflation and rising interest rates have moderated economic activity. While the headline consumer price index has cooled slightly, measures of core inflation have been running at an uncomfortably strong pace. In response, the Fed has now raised the effective federal funds rate by 75 bps in each of the past four FOMC meetings, and Committee members have made it abundantly clear that they will continue to tighten monetary policy until price pressures have meaningfully abated. A period of below-trend real GDP growth and a higher unemployment rate would be needed for them to be successful in this endeavor.

The odds of a recession coming to fruition have appeared to be increasing. Higher financing costs have weighed on capital investment. And while it has been strong recently, there has been a downshift in job growth and businesses are likely to slow hiring even further as rising cost pressures crimp profit margins. What is more, consumer spending has appeared set to pull back as inflation has diminished purchasing power and taken an increasingly larger bite out of household savings. The relative strength of both household and corporate balance sheets will likely result in a relatively shallow and short-lived downturn in real GDP.

Inflation: Inflation has continued to trend well above the desired rate. Consumer prices rose 0.4% in September from August. On a year-over-year basis, the consumer-price index decelerated to an 8.2% increase, from 8.3% in August. But core prices rose 0.6% in September from August, and by 6.6% on a year-over-year basis, which was a new four-decade high.

However, there have been signs that the commodity price shock and supply chain problems that were behind the initial surge have abated - cooling some of the supply-side pressure. The Fed has also stepped up to the plate, raising interest rates at a brisk clip to temper the demand-side source of inflation and keep expectations for future price gains anchored. These factors should help cool inflation in the coming quarters.

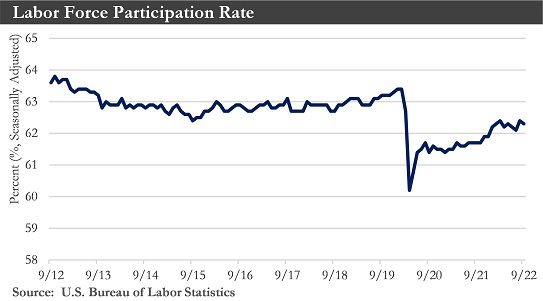

Labor Market: The labor market continued a gradual cooling pattern as high inflation and rising interest rates have weighed on the economy. U.S. employers added 263,000 jobs in September. The unemployment rate fell to 3.5% from 3.7% in August matching a half-century low that was last reached in July, a reflection of people leaving the job market. Wage growth moderated slightly but has remained well above rates that are consistent with the Fed's 2% inflation target.

The labor-force participation rate dipped in September. That could complicate the Federal Reserve’s inflation fight since the labor market needs more workers competing for jobs to help cool wage growth and boost overall productivity. While the labor force participation rate could edge modestly higher over the remainder of the year, aging demographics would suggest there is not a lot more room to run, and the participation rate could peak by early 2023.

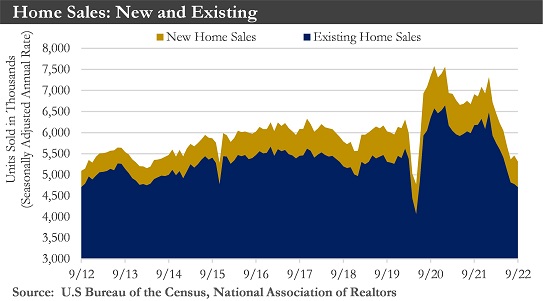

Housing Market: The housing market has weakened, with existing home sales having now declined for eight consecutive months. Existing home inventories have remained stubbornly low. There are several reasons for this including a general housing shortage and less incentive for homeowners to move given higher mortgage rates. Also, reduced affordability has continued to function as a headwind on consumer demand for housing. Meanwhile, building permits, a forward-looking indicator that leads housing starts by a couple of months, plummeted in August and September. The drop in permits reflected the ongoing trend of builders tapping the brakes on construction in response to weaker demand and rising financing costs.

The loss in purchasing power due to higher mortgage rates has been sharp and significant, with mortgage payments for a median-priced home up over 50% from a year ago. Wages have not kept pace with this increase, while inflation has continued to take a sizable bite out of consumers’ wallets. These factors, together with an expected softening in labor market conditions in the months ahead, would suggest that the headwinds facing the housing sector will persist for some time and likely lead to a further decline in home prices.

Holiday Sales in 2022: Despite the pandemic, holiday sales grew at a historic pace for the 2020 and 2021 holiday seasons. This year, with the pandemic fears now largely in the rearview mirror, consumers could look forward to a more typical holiday shopping season.

Holiday sales will likely rise about 6% over last year. Cash reserves that households built up during the previous two years have begun to decline, a sign that could indicate consumer staying power has started to wane. Household finances have recently taken a hit with a lower saving rate and declining after inflation wages, posing a possible downside risk to holiday sales activity in the coming months.

Consumers in the 2020 and 2021 shopping seasons faced limited competition for their dollar with dining out and other services spending largely off the table. This coming season, however, these same consumers could look to resume holiday travel and other services spending amid a period of historically high inflation.

The price-taking consumer from the past two seasons could give way to the deal-hunting consumer this year, a sentiment that could be at odds with retailer plans looking to pare back the blockbuster Black Friday deals of years past.

Manufacturing: One sector which has shown clear signs of slowing is manufacturing, with the ISM Manufacturing PMI quickly approaching the contractionary territory. The index dropped by 1.9 percentage points to 50.9 in September, reaching its lowest level since May 2020. Slowing demand was a leading contributor to the lower reading, with both new orders and new export orders contracting. Some of this demand has shifted into the service sectors, with the ISM Services PMI remaining well in expansionary territory, though it too has shown some signs of slowing. While the reading for September was slightly above expectations at 56.7, a slowdown in the backlog of orders as well as new orders could be indicative of the early signs of peak demand for services.

Monetary Policy: The solid employment report as well as the uncomfortably high inflation rate in September kept the Federal Reserve on track to approve another large interest-rate increase at its meeting in early November as they seek to lift borrowing costs high enough to soften the labor market and ease inflation pressures. Last year, the Fed believed that prices were being driven up by supply-chain bottlenecks and strong demand fueled by government stimulus. But they have become concerned now that tight U.S. labor markets could sustain higher prices in the years to come, even if energy prices declined and prices fell for goods that soared over the past year, such as used cars.

The Fed lifted rates by 0.75 percentage points at each of its past four meetings, bringing its benchmark federal-funds rate to a range between 3.75% and 4.00% - the most rapid pace of increases since the 1980s. To continue to slow spending, investment, and hiring the Fed raised rates by another 0.75 points. The Fed could also delay an anticipated slowdown in the pace of rate rises after that. Another possibility could be that rates would need to rise to even higher levels early next year than what policymakers and investors had previously anticipated.

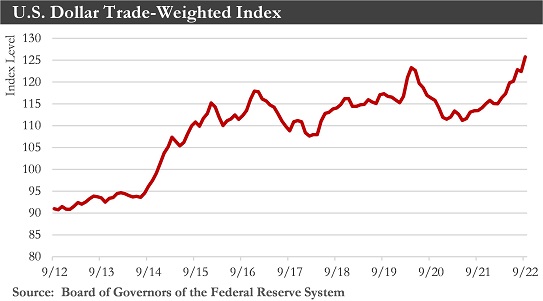

U.S. Dollar: Given the outlook for the U.S. recession and a quicker end to the Fed tightening cycle at a slightly lower rate than expected the outlook for the U.S. dollar has also changed. The dollar should still gain against most foreign currencies through 2022 until early 2023 as the Fed tightens more quickly than most foreign central banks. However, that shorter Fed rate hike cycle, accompanied by U.S. recession and followed by Fed easing, would translate into a peak in the U.S. dollar by Q1-2023. Beyond that, the dollar should soften gradually during most of 2023.

Global: The global economy has continued slowing and there has been no single factor behind the lethargy. This could be due to the effects of inflation, the Ukraine crisis, the slowdown in China brought on by frequent COVID-19 lockdowns, and problems in its property sector. In Europe, an energy crisis has battered household finances and weighed on industrial output. China has been reckoning with the fallout of its real estate slowdown and strict COVID controls.

Among the hardest-hit nations have been emerging markets and developing economies that relied on increasingly costly imported fuel and commodities. Many were already struggling with large debts following pandemic-linked economic slumps and a period of easy money fueled by low-interest rates. Now, slowing growth, rising U.S. interest rates, and the strengthening U.S. dollar have further squeezed these nations, stoking worries about the potential for a debt crisis in low- and middle-income countries.

Monetary authorities around the globe have their work cut out for them, with increasing questions on whether they can pull off a soft landing: reduce demand enough to wrestle inflation down from 40-year highs, without crashing their economies into a deep or prolonged recession.

Outlook: Geopolitical tensions, elevated market volatility, and the fastest pace of central bank tightening in decades are meaningful economic headwinds contributing to an unusually uncertain environment. A recession is likely to strike across developed markets and elevated inflation is likely to stick around. Central banks are in a miserable position, having to address inflation while growth is already at risk.

Prospects for global economic growth remain dim. The global economy will likely grow just 2.2% this year. Global growth of 2.2% would mark one of the slowest paces of growth for the global economy in the past few decades and an expansion that would be well below the long-term average growth rate.

Persistently high global inflation and aggressive central bank tightening are the root causes of a more pessimistic view of the global economy; however, a sharp slowdown in China's economy is also contributing to slower global growth.

Developing nations face an extremely challenging near-term outlook, as the sharp slowdown in global growth raises the risks of a prolonged recession. The challenges for the developing world are shaped by higher food, fertilizer, and energy prices caused by the war in Ukraine, as well as rising interest rates, currency depreciation, and capital outflows, which could result in a shortage of funds needed to support people’s lives and economic activities.

While growth prospects are deteriorating sharply for wealthier economies including the European Union and China, developing countries confront additional risks: Policies adopted by advanced economies to address inflation and the economic slowdown could leave insufficient capital for poorer nations.

The risks to growth remain unusually large. Among them are central banks' potential miscalculations as they raise interest rates to battle inflation, further U.S. dollar appreciation, more unexpected increases in energy and food prices, and reduced natural-gas supplies from Russia to Europe. A banking crisis in China triggered by the property sector and a resurgence of COVID-19 or new global health scares would also be potential risks.

Sources: Department of Commerce, Department of Labor, Institute for Supply Management, Morningstar, Bloomberg

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.