There could be lasting economic consequences with financial market conditions tightening in recent weeks. Credit growth to the non-financial sector could downshift, exerting headwinds on U.S. GDP growth in coming quarters. Lingering uncertainty should keep credit spreads wider in the coming weeks and months, and many banks could tighten lending standards, at least in the near term.

U.S. real GDP is expected to contract at least 1.0% later this year and into early 2024. Businesses are expected to hold back fixed investment spending in coming quarters and will likely start downgrading hiring plans. A vicious cycle could take hold in which tighter financial conditions lead to slower growth, further monetary tightening, then even slower growth, and so on.

Bank Failures Raise Recession Odds: Banking-sector turmoil has raised the odds that the U.S. economy, already widely seen as prone to recession, might tip into one.

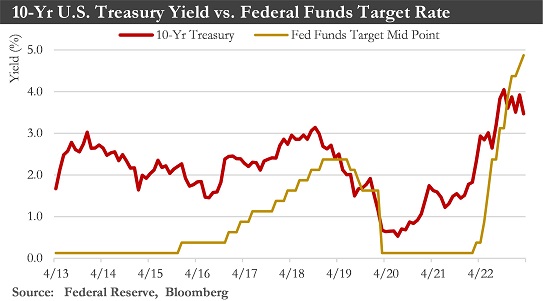

Will the quick tightening result in a recession or a soft landing? To combat decades-high inflation, the FOMC has raised rates the fastest since the 1980s. At present, underlying strength in the labor market and inflation have suggested the committee has room to raise rates even further. At the same time, recent developments in the financial sector could have lasting consequences in the form of wider credit spreads and tighter lending standards. Together, these dynamics could weigh on overall economic growth and bolster the year's likelihood of a recession.

After weeks of federal interventions to stabilize the banking system and market volatility driven by investor uncertainty, the economic outlook now hangs on private-sector confidence and Federal Reserve interest-rate policies.

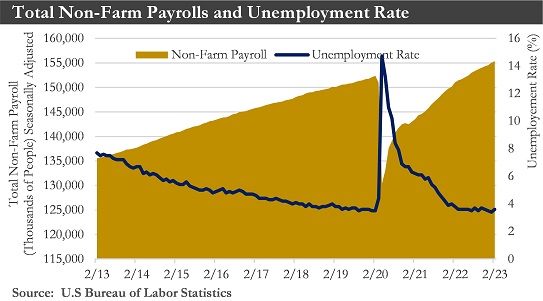

The collapse of Silicon Valley Bank (SVP) and Signature Bank, followed by stress at Credit Suisse Group AG and First Republic Bank, has represented a new threat that could strain bank lending and the willingness of businesses to hire and households to spend. The economy’s strength has been robust job market.

Questions hung over the economic outlook before SVB failed. Large tech companies had been cutting jobs after overexpanding during the Covid health crisis. Fed interest-rate increases had frozen the real-estate sector and rattled stock investors. Corporate profits were declining in many sectors, and consumer moods had soured during two years of a rising cost of living. Yet a strong job market trumped those challenges and kept the economy growing.

The main goal of policymakers in recent weeks has been to stop the panic that led depositors in small and medium-sized banks to pull their money out in search of perceived safer holdings. When banks lose depositor funds and other sources of money, they pull back on lending, potentially leading to a credit crunch that slows household and business borrowing, spending, and investing.

But Is a Recession on the Horizon?

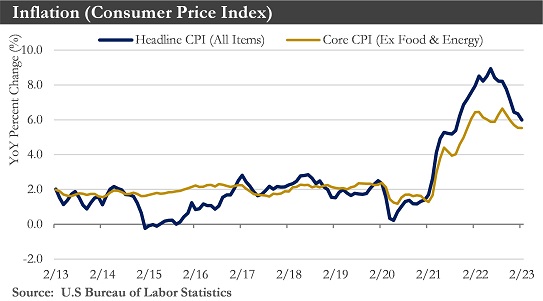

Although a mild recession in the year's second half has remained the most likely outcome, several positive developments have boosted the odds that the economy could avoid a recession.First, February's solid jobs report indicates that the labor market has remained robust. Second, inflation has receded at a pace that is faster than previously anticipated. In addition, there have been tentative signs that wage growth, an underlying driver of prices in the labor-intensive service sector, has begun to moderate. Another reason for cautious optimism is that easing inflation and solid income growth would improve consumer purchasing power.

Monetary Policy: The central bank’s focus in recent weeks has shifted from economic readings to stresses in the financial system, including a drop in liquidity in U.S. Treasurys amid the fallout after the collapse of Silicon Valley Bank.

The Federal Reserve raised interest rates another quarter-percentage-point to fight inflation. Still, it has signaled banking-system turmoil might end its rate-rise campaign sooner than seemed likely two weeks ago. The decision has marked the Fed’s ninth consecutive rate increase aimed at battling inflation over the past year. It will bring its benchmark federal funds rate between 4.75% and 5%, the highest since September 2007.

When inflation was the Fed’s singular focus over the last year, raising rates was the only option. But now that the financial system's stability has been brought to the forefront, the Fed has to toe a fine line.

Raising rates while focusing the statement on the possible adverse outcomes would acknowledge the flow-through of financial market stress on the broader economy. The Fed's economic projections have changed to weaker growth and higher inflation over the next two years. The downdraft from tighter credit conditions could weigh on economic momentum enough to negate the need for further rate hikes discussed only a few weeks ago.

If the Fed strategy turns out to be sound—with the bank instability largely contained and inflation falling—a truly systemic financial crisis will have been avoided at a relatively low cost in terms of market wreckage or inflation.

Consumers: American consumers are faced with another test, from banking-sector turmoil and tighter financial conditions, as households have already grappled with elevated inflation and rising interest rates threatening to trim the spending that has been a hallmark of the resilient U.S. economy. Unrest in the banking sector could make it more difficult for some consumers to obtain loans for buying big-ticket items.

Any spillover from the banking sector’s problems could threaten consumer spending, which accounts for about 70% of U.S. GDP. Strong spending helped drive the economy out of the pandemic recession, though it showed signs of slowing late in 2022 in the face of historically high inflation and rising interest rates. Consumer activity picked up in January but has shown renewed signs of cooling. Spending at retailers declined in February before a handful of banks failed. Consumer sentiment fell in March for the first time in four months.

Inflation: Inflation eased in February but remained stubbornly high, presenting a challenge for the Federal Reserve as it has confronted how to slow the economy with higher interest rates even as it has moved to stem banking problems. The consumer price index rose 6% in February from a year earlier, down from a 6.4% gain the prior month. It was the smallest increase since September 2021. When excluding volatile food and energy costs, prices advanced slightly slower to 5.5%. Monthly data showed price pressures persisted in many corners of the economy. January inflation numbers reinforced the view that the U.S. economy is only in the earliest stages of a disinflationary process.

Labor Market: A hot job market has emerged as one of the biggest economic surprises among many twists since the Covid-19 pandemic hit three years ago. It has remained incredibly tight, and given the recent strength in hiring activity, it should slow in the months ahead. U.S. hiring grew solidly but cooled some in February as employers added 311,000 jobs, while unemployment rose to 3.6%. The three-month average on hiring ticked up to 351,000, highlighting the considerable strength in the labor market.

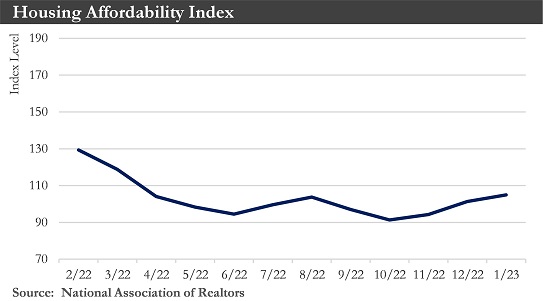

Housing Market: The residential sector ended 2022 with several green shoots indicating the worst of the housing correction may be in the rear-view mirror. Affordability-crunched buyers are slowly returning as mortgage rates have declined and home price appreciation has softened. Strong labor market conditions have continued to propel income growth, all while easing inflation has enhanced household purchasing power. All of these factors have been encouraging signs. However, the full impact of tighter monetary policy in 2022 has yet to be felt, and a recession risk has remained elevated this year. What is uncertain is whether lower mortgage rates will spur a revival in housing activity, or a looming economic downturn could lead to further retrenchment.

Manufacturing: The American manufacturing sector has shown signs of weakness after two years of solid growth, as higher interest rates and a slowdown in exports have threatened production. Several indicators show that U.S. manufacturing industries has experienced a downturn. These include recent declines in manufacturing production and weak readings in survey-level data, such as the Institute for Supply Management, where the headline manufacturing index has dropped well into contractionary territory. Manufacturing job growth – a lagging but important indicator – has also lost considerable steam in recent months, weighed down by softness in non-durable goods.

A manufacturing downturn could signal trouble in the broader U.S. economy. Although manufacturing accounts for a relatively small share of gross domestic product, about 11%, it has historically been an early indicator of recession. Weaker manufacturing data has suggested that consumers and businesses are starting to retrench in the face of economic uncertainty.

The manufacturing sector could see continued softness in the quarters ahead due to slower demand for consumer goods amid the ongoing transition in spending toward services and expectations for some weakening in the labor market. With many trading partner countries going through a similar economic cycle to the U.S., the export channel will not be a panacea for manufacturers this year.

Despite the many obstacles, there have been several tailwinds for manufacturing. Pent-up auto demand, rising military spending, reshoring efforts, improving demand from China’s reopening, and planning investments in electric vehicles and the semiconductor space should all help keep a floor on the manufacturing sector as it goes over the latest bump.

U.S. Dollar: With central bank rate hikes expected to be completed during the first half of this year, an extended period of U.S. dollar depreciation is approaching. Further Fed tightening and possible safe-haven support should help the dollar for now, but that could be offset by central bank actions making U.S. dollars more readily available. Longer term, an eventual U.S. recession, and Fed easing should see the U.S. dollar soften against G10 and emerging currencies later this year.

Global: The outlook for global activity has continued to rise, and global GDP should grow 2.0% this year. The economies of the Eurozone and the United Kingdom, in particular, have shown more resilience than anticipated as cost-of-living pressures have eased. For 2023, Eurozone GDP should edge up 0.1%, while the forecast for a 0.6% contraction in U.K. GDP this year would be smaller than expected.

With underlying inflation pressures proving quite persistent, several central banks are expected to tighten monetary policy more than anticipated. Among the central banks where more rate hikes are expected include the European Central Bank and the Bank of England.

China’s revival has helped boost factory production in other parts of Asia. Ditching strict pandemic curbs in China will benefit consumption, potentially a boon for countries like Thailand that are popular among Chinese tourists. Some caution should be exercised because of uncertainties as to how much—and how soon—China’s reopening would benefit the rest of the region.

Outlook: To the extent that the underlying trend in economic activity is softening, the economy needs to weaken more to end inflation quickly. The ISM services index has shown that activity expanded broadly at a solid clip in February. Manufacturing activity continues to lose steam but at a reasonably gradual pace. There are still some rocky times ahead for the manufacturing sector. The unwinding of pandemic-era spending that disproportionately benefited goods and higher financing costs have remained headwinds to demand. The ISM manufacturing index for February edged up only marginally in February to 47.7 and thus remained in contraction territory for a fourth consecutive month.

The solid jobs market is keeping consumers feeling upbeat about current conditions. However, a drop in consumer confidence (down 3.1 points in February) has signaled some caution ahead. Yet, sticky inflation and climbing interest rates have cast gloom over the future.

The weariness of the elevated rate environment was on display with housing data. Builders continued to curtail development. Meanwhile, pending home sales jumped in January, helped along by the slide in mortgage rates that began mid-November. However, mortgage rates have climbed a bit recently as stronger-than-anticipated inflation, jobs, and spending data have pushed up market expectations for further Federal Reserve policy tightening. Mortgage rates are expected to trend lower later in the year as the end of Fed tightening comes closer, which, along with some further easing in home prices, should help improve affordability.

Capital Markets

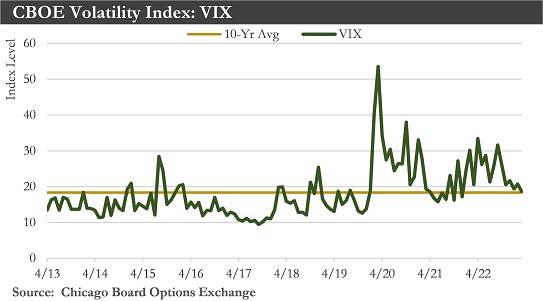

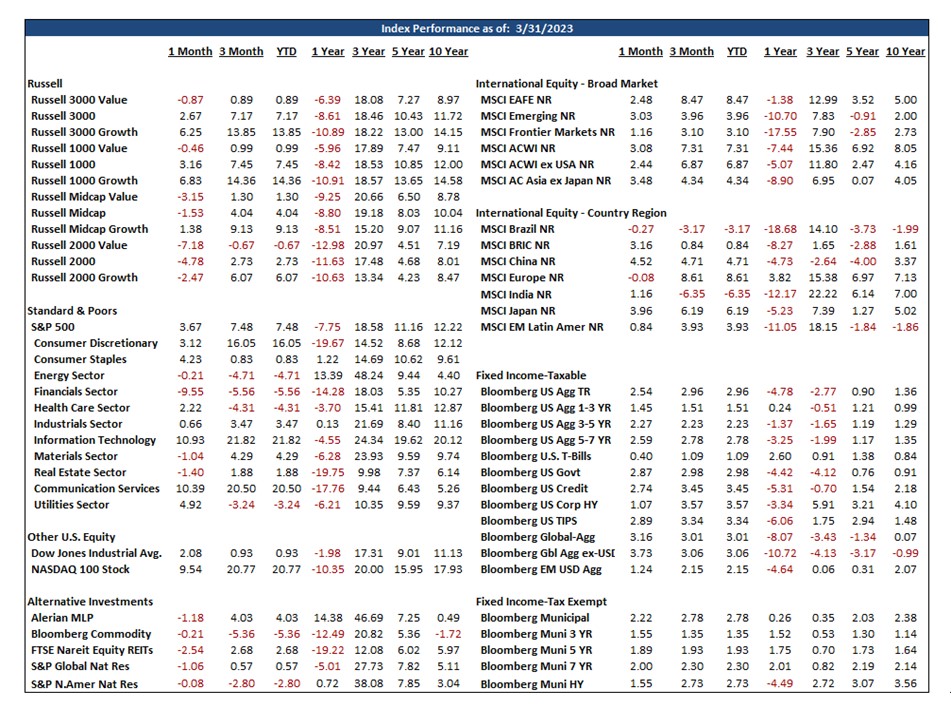

Recap: January through March provided a very eventful quarter of market behavior to say the least! Two Federal Reserve rate hikes, crises in the banking sector, and concerns about a possible recession on the horizon could not impair a strong rebound in equity and bond markets after a difficult 2022. After a few months of relative market tranquility, volatility skyrocketed in early March with the collapse of Silicon Valley Bank. However, as authorities rapidly stepped in to put their “finger in the dike” of the banking system, markets quickly settled down. More than anything else in Q1 investors seemed more focused on the likely end of the Fed’s rate hiking cycle and less so on the deterioration in corporate earnings growth which began surfacing in Q4 of 2022.Both stocks and bonds gained ground in Q1 despite surging but temporary volatility that began two-thirds of the way through the quarter. The broad U.S. equity indexes finished March on a positive note and for the quarter the large-cap S&P 500 posted a 7.5% return, the Russell Midcap was up 4.0%, and the small-cap Russell 2000 gained 2.7%.

Growth stocks far outpaced Value stocks resuming their recent performance dominance in March and for the full quarter (in part due to the large percentage bank stocks constitute in the Value index). For all of Q1 large, mid, and small-cap Growth stocks dramatically outpaced their Value counterparts reversing a performance trend that was a hallmark of 2022.

International equities also posted positive returns for March and Q1. Returns were more or less on par with broad U.S. equity markets. In Q1, the MSCI All Country World Index ex-U.S. was up 7.0%, the MSCI European, Australian, and Far East Index was up 8.7%, and the MSCI Emerging Markets Index was up 4.0%.

The bond market had a turnaround in Q1 after providing an uncharacteristic sea of red ink in 2022 due to rapidly rising interest rates across the maturity spectrum. The bond market on Q1, sensing the end of the rate hiking cycle and anticipating a recession in the coming quarters, rallied on the prospects that inflation will also continue to fall as will interest rates. The Bloomberg U.S. Aggregate Index was up 2.5% in March and 3.0% for Q1, the High Yield Index gained 1.1% in March and 3.6% for Q1 while the Global Aggregate ex-U.S. was up 3.7% in March and 3.1% for all of Q1.

Outlook: The outlook for stocks remains uncertain given the present concerns about the fragility of regional and smaller banks and the beginning of what appears to be a trend of declining corporate earnings performance. In addition, the U.S. seems headed into what is likely to be a period of slower economic growth if not an outright recession. The stock market does not like uncertainty as recent volatility attests. Given this backdrop stock valuations remain somewhat elevated from historical standards with much of that being driven by a relatively small handful of well-known mega cap Growth stocks which represent a surprisingly disproportionate share of the overall capitalization of the broad stock market. These same stocks took a beating last year.

However, the outlook for bonds has brightened since last quarter largely due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is coming down, and now bonds actually offer a respectable coupon rate after years of ultra-low interest rates.

There continue to be downside risks to the capital markets which should be kept in mind as 2023 progresses. Those risks include the Fed possibly overshooting their rate increases, a deeper than-expected recession occurs, more stress in the banking system emerges due to the industry’s deposit level declines, an increase in credit defaults as the economy slows, and of course a possible escalation in the conflict in Ukraine with its potential impact on the prices of oil and commodities.

A longer-term view of markets suggests the tailwinds stock and bond investors enjoyed for the past decade or more including massive fiscal stimulus as well as declining and ultra-low interest rates will not resurface any time soon. Securities’ values are more likely to be driven by the organic operational successes of businesses and not help from the federal government. That will likely result in market returns being lower than in the recent past.

Sources: Bloomberg, Morningstar, Institute for Supply Management, Department of Commerce, Department of Labor

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.