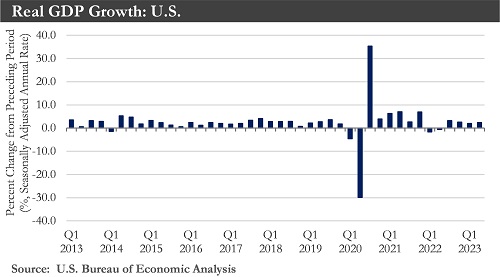

The resilience in consumer spending has kept the economy growing solidly during the first half of the year. With the labor market remaining strong, consumers have been able to weather the headwinds of higher prices and interest rates. Business investment also increased in the second quarter as equipment purchases rose notably and investment in structures remained elevated. Consumer and business sentiment measures have stabilized recently as near-term growth prospects have improved, although future expectations have remained relatively pessimistic.

Fresh signs of labor market strength reinforced a picture of an economy with broad-based momentum despite rising interest rates. Layoffs retreated last month, and economic growth was more robust than initially reported in the first quarter. Other recent data showed increasing new home sales, orders for long-lasting goods, and consumer confidence. What has been evident is stronger-than-expected growth, tighter-than-expected labor markets, and higher-than-expected inflation.

At the start of the year, a recession was expected to have materialized by now. Indeed, consumers, workers, and businesses have faced challenges over the past year, with interest rates rising and inflation elevating.

Instead, the economy has continued to grow, even in pockets sensitive to higher interest rates. The housing market has been a key example. A historically low number of existing homes for sale helped push up sales of newly built ones. New home sales rose by double digits in June, far exceeding expectations.

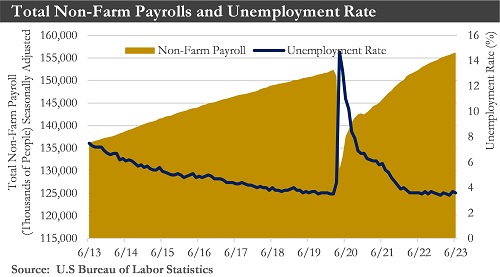

The labor market has remained resilient despite the Fed’s actions. Employers have continued to add jobs, and the unemployment rate has remained near historic lows. Job openings have surpassed expectations, with millions looking for work in June.

Robust consumer spending and the solid jobs picture have bolstered the economy. The economy has remained reasonably healthy and has some momentum remaining. The consensus forecast should see the economy slipping into a mild recession, which likely will come later than predicted.

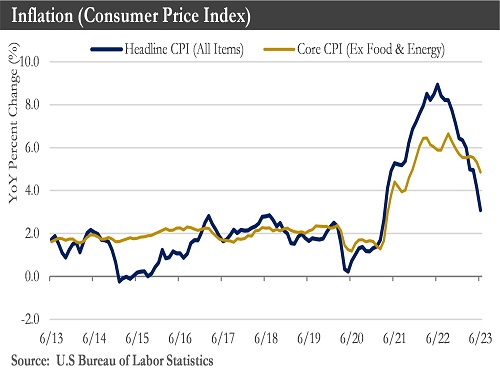

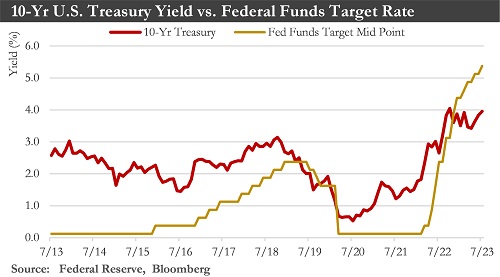

With the Federal Reserve's most recent interest rate hike in July, the policy rate now sits at its highest level in two decades. Progress has been made on the inflation front; however, the Federal Reserve will need more time to decide whether the trajectory points to a sustainable return to its 2% target. The cumulative effects of the 525 bps in rate hikes have yet to filter through the economy fully and should continue to weigh on economic growth through the second half of this year.

Inflation: U.S. inflation eased last month to its slowest pace in over two years as underlying price pressures cooled more than expected. The consumer price index climbed 3% in June from a year earlier, sharply lower than the recent peak of 9.1% in June 2022. Core inflation rose 0.2% in June from May. The 12-month change on core inflation edged lower by 0.5% in the month, falling to 4.8%, while the three-month annualized change slipped to 4.1%.

Headline inflation has fallen sharply over the past year. The core index, however, has been much slower to come down, though encouraging signs have started to emerge. Shelter costs – a key contributor to price growth – have definitively rolled over, while goods have become a source of deflation. There has been some easing in price pressures across the stickier and more labor-intensive service components of inflation, with the 12-month annualized change in non-housing services falling to 3.9% – the slowest pace of growth since December 2021.

Core inflation in the year's second half should run about 3% annually. This expected improvement relative to the 4.6% pace of core inflation in the first half of this year will likely be enough to where the FOMC believes it could sit and wait for the effects of prior tightening to work through the economy.

Labor Market: The strong U.S. labor market has fueled economic momentum and kept pressure on the Fed to raise rates again as it has fought high inflation. Hiring eased slightly in June as employers added 209,000 jobs. The unemployment rate fell to 3.6%. Hiring over the last three months averaged 244,000 jobs per month, a step down from the 312,000 measured in January-March.

Meanwhile, the participation rate held steady at its cyclical high of 62.6% for the fourth consecutive month. Average hourly earnings rose 0.4% in June, matching May's upwardly revised gain – and have moved up 4.4% over the past year.

Beyond the hiring numbers, signals on the inflation front have remained mixed. A stronger-than-expected reading on average hourly earnings and upward revisions to wage growth in earlier months have suggested the Federal Reserve is not out of the woods yet fighting to tame elevated inflation.

Despite the early signs of cooling, the labor market has remained far too tight. Taken alongside the recent strength across other key economic indicators (i.e., housing starts, home sales, new orders of capital goods), all have pointed to an economy still running far too hot to cool inflation.

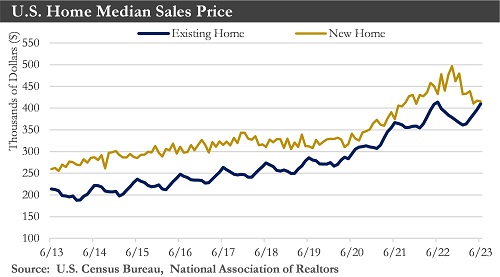

Housing: Housing activity looked to have steadied so far this year following 2022's dramatic decline. On balance, new and existing home sales, builder sentiment, and new residential construction have improved in 2023.

The turnaround in home sales has been primarily due to slightly better affordability conditions for buyers. While mortgage rates have remained elevated, easing home price inflation and sturdy income growth have bolstered the resale market. The bounce back in new home sales has been more pronounced, as builder incentives have successfully bridged the affordability gap for buyers. A more robust pace of new home sales as builder supply constraints ease will likely translate to a rebound in new single-family construction.

Given that the Federal Reserve could keep monetary policy in a restrictive stance until inflation is convincingly on the road to its 2% target, mortgage rates will likely remain elevated. Home price appreciation has grown as buyers compete for a remarkably shallow pool of existing homes for sale.

High mortgage rates and a deteriorating macroeconomic backdrop would mean a full-fledged housing rebound in the distant future. That noted, the residential sector has been on the path to recovery.

Monetary Policy: The Federal Reserve Open Market Committee (FOMC) raised the federal funds rate to the 5.25% to 5.50% range and announced a continuation of its balance sheet runoff. This move was widely expected, with the Fed establishing a new cruising speed in its rate hiking cycle. Although the Fed gave itself extra time to assess whether the economy would turn down under the weight of 500 basis points in rate hikes over the last 16 months, the economy has continued to exude resilience.

The Fed has not seen enough evidence from the economy to declare an end to the hiking cycle. Given the new slower pace of rate hikes, the Fed will likely hold rates steady at its next meeting in September. This would give the Fed a three-month window to monitor the economy before deciding whether it should hike again later in the year. If the labor market fails to weaken and core inflation fails to make the progress expected, another 25 basis point hike would be on the table.

U.S. Dollar: The U.S. dollar had an incredible run throughout 2022 as the Federal Reserve embarked on its historic rate hiking cycle to curtail the worst bout of inflation in forty years. With inflation pressures proving more persistent than anticipated, global central banks are poised to continue their rate-hiking campaigns and keep policy rates higher for longer.

The cumulative tightening of central banks should slow global economic activity, with the most harmful effects in Europe, where central banks could remain in tightening mode for longer. In this environment of heightened global uncertainty and relative U.S. economic outperformance, flight-to-safety inflows should push the dollar higher. Only once economic uncertainty abates will the dollar likely see some reversal.

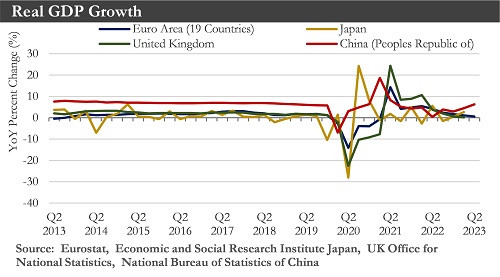

Global Economy: Prospects for global growth have improved over this year. The U.S. economy has been resilient despite Fed rate hikes. A bitter winter in the Eurozone did not materialize, and the energy crisis never intensified. China exited Zero-COVID, allowing local activity to rise and global supply chains to normalize. However, the most positive effects of these developments have now likely passed. At least for 2023, peak global economic activity has probably been achieved. Over the second half of this year, global economic activity should steadily and gradually soften. While the U.S. recession could be a coin flip, U.S. economic and sentiment indicators have suggested the economy could slow in the coming quarters. In Europe, the Eurozone experienced a recession around the turn of the year and could face a renewed stumble. U.K. recession seems imminent, and activity across developed Europe will likely not be as robust as initially expected.

The most significant contributor to the peak growth theme will be China. China's economy has slowed sharply in just a few months. Since the end of Q1-2023, China's growth outlook has deteriorated, dragging down global GDP growth. Still, the ripple effects of a China slowdown across the advanced and developing economies would reinforce the peak growth theme. In addition, numerous underlying vulnerabilities have percolated within and across China's economy. If these vulnerabilities crystalize, the China and global economic slowdown could be exacerbated at any point.

Outlook: There is good reason to remain optimistic that further progress will be made on the inflation front. For starters, the anticipated slowing in shelter costs now appears to be firmly intact, with both owners’ equivalent rent (OER) and rent of primary residence (RPR) having decelerated in recent months. On the goods side, used vehicle prices are expected to be a source of downward pressure on inflation in the coming months. Outside of this category, prices across all other goods have already been flat for three consecutive months and should trend lower through the second half of this year alongside weaker consumer spending. Input costs are also trending favorably.

Core inflation on a 12, 6, and 3-month annualized basis is still running at a multiple of the Fed’s 2% inflation target. And, with the labor market continuing to exude considerable resilience, policymakers will need to see more convincing evidence that the disinflationary process is firmly intact before calling it quits on rate hikes. The FOMC will likely maintain a tightening bias over the near term as it continues monitoring incoming data and fine-tuning its tightening cycle's endpoint.

Whether consumers will spend at the same pace later this year needs to be clarified. High interest rates will persist, making vehicles, appliances, and other products that Americans often take out loans to buy more expensive. Student loan repayments are set to resume later this year. Americans are running through the stash of savings they built up at home earlier in the pandemic.

The overall economy has held up reasonably well to date in the face of aggressive Fed tightening; further moderation is anticipated to take hold in the second half of the year amid tighter lending standards. While policymakers remain divided on the probability of recession and the odds of a soft landing appear to be rising, it remains clear that overall growth is slowing.

Consumers and businesses are feeling more optimistic about the outlook. As inflation falls from historic highs and the labor market remains tight, the prospect of a soft landing - in which inflation returns close to the Fed’s 2% target without a recession - appears more probable.

Global economic growth this year is likely to be stronger than previously estimated. The improved outlook reflects labor-market strength, strong spending on services such as tourism, and diminished financial stability risks.

Source: Department of Labor, Department of Commerce, Bloomberg, European Central Bank

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.