The trajectory of the economy should largely depend on how consumers fare in the coming months. Consumers have benefited from a tight labor market. Employers have held on to the workers they have, with jobless claims remaining low. Many businesses have also ramped up pay as they struggle with staffing shortages. Still, consumers might be starting to crack. Many have tapped into pandemic savings and turned more to credit cards to finance spending.

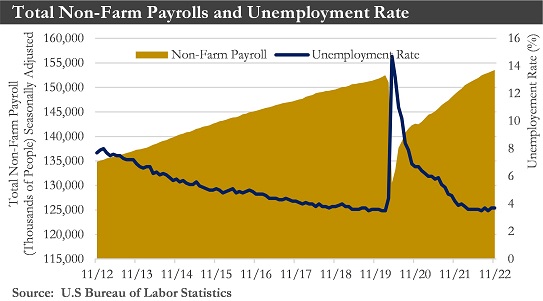

The labor market has pointed to an economy that is gradually losing momentum following a torrid stretch of growth last year and earlier this year. Over the past three months, employers added an average of 289,000 jobs a month, down from 539,000 during the same period a year ago.

The ISM purchasing managers' indexes weakened in October. While the headline manufacturing index just managed to stay expansionary (though the November reading has fallen into contractionary territory), the new orders and new export orders indexes have continued contracting for the second and third straight month, respectively. Services activity also slowed, with demand clearly on a downward trend. This would seem to mean that the cumulative impact of rate hikes might be catching up to consumers. However, more concerning to the Fed is that following five straight months of decline, the prices paid component of the services index has suddenly accelerated. This would suggest that the largest sector of the economy is still facing faster and more widespread price increases.

After two years of disruption, supply chains have almost returned to normal, meaning shelves should be fully stocked, and some prices should be lower this holiday season. To be sure, isolated shortages persist, and only some items have seen lower prices. Overall inflation has continued to be high and squeeze incomes.

Still, the widespread stockouts that marked the last two holiday seasons have been largely absent thanks to increased capacity throughout the supply chain, slackening demand driven by spending shifts from goods to services and higher interest rates, and a “new normal” for supply-chain management that has emphasized earlier delivery lead times and heftier inventories.

The 2022 U.S. midterm elections have concluded. The Democrats have retained control of the Senate while the Republicans have gained a slim majority in the House of Representatives, ensuring that divided government has returned for the first time since 2018-2019. Under this election outcome scenario, status quo and political gridlock could be the most likely outcome, with the possibility for some government shutdown/debt ceiling theatrics over the next two years.

Labor market: The U.S. labor market has remained strong but is showing more signs of cooling following the Federal Reserve’s aggressive interest rate increases aimed at combating high inflation.

Employers added a seasonally adjusted 261,000 jobs in October, a robust number but the fewest since December 2020, and the unemployment rate rose to 3.7%. Wage gains in October ticked up from the previous month. On an annual basis, however, wage increases have eased, a possible sign of loosening in the labor market.

The labor market has been pulled by two competing forces. On the one hand, employers have restored jobs they had cut at the height of the pandemic. On the other, some have pulled back on hiring amid growing uncertainty about how much the economy could slow and whether it might slide into recession.

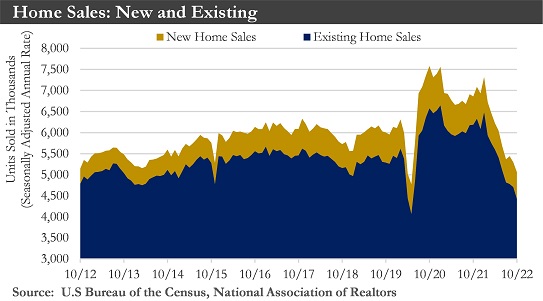

Housing market: Home-buying demand has sunk in recent months as higher interest rates have raised mortgage payments for many prospective buyers.

Sales of newly built homes dropped sharply in September from the previous month, the latest sign that rising interest rates have caused an abrupt slowdown in the housing market. The decline in September marked the fourth time in 2022 that these sales have fallen by 10% or more from the prior month.

The decline in new-home sales has followed other recent data signaling the market’s weakness after a nearly two-year housing boom. Existing-home sales have fallen for eight straight months. Mortgage applications to purchase homes also fell from a year earlier while a measure of home-builder confidence has steadily weakened in recent months.

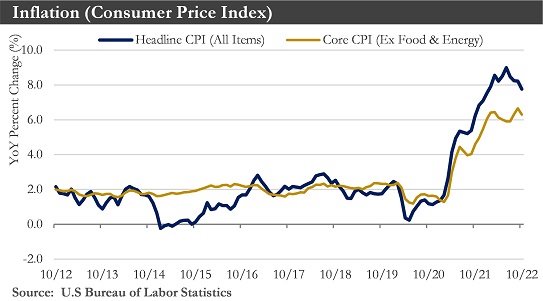

Inflation: Consumer prices rose at a slower pace in October than in recent months. Core prices rose 0.3% from September, the smallest monthly gain in one year, and by 6.3% on a year-over-year basis, down from 6.6%.

Price pressures have started to ease, although inflation's descent is still poised to be slow with some bumps along the way. The shift in consumer spending toward services, rising retail inventories, and declining transportation costs have helped reduce goods inflation, a trend that should continue in the months ahead. Strength in services inflation, however, could mask much of this improvement. While the October CPI report indicated services inflation has also started to ease, improvement is expected to prove more stubborn in its retreat than goods inflation given the continuing strength in labor costs.

Monetary Policy: The FOMC elected to lift the target range for the federal funds rate 75 bps to a range of 3.75%-4.00%, after its November policy meeting. The FOMC has been preparing to slow the pace of tightening at future meetings, though it has not finished tightening yet. The risk of not tightening enough and inflation becoming entrenched would outweigh the risk of over-tightening. A 50 bps rate hike at each of its upcoming meetings in December and February should occur before ramping down to 25 bps at its meetings in March. The FOMC will then stay on hold for the remainder of 2023, even though the economy has slipped into recession, before beginning to ease policy in 2024.

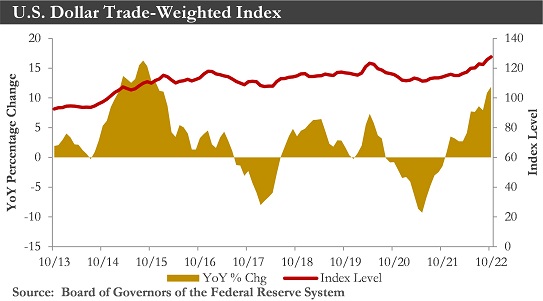

U.S. Dollar: With the FOMC turning more hawkish, combined with foreign central banks being unable to keep pace with the Fed, the U.S. dollar should continue to strengthen. Right now, broad dollar strength has been forecast against most G10 and emerging market currencies through the end of this year. Given the Fed outlook on interest rates, dollar strength could persist into early 2023.

There are two reasons that the Treasury Department would unlikely take steps any time soon to reduce the value of the dollar—or to slow its rise. First, with the Fed on course to keep raising interest rates, any U.S. foreign-exchange intervention would have a limited impact on the dollar’s value. Second, a strong dollar would help lower inflation, and the Treasury would not want to take steps that could undercut the Fed’s efforts to tame inflation.

The dollar’s strengthening relative to other currencies has put pressure on many other countries around the world, boosting the costs of imports priced in dollars and servicing dollar-denominated debts. This has been particularly difficult for many developing economies struggling with large debts and importing much of their fuels, food, and other commodities. Wealthier economies have faced troubles, too, as their import costs have risen.

United Kingdom: The U.K. economy contracted in the three months through September, as high energy prices and rising interest rates marked the beginning of what policymakers expect will be a long-lasting recession. This downturn could affect much of Europe in the coming months.

The country’s gross domestic product was 0.7% lower on an annualized basis in the third quarter compared with the three months through June. The decline likely means the U.K. is almost certain to enter into a recession. Much of Europe could follow the U.K. into recession this quarter. However, the bloc’s downturn should be shorter-lived.

The U.K.’s contraction has occurred due to one-off factors reflecting the sharp rise in energy - driving up prices and leaving consumers with less to spend on other goods and services. But the U.K. economy has also been hobbled by unique factors, including a shortage of workers due in part to a surge in long-term illness in the wake of the pandemic, and the longer-term impact of the country’s departure from the European Union, which has seen business investment stagnate. Widening labor strikes could also deepen the recession as workers begin to press for pay rises that match inflation. Adding to pressure on the economy, the government has planned a series of tax increases and spending cuts to narrow a shortfall in government finances following years of borrowing during the pandemic, as well as a new subsidy program to protect households and businesses from crippling energy bills. The tax increases and reduced government spending will deepen the downturn by hurting demand further.

Eurozone: The European Central Bank (ECB) raised interest rates by three-quarters of a percentage point for the second time in a row, moving briskly to quash record inflation even as the eurozone has moved closer to recession. The bank said in a statement that it would increase its policy rate to 1.5%, the highest level in more than a decade, and said that it could raise rates further over coming meetings.

The ECB has moved less aggressively than the Fed to raise interest rates this year. That has reflected the region’s weaker recovery from the Covid-19 pandemic, the hit to activity dealt by the Ukraine war, and concerns about economic fragility in Southern European nations.

Overall, the ECB’s mildly less hawkish guidance and widespread signs of a contracting Eurozone economy have been consistent with a smaller 50 basis point Deposit Rate hike to 2.00% in December.

Global Economy: The outlook has continued to be relatively pessimistic for growth prospects for 2022 as well as 2023. As for all of 2022, a below-consensus growth forecast of 2.3% is reasonable. A fair portion of a more pessimistic outlook has come from a less robust growth outlook for the United States as well as select foreign economies. First and foremost, China's economy is still struggling to gather momentum, and the commitment to Zero-COVID policies as well as an imploding real estate sector are likely to have economic consequences for growth. With Zero-COVID policies likely to stay in place for the foreseeable future, and with home prices and real estate more broadly under sharp pressure, China's economy will likely grow just 3.2% this year. The United Kingdom and Eurozone are already on the brink of recession, and both of these economies could experience less robust growth in Q4 than what they experienced earlier in the year, likely even outright contractions. Slower growth in the United States, China, and across Europe should underpin a below-consensus 2022 global GDP growth forecast.

Outlook: For the past several months, a mild recession beginning in early 2023 has been expected. The odds of that happening only appear to be increasing. Higher financing costs are weighing on capital investment. And while it has been strong recently, there has been a downshift in job growth and businesses are likely to slow hiring further as rising cost pressures crimp margins.

What's more, consumer spending appears set to pull back as inflation diminishes purchasing power and takes an increasingly larger bite out of household savings. However, the relative strength of both household and corporate balance sheets currently should result in a relatively shallow and short-lived downturn in real GDP.

The combination of continued Fed tightening and elevated inflation, which has caused real personal income to contract in recent quarters, will likely lead to retrenchment in real consumer spending beginning in Q1-2023. Weakness in consumer spending and the continued squeeze on profit margins will then lead businesses to cut business investment spending, both fixed investment and inventories, and reduce payrolls. The slowdowns, if not outright economic contractions forecast for some key U.S. trading partners could also weigh on growth in American exports.

Even in the face of the most aggressive Fed-tightening cycle since 1982, the uncanny staying power of the consumer and sustained tightness in the labor market both have more legs than previously thought. In recognition of that resilience, the timing of an eventual recession has likely been pushed to the second half of next year, the FOMC will likely raise the fed funds rate to a slightly higher terminal rate and to keep it there for longer than previously expected.

This downturn should not be especially deep or prolonged. The underlying fundamentals of the economy, especially the relative strength of balance sheets and the labor market, are reasonably sound at present. Moreover, the Federal Reserve may indeed be able to pull off a "soft landing."

Sources: Department of Commerce, Department of Labor, Morningstar, Bloomberg, National Association of Realtors, People’s Bank of China, European Central Bank, U.K. Office of National Statistics, Federal Reserve

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.