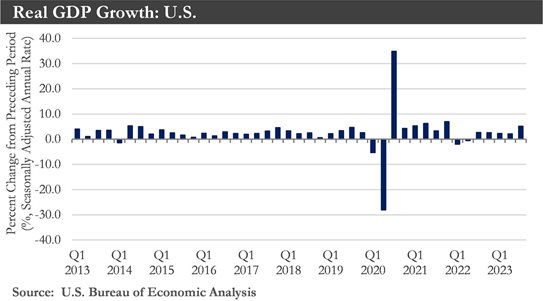

Recap: The U.S. economy continues to show remarkable resilience in the face of higher interest rates and tightening credit conditions. U.S. real GDP increased 5.2% in the third quarter, marking the most robust annualized pace since Q4-2021 when stimulus payments were in full force. The increase was widely expected in light of robust consumer spending seen over the summer. Their sustained spending has been supported by a strong labor market and savings accumulated during the COVID-19 pandemic because of government relief and locked-in low mortgage rates.

Measures of labor force productivity have made impressive gains. After nearly two years of lagging behind inflation, recent wage gains have, on average, surpassed the pace of price increases, and workers are still in demand. Layoffs are well below historical averages. Labor force participation for adults in their prime working years is also higher than before the pandemic. That has led forecasters to believe that the economy may be able to remain hot longer than previously thought possible.

Financial markets have been volatile, and consumer sentiment is gloomier than before the pandemic. That is partly because the bottom one-third of households have exhausted savings accumulated during the pandemic and have increased borrowing to stay afloat. And the mammoth increase in interest rates since early 2022 looms over everything. But unless a significant shock occurs or household savings drain faster than expected, the economy will likely keep chugging along.

However, this year's economic resilience could soon face tests. Higher long-term interest rates and wars in Ukraine and the Middle East are all factors that could cause economic cracks to emerge. Economic growth is expected to decelerate to nearly 1% in Q4 before slipping to a near-stall speed through the first half of next year.

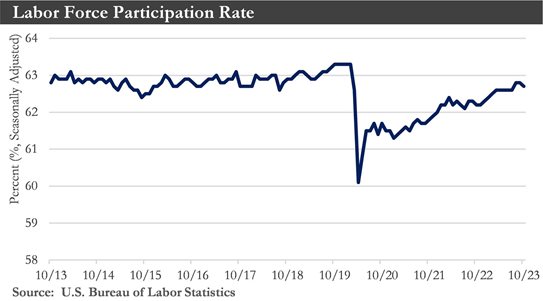

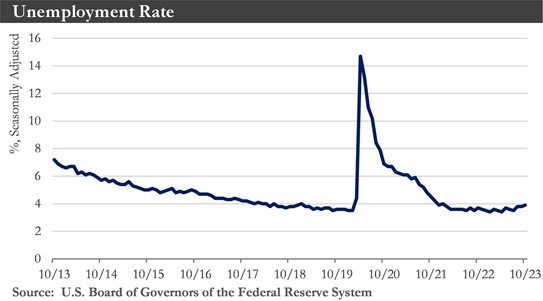

Labor market: One reason for the economy’s resilience has been the strong labor market, which has kept creating jobs despite higher borrowing costs and a volatile global situation with wars in Europe and the Middle East.

The strong labor market encourages people to come off the sidelines and look for a job, enticed by higher wages and benefits. The share of working-age people either working or looking for a job has climbed and recently hit the highest level in over two decades.

However, job growth slowed in October, with the U.S. economy adding the fewest jobs in four months and recording the second weakest monthly gain. In the household survey, employment fell by more than the labor force, which pushed the unemployment rate to a near two-year high of 3.9%. The numbers point to an economy that is losing steam as it confronts higher borrowing costs, persistent inflation, and wars in Europe and the Middle East.

There are signs that the job market could lose momentum in 2024. The number of new hires and the number of people who voluntarily quit their jobs trended down since the beginning of last year, while the number of layoffs has remained steady. Those trends suggest that the labor market is becoming more stable, with less turnover, as uncertainty about the future prompts employers and their staff to decide that now is not the time to make significant changes.

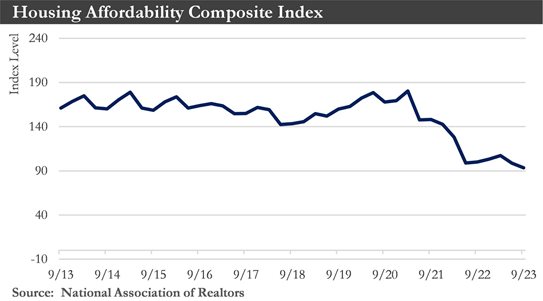

Housing: Home sales fell in October to a fresh 13-year low as high-interest rates and home prices continued to pummel the housing market. Home-buying affordability sits near its lowest level in decades. Existing home sales for the entire year in 2023 are on track to be the weakest since at least 2011.

Existing home sales, which comprise most of the housing market, decreased 4.1% in October. Even as home-buying demand slumps, the inventory of homes for sale has stayed low. The limited supply is a significant reason home prices are rising in much of the U.S. The new home market – which, until recently, benefited from the shortage in the existing home market – will not escape unscathed, with early data showing that it, too, is beginning to feel the impact of higher rates.

The slowing housing market is one of the most direct results of the Federal Reserve’s efforts to curb inflation and cool the economy by raising its benchmark interest rate to a 22-year high. The combination of elevated mortgage rates and high prices is expected to keep home-buying affordability low in the coming months, making it difficult for first-time home buyers to enter the market.

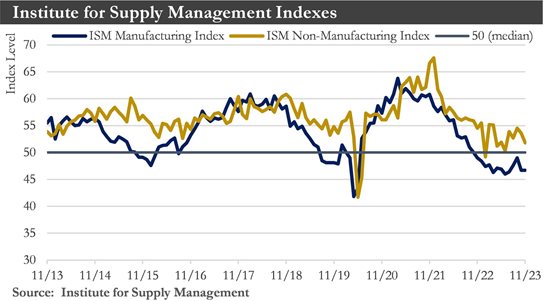

Manufacturing and Services: One sector of the economy that is not faring very well is manufacturing. As measured by the ISM sentiment survey, activity in the sector continued to contract in October, falling to its lowest level since July, on broad-based weakness. The silver lining, however, is that a pullback in raw materials prices is easing cost pressures, which should help to mitigate price pressures for consumer goods. The services side of the economy fared better, with the ISM services index expanding again in October, though at a slower pace. Twelve out of eighteen industries reported growth; however, the softer-than-expected reading suggests that the Fed's hiking campaign is also influencing the services sector.

Monetary Policy: The Federal Reserve left interest rates unchanged at a 22-year high and signaled rates would remain elevated well into next year to keep inflation moving down. The Fed policymakers have been trying to balance two risks. They want to avoid overdoing rate rises to prevent causing an unnecessarily severe downturn. They also want to avoid inflation from reaccelerating or to settle at levels well above their 2% target.

In recent months, the economic outlook has been buffeted by three forces with differing implications for monetary policy. First, economic activity picked up, defying expectations of an imminent slowdown. Second, inflation continued cooling. Third, financial conditions have tightened amid a swift run-up in longer-term Treasury yields, leading borrowing costs to rise for households and businesses.

The Fed will likely remain on hold through most of Q2-2024, which is more or less consistent with market pricing. Consequently, the stance of monetary policy, as measured by the real fed funds rate, likely will become more restrictive in the coming months as inflation slowly recedes toward the target while the Fed keeps the nominal fed funds rate on hold. This "passive" tightening of monetary policy will likely lead to a period of economic weakness, if not outright contraction in real GDP, next year, which will eventually induce the Committee to ease policy.

Holiday Sales: Holiday sales are set for another solid year despite a deceleration from the pandemic-savings-infused booms of the last three years. Retailers will have to step up to the plate this year with a less-than-supportive backdrop of economic uncertainty and geopolitical unrest. A myriad of deals for shoppers earlier in the shopping season means the concentration of holiday sales has been increasingly spread over time. The monthly increase typically seen in December has been shrinking since the mid-nineties.

E-commerce has been the king of holiday sales in the past four holiday shopping seasons. This trend is likely to continue in 2023 as online retailers fine-tune last-mile delivery capabilities.

There are some unique factors at play this holiday season. Better inventory management should benefit retailers, with inventory-to-sales ratios back up to pre-pandemic levels. Holiday sales are expected to increase by 5.0% this year, which, if realized, would be above the long-term average but the smallest annual gain of the past four years. December is still the most important month of the year, but on-trend, its growth gets smaller each year as spending keeps getting pulled forward.

Eurozone: The European economy has had a tough few years. The Ukraine crisis produced a collapse in consumer sentiment and real wages due to supply chain challenges and surging energy prices. The staggering inflationary shock continued to hammer private consumption through the first half of this year, with real household expenditures virtually unchanged since the third quarter of 2022. The European Central Bank (ECB) also started raising interest rates in mid-2022 to fight high inflation, helping further tighten financial conditions. Thankfully, growth is set to return to the consumer sector in 2024.

Some of the headwinds are now set to start relaxing. The inflationary impulse is dissipating as energy prices come off their highs amid downbeat growth expectations. With inflation fading, a tight labor market will support real wage growth. Consumer confidence has also come off the floor.

Inflation is expected to cool slowly, so the ECB is likely to keep policy rates high well into next year – the first cuts are not expected until mid-2024. This period of elevated policy rates at a time of falling inflation means inflation-adjusted borrowing costs should continue to rise in the near term and weigh on new investment.

Overall, 2024 is set to be another challenging year for the euro area. High-interest rates and energy prices have drastically adjusted the cost structure of firms and households. Not surprisingly, given these relentless challenges, sentiment is depressed relative to historical levels. The recovery will take time, and a material revival in growth is expected in the latter part of 2024. The outlook for GDP growth is 0.6% in 2023 and 2024.

China: China’s economy is experiencing a rough 2023. The abandonment of draconian COVID-19 controls around the turn of the year triggered a burst of consumer-led growth. But that impulse waned as households began to dial back spending, their caution reflecting a bleak outlook for real estate and other factors such as rising youth unemployment.

Exports tumbled as rising interest rates in the U.S. and Europe squeezed demand for Chinese-made goods. Chinese consumers confronted weak or even falling prices as demand slumped. Chinese officials responded by cutting interest rates and unleashing a flurry of small stimulus steps to support spending and stabilize the property sector. Those efforts were bearing fruit, with gross domestic product data for the third quarter showing an economic acceleration compared with the year's second quarter.

China’s economy suffered a setback as surveys showed factory orders shrank and construction activity slowed in October. Manufacturers faced weakening orders from domestic and overseas customers in October, as the eruption of the Middle East war cast a new shadow over the global economy.

The economy’s difficulties have thrown fresh attention on longer-term challenges to China’s growth. Additionally, measures including more interest-rate cuts and higher spending on infrastructure may be forthcoming, especially in light of recent floods in some parts of the country.

Outlook: The U.S. economy is approaching a soft landing: inflation is returning to its pre-pandemic norm without a recession or even much economic weakness. Six months ago, the consensus was that the economy would enter a recession over the next 12 months. This month, the probability appears to have dropped significantly.

The solid economic rebound following the pandemic pushed inflation to four-decade highs of 9.1% last year. In response, the Federal Reserve raised interest rates between 5.25% and 5.5%, the highest level in 22 years. November’s report showed inflation had come down to 3.2%. The big drop happened while employers continued to add jobs and without any obvious sign that economic growth was petering out.

Still, a soft landing is not guaranteed. Inflation has yet to make it to 2%. The economy may yet crumple under the delayed impact of higher interest rates. Outside forces like a spike in energy prices or a financial crisis could intervene.

The American consumer, whose spending has sustained recent growth, may need more steam. Consumer spending slowed in October for the first time since Spring. A big question is whether consumers, whose spending powered the recovery, can keep it up. Much of the spending has come from savings, which pandemic-era stimulus programs had buttressed. The savings rate has been falling since Spring.

Early warning signs are also developing in the labor market. The unemployment rate has been up half a percentage point since April. The number of people filing first-time jobless claims is bumping at historically low levels, indicating employers are still reluctant to lay off workers. But the number of people collecting unemployment benefits has climbed for the last two months, suggesting those unlucky enough to be laid off find it harder to find a new job.

There is also a risk that higher interest rates have made many businesses and households more exposed to unexpected shocks. Higher borrowing costs will make it increasingly costly for companies to refinance their debt. Many small businesses are also scaling back their expansion plans.

Where does the economy go from here? First, the third quarter’s momentum might be short-lived. Even though hourly wages are going up, workers are working fewer hours. If this continues, households could pull back. Second, the economy could continue to run hot and send inflation up again. That could prompt the Fed to raise interest rates further, slowing the economy and increasing the risk of recession. Third, growth could stay strong, but inflation remains under control. This would be the best of all worlds because it would imply higher productivity. If that is the case, stronger growth could continue without the Fed having to raise interest rates.

Sources: Department of Labor, Department of Commerce, Bloomberg, Institute for Supply Management, European Commission, Federal Reserve Board