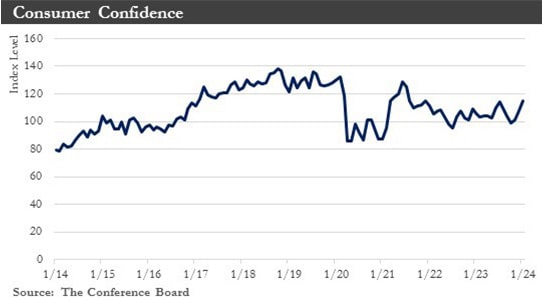

Recap: Americans have rapidly become much more upbeat about the economy. Consumer sentiment surged 29% since November, the biggest two-month increase since 1991, adding to gauges showing improving moods. This has been a sharp turn after persistently high inflation, the lingering shock from the pandemic's destruction, and the nearing fear of a recession, all of which had put a damper on feelings about the economy in recent years despite solid growth and consistent hiring. Americans have felt encouraged as inflation cools and the Federal Reserve signals that interest-rate increases have ended. And with a solid labor market and freely spending consumers, recession fears for 2024 have faded.

The labor market’s slowing but steady pace during 2023 and sharpening decrease in inflation have fueled optimism that the economy can achieve a soft landing. That would mean inflation could ease without a recession. However, even if Fed policymakers could pull off a "soft landing,” real GDP growth in 2024 would likely be lower than in 2023.

On a solid note, consumer spending ended 2023, evidenced by retail sales increasing a stronger-than-expected 0.6% in December. The payrolls report showed that hiring unexpectedly accelerated in December, with the U.S. economy adding 216,000 jobs. Other data reports were a mixed bag. The strength in retail sales at the end of the year had some pass-through effects on industrial production. Consumers increased vehicle purchases in December, although this was partially related to the return of year-end discounts. Meanwhile, the ISM indexes signaled softness. There was a slowdown in the expansion of the services side of the economy, and the manufacturing sector remained in contraction for the 15th month in January, although less so for the month.

Manufacturing should be firmer in the coming months as businesses anticipate lower financing costs amid expectations that the Federal Reserve will ease interest rate policy by early summer. Lower borrowing costs would also benefit residential real estate.

The U.S. dollar should remain well-supported versus most foreign currencies in the first half of 2024. It should remain stable but could decline in 2024 as the Fed eases monetary policy.

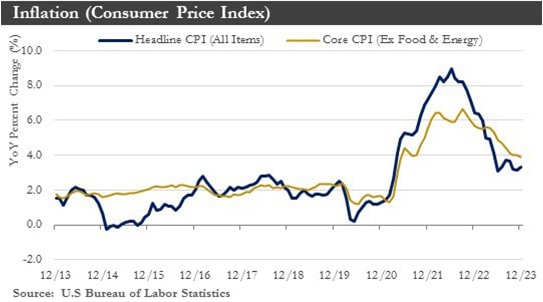

Inflation: The Consumer Price Index (CPI) rose 0.3% in December, and core prices rose 0.3%. The twelve-month change of core inflation fell 0.1 percentage points to 3.9% – the slowest growth since May 2021. The rapid cooling of core price increases over the past year has raised hopes of a soft landing, where inflation could be tamed without a surge in unemployment or a recession.

Although considerable progress on the inflation front has been made over the past year, imbalances in the labor market have remained and, if left unchecked, would threaten to stall the disinflationary process. As a result, Fed officials need to see more compelling evidence that the labor market has cooled, and that inflation will remain on a sustained downward path toward 2% before pulling the trigger on rate cuts. This action would not happen until mid-year.

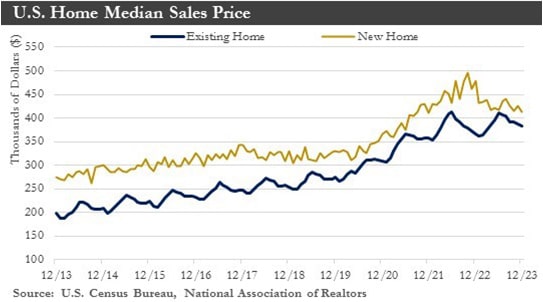

Housing Market: Existing home sales have fallen a whopping 36% since the start of 2022. Mortgage rates rose quickly over the summer and autumn months. Given the negative impact that this has on housing affordability, existing home sales have continued to fall in December. A lean inventory backdrop has not helped, either. The recent decline in mortgage rates has boosted home-buying activity as 2024 begins.

The new home market – which, until recently, benefited from the shortage in the existing home market – should begin to feel the impact of higher rates. New home prices have been down roughly 7% from their peak at the end of 2022, and homebuilders have been providing incentives to push inventory along. With conditions in the new home market softening, builders should make greater use of these incentives in the near term.

Lower financing costs should continue to be a tailwind for the residential sector in 2024. An energetic rebound, however, would be unlikely, given that rates have remained elevated over recent norms. A weaker macroeconomic backdrop could be another potential obstacle for housing this year.

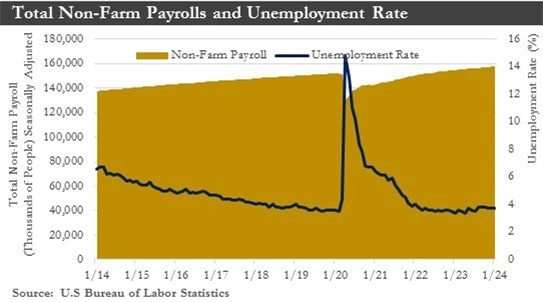

Labor Market: The labor market held up surprisingly well in 2023 and has been off to a solid start in 2024. U.S. employers hired at a faster-than-expected pace in January, extending 2023’s steady gains. Non-farm payroll employment jumped by 353,000 in January. The unemployment rate was unchanged at 3.7%, as fewer people in the labor force offset the increase in employment. The labor market's resilience has defied expectations and remained a bright spot in the economy.

Wages rose a healthy 0.6% last month and 4.5% from a year earlier. The latter was an increase from December’s 4.1% annual increase.

Manufacturing and Services: A stark divergence has remained between the manufacturing and services sectors. According to the ISM Manufacturing Index, December marked the 15th straight month of slowed manufacturing activity. Its services sector counterpart has continued to expand, although at a slower pace.

According to survey responses, manufacturers have continued to be weighed down by weak demand for new orders, the unfavorable financing environment, and the grim prospects for manufacturing employment. Growth in new orders increased in January, offering some encouragement. In contrast, survey responses among service providers were generally positive despite December's dip in activity. Although manufacturing should remain under pressure, manufacturers surveyed by ISM have grown more optimistic as inflation pressures abate and expectations mount for Federal Reserve rate cuts in 2024.

Monetary Policy: Federal Reserve officials have signaled they are comfortable maintaining their benchmark federal funds rate at a 23-year high as they await more evidence that inflation has fallen back to their 2% target. January’s job market report should do little to alter that calculus. With inflation still simmering below the surface and the labor market continuing to crank out new jobs, monetary policy easing is not likely to come until later in the year.

Global Economy: The continued resilient outlook for U.S. growth has implications for the global economic outlook. More robust U.S. growth should allow the Eurozone and the United Kingdom to recover more quickly from recession conditions and, given extensive trade linkages, should also support activity in Canada and Mexico. Overall, a mild slowdown in global GDP growth from 2.9% in 2023 to 2.5% should occur in 2024. Amid this backdrop, select central banks should adopt a more gradual approach to lowering interest rates. For the European Central Bank and the Bank of England, interest rate cuts will likely proceed at a more measured pace, with policy interest rates not leveling out until the second half of 2025.

China: China's gross domestic product expanded 5.2% in the fourth quarter and for the entire year in 2023, the slowest annual rate since 1990. Consumption was the most significant contributor to overall growth in 2023. Investment was lackluster in 2023. Fixed-asset investment growth slowed while private-sector investment remained weak.

This year, maintaining growth at a similar pace could prove more challenging, given policymakers' hesitance to launch big-ticket stimulus packages. China’s growth rate should slow this year and range from 4% to 4.9%.

In the near term, China has few obvious growth drivers. Export demand should soften as the global economy could slow this year. Chinese families, hit by years of pandemic restrictions and receiving no direct financial support from the government, have turned cautious on spending amid a weak job market. Private businesses have been holding off on new investments while foreign investors have pulled funds out of the country.

In the long run, China could face a daunting list of headwinds, including an aging population, higher debt levels, and a worsening external political environment, which has seen relations with the U.S.-led West plummet.

Chinese authorities have unleashed a barrage of smaller-bore measures, such as trimming key interest rates, cutting mortgage costs for home buyers, and prodding banks to lend more to distressed property developers. However, these measures have done little to reverse downward pressure on the economy.

Outlook: Despite interest rates reaching a 22-year high, the U.S. economy expanded by a robust 2.4% in 2023 – a pace of growth well above any of its peers. Last year’s resilience has been traced back to several factors, including a resurgent consumer, increased construction of semiconductor and electric vehicle battery manufacturing facilities, and stronger fiscal tailwinds.

Last year's tailwinds should fade this year but not completely die out. The U.S. economy should expand by 1.5% in 2024, slightly below its trend growth rate but well above the more anemic pace of growth expected across other advanced economies.

The labor market’s slowing but steady pace during 2023, coupled with a sharp slowdown in inflation, has fueled optimism that the economy could achieve a so-called soft landing, meaning inflation eases without a recession.

Federal Reserve officials have signaled they are comfortable maintaining their benchmark federal funds rate at a 23-year high as they await more evidence that inflation has fallen back to their 2% target. The labor market should not overheat, as private-sector hiring has eased recently.

Weaker consumer spending could be a key ingredient in slower U.S. growth, with excess savings set to be reduced this year. Consumers could be more cautious, with credit card and auto loan delinquency rates rising above pre-pandemic levels despite a very low unemployment rate. This would suggest that many households have increasingly felt the pinch from high inflation and rate increases and would become more cautious in spending. With Washington in a stalemate and funded under continuing resolutions until the election, the fiscal impulse from the Federal government should diminish, weighing on its contribution to growth. The one area of the economy that could improve its fortunes is housing, where lower borrowing costs would bolster activity in the year's second half. Slower economic growth in 2024 should create a better balance in the labor market. Cooler wage growth would be needed to get inflation back to 2%, and the next stage of the disinflation process should be a bit slower.

Sources: Department of Labor, Department of Commerce, Bloomberg, Institute for Supply Management, National Association of Realtors, European Commission, National Bureau of Statistics of China