U.S. retail spending and manufacturing weakened in November, signs of a slowing economy as the Federal Reserve continued its battle against high inflation. The Fed raised its benchmark interest rates by 0.5 percentage points to a 15-year high and signaled plans to continue lifting rates through the spring. The economy has shown signs of slowing, and inflation has eased from a summer peak, but the labor market remained tight despite layoffs in sectors such as tech and real estate.

The elevated rate of inflation, which has eroded household real income, and the degree of monetary tightening will likely cause the U.S. economy to slip into a modest recession beginning in 2023. Policymakers will likely continue to come down on the side of bringing inflation back toward the Committee's target of 2% at the expense of allowing the unemployment rate to rise. The U.S. economy could be at risk of shedding over one million workers in 2023, with an unemployment rate that could rise by 1.5 percentage points. That would inject the needed slack in the labor market to ease concerns that wage pressures could feed into inflation.

Despite falling real incomes households have continued to spend by bringing the personal saving rate down below 3%, the lowest rate since 2005, and by running up credit card debt.

The United States is not the only economy with an inflation problem at present. Inflation has risen sharply in most foreign economies as well, and central banks in those countries have faced the same dilemma as the Federal Reserve. Like their counterparts at the Fed, policymakers at many foreign central banks could choose to bring inflation down at the expense of the labor market. Consequently, many foreign economies will likely also experience contractions in net of inflation GDP in 2023. Moreover, the downturns in the Eurozone and the United Kingdom could be especially pronounced.

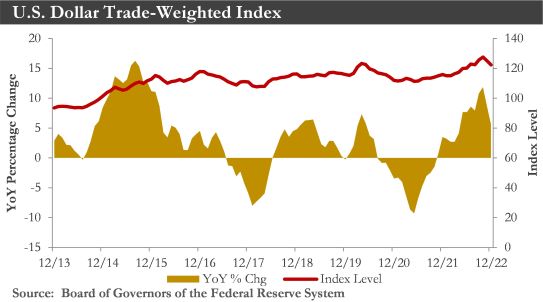

The U.S. dollar has strengthened against most foreign currencies throughout 2022, and this trend of appreciation should continue through the early part of 2023. But as the FOMC brings its tightening cycle to an end and as market participants begin to anticipate eventual policy easing in the United States, the dollar should trend lower against many foreign currencies starting in mid-2023.

Looking back into the fourth quarter of 2022, the U.S. economy should show some resilience expanding by around 2.0-2.5%. Consumer spending and business investment appeared to be holding up reasonably well. However, it would be a stretch to assume that the rapid adjustment in interest rates will not soon start to weigh on broader economic activity. A more meaningful downward demand adjustment could begin in early 2023, with growth expected to fall to a near-stall speed in 2023.

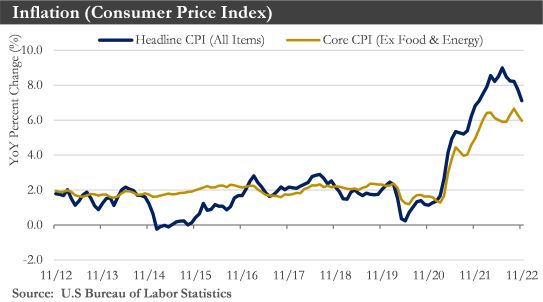

Inflation: In November, consumer prices rose at the slowest 12-month pace since December 2021, closing out a year in which inflation hit the highest level in four decades and challenged the Fed’s ability to keep the U.S. economy on track.

The consumer price index climbed 7.1% in November from a year ago, down sharply from 7.7% in October - building on a trend of moderating price increases since June’s 9.1% peak. Core CPI rose 6% in November from a year ago, easing from a 6.3% gain in October.

Inflation soared in 2022 as the economy recovered from the Covid-19 pandemic. Prices leaped as surging consumer demand—fueled by very low-interest rates and government stimulus—collided with limited supply caused by pandemic-related disruptions. Russia’s invasion of Ukraine inflamed inflation worldwide further pushing up prices for energy and other commodities, culminating in June’s U.S. CPI reading, the highest since 1982.

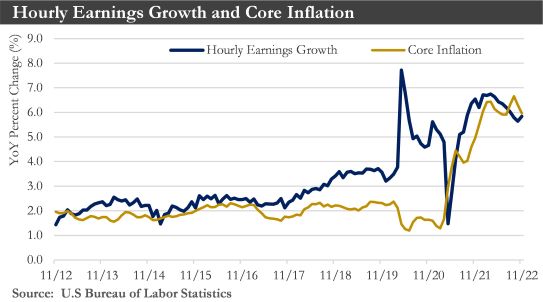

Overall inflation has eased since the summer as supply bottlenecks have improved. Inflation has remained high, however, and has spread to more labor-intensive services as wages surged in a tight labor market where demand for workers has exceeded the number of unemployed looking for jobs. Low unemployment and wage gains have helped fuel consumer spending, which has remained robust despite rapidly rising prices. Home prices have fallen as mortgage rates increased. An easing of housing costs and the slowing pace of price increases for goods could take some pressure off inflation. For the next 6 to 12 months, even without moderation in wage growth, core inflation could come down quite considerably with just the disinflation expected from goods and shelter prices.

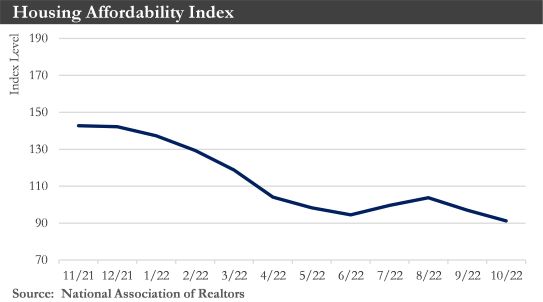

Housing: The drop in home sales in 2022 marked one of the biggest impacts of the Federal Reserve’s aggressive interest rate increases aimed at cooling the economy and bringing down high inflation. Home sales are highly interest-rate sensitive and fuel other economic activities such as spending on renovations, furniture, and appliances. The housing market slowdown could persist well into 2023 because home-buying affordability has been near its lowest level in decades. Home prices have continued to rise on an annual basis due to low supply, though the pace of home-price growth has slowed sharply.

Labor market: The U.S. labor market has remained historically tight, with many employers competing for a limited pool of workers and bidding up wages despite an uncertain economic outlook. Low unemployment and wage gains have been helping fuel consumer spending - the economy’s main engine - but also contributing to inflation that is running close to a four-decade high.

One big question is how long the labor market’s strength can last as the Fed raises interest rates. In November, payrolls grew in leisure and hospitality, healthcare, and government. The information sector—including many tech jobs—also hired workers at a healthy clip. But cracks have been emerging. Some companies in technology, entertainment, and real estate have shed workers, with many growing nervous about the economic outlook.

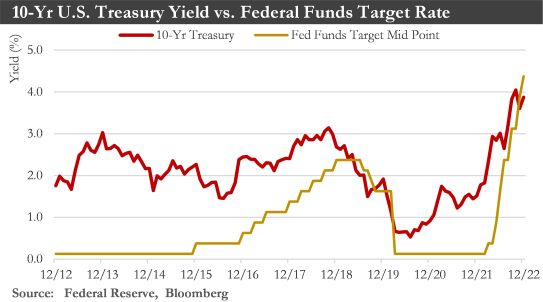

Monetary Policy: The Federal Reserve Open Market Committee (FOMC) lifted the federal funds rate to the 4.25% to 4.5% range, announcing a continuation of its balance sheet runoff, and signaled plans to keep raising rates over its next few meetings to combat high inflation. Policymakers should continue to come down on the side of bringing inflation back toward the Committee's target of 2% at the expense of allowing the unemployment rate to rise. The FOMC also raised the target range for fed funds from 5.00% to 5.25% by March. Furthermore, the FOMC maintained its target range at an elevated level through the rest of 2023. Given the current pace of hikes, the Fed likely pauses in the first half of 2023 to observe the impact of past rate hikes on the economy. But as the Committee becomes convinced that inflation is firmly on the road back to 2% and as the unemployment rate nears 5%, the FOMC could commence an easing cycle in early 2024.

The effect of this current monumental rate hike cycle will eventually take its toll on the economy. GDP could decelerate significantly in 2023 as the lagged effects of policy slow consumer spending. Given that inflation has already started moving in the right direction, this economic weakness should help drive price growth even more quickly toward the Fed's 2% target.

U.S. Dollar: The over-arching theme for most of 2022 was that of U.S. dollar strength. This theme could persist into early 2023 as U.S. economic trends have remained resilient relative to other major developed economies, and as the Federal Reserve has pursued a more aggressive pace of monetary tightening compared to other major central banks.

But as the Fed ends its tightening cycle and U.S. economic trends worsen, the dollar will likely enter a period of cyclical depreciation and weaken against most foreign currencies for 2023. Dollar weakness will be broad enough such that most G10, as well as emerging market currencies, could strengthen vis-à-vis the dollar throughout 2023. A pause in Fed rate hikes should take pressure off many foreign currencies, particularly currencies in the developing world. In that sense, 2023 could be ripe for emerging market currencies to not only recover against the U.S. dollar but also outperform relative to G10 currencies. Currencies associated with stable local politics and sound underlying economic fundamentals could also outperform.

Europe: Europe—not just the Eurozone, but also the United Kingdom—has appeared to be on the brink of entering a prolonged period of recession that is expected to last for much of 2023. A European recession has stemmed primarily from inflationary pressures and central bank rate hikes, but energy supply disruptions and accelerating wage growth have also compounded the continent's economic slowdown. With the Eurozone, the United Kingdom, Canada, and some larger developing economies joining the United States with their economic downturns in 2023, a large percentage of the global economy could be in recession in 2023.

China: China's growth prospects could remain sluggish for the foreseeable future. In fact, given the underwhelming October activity data, China's economy could expand by just 3% in 2022. China could grow at a subdued level as virus flare-ups result in broad mobility restrictions over the entire course of 2023. And as the local economy has struggled to gather momentum under the COVID policy as well as the slumping real estate industry, China’s policies should likely turn more accommodative. This accommodative policy should support the economy modestly, but not enough to return China to the growth powerhouse it once was. Authorities recently announced a large fiscal package to support the real estate sector. The People's Bank of China (PBoC) will ease monetary policy further in an attempt to offset a portion of the economic slowdown, weakening the Chinese renminbi.

Capital Markets

Recap: 2022 was a historic year with both stock and bond markets suffering unique double-digit losses. The largest factors negatively impacting markets included multi-decade high inflation, the Fed’s persistent fight to contain it with eye-popping rate increases, and the promise of more increases to come. The war in Ukraine, divisive partisan politics, a weakening housing market, falling consumer sentiment, talk of recession, and the prospects of declining corporate profits and margins also combined for a toxic brew of negative inputs concerning investors. And the news around the world was gloomy as well with Europe and the U.K. headed for recession and China, the world's second-largest economy, headed for much slower annual growth than it is accustomed to.

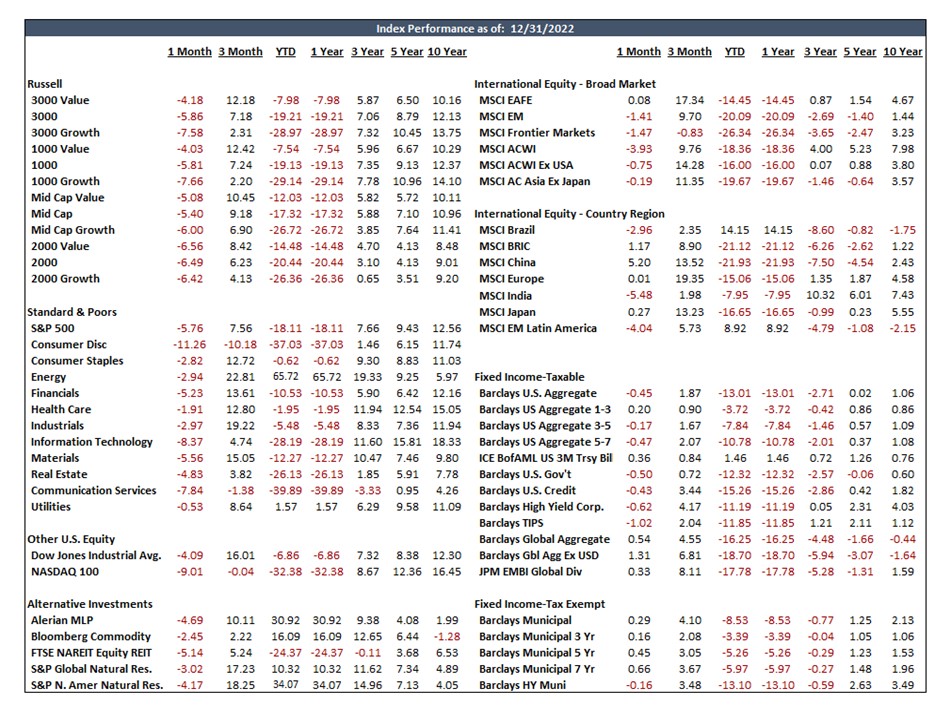

Though the fourth quarter provided positive return momentum going into 2023 with both stocks and bonds gaining ground on earlier losses during the year. These gains were not nearly enough to offset the large declines from earlier in the year. U.S. equities finished the year with a positive fourth quarter as the large-cap S&P 500 posted a 7.6% return, the Russell Midcap was up 9.2%, and the small-cap Russell 2000 gained 6.2%. For the full year of 2022 however the S&P 500 was down 18.1%, the Russell Mid Cap was down 17.3%, and the Russell 2000 was down 20.4%.

Stylistically Value stocks resumed their performance dominance over Growth stocks in the fourth quarter. For all of 2022 large, mid, and small-cap Value stocks dramatically outpaced their Growth counterparts continuing a performance trend reversal that began in 2021 following years of lagging the performance of growth stocks.

International equities also posted positive returns for the fourth quarter but delivered negative returns for the full year just like domestic stocks. That said, the fourth quarter gains were stronger in overseas markets contributing to international developed market equities outpacing U.S. stocks. For all of 2022, the MSCI All Country World Index ex-U.S. declined 16% while the MSCI Emerging Markets Index declined 20.1%.

The bond market turned into a sea of red ink in 2022 as bond price declines mounted while interest rates rose during the year. There was no escaping the downward price pressure on bonds from rapidly rising interest rates. The bond market, sensing the worst was over for the rate hiking cycle began clawing back some earlier year losses in the fourth quarter with fixed income around the globe posting positive returns. The Bloomberg U.S. Aggregate Index was up 1.9% in the fourth quarter, the High Yield Index gained 4.2% and the Global Aggregate ex-U.S. was up 6.8% in the fourth quarter. However, for the year these same three gauges of bond performance were down 13.0%, 11.2%, and 18.7% respectively. The strong U.S. dollar made non-U.S. bonds less attractive and added to the downward pressure on those bond prices.

Outlook: The outlook for stocks and bonds has brightened somewhat since last quarter largely due to the likelihood that the Fed is closer to the end of its rate hiking cycle than they were at the end of last quarter. That said, however, it takes time for a Fed rate hike to flow through the economy and show up in changes to corporate revenues, profits, margins, and employment trends. With all the hikes of 2022 behind us but at least a few more on the way, there is still a time lag yet to experience, probably until the end of this year, for the impact of the Fed’s tightening cycle to fully impact the economy. Until there is greater clarity on the actual impact on the performance of the economy stocks may well be moving sideways with no clear direction.

There continue to be downside risks to the capital markets which should be kept in mind as 2023 gets underway. Those risks include the Fed overshooting their rate increases, a deeper than-expected recession, contagion which could emerge from an increase in credit defaults as rates continue to rise, and of course a possible escalation in the conflict in Ukraine and its potential impact on the prices of oil and commodities. These types of events could well lead to elevated market volatility in comparison to recent years – this volatility however often creates new investment opportunities.

A longer-term view of markets suggests the tailwinds stock and bond investors enjoyed for the past decade or more including massive fiscal stimulus as well as declining and ultra-low interest rates will not resurface any time soon. Securities values are more likely to be driven by the organic operational successes of businesses. That will likely result in market returns being lower than in the recent past.

.jpg)

Sources: Bloomberg, Department of Labor, Department of Commerce, Morningstar, Peoples Bank of China

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.