Congress passed legislation suspending the debt ceiling through the end of 2024 just weeks ago, avoiding what would have been the first default in U.S. history. The financial sector has also avoided contagion that would have triggered widespread instability in the banking system during the second quarter.

Over the past month, data releases have revealed a still-strong economy not yet on the brink of recession. As of May, the labor market registered a 14-month streak of better-than-expected payroll gains. While small business hiring plans are trending down, the descent has been gradual, and hiring plans have remained historically elevated.

There was a recent 0.5% jump in real consumer spending. Upward revisions to forecasts for payrolls and disposable income have pushed up consumer spending expectations through the year's end.

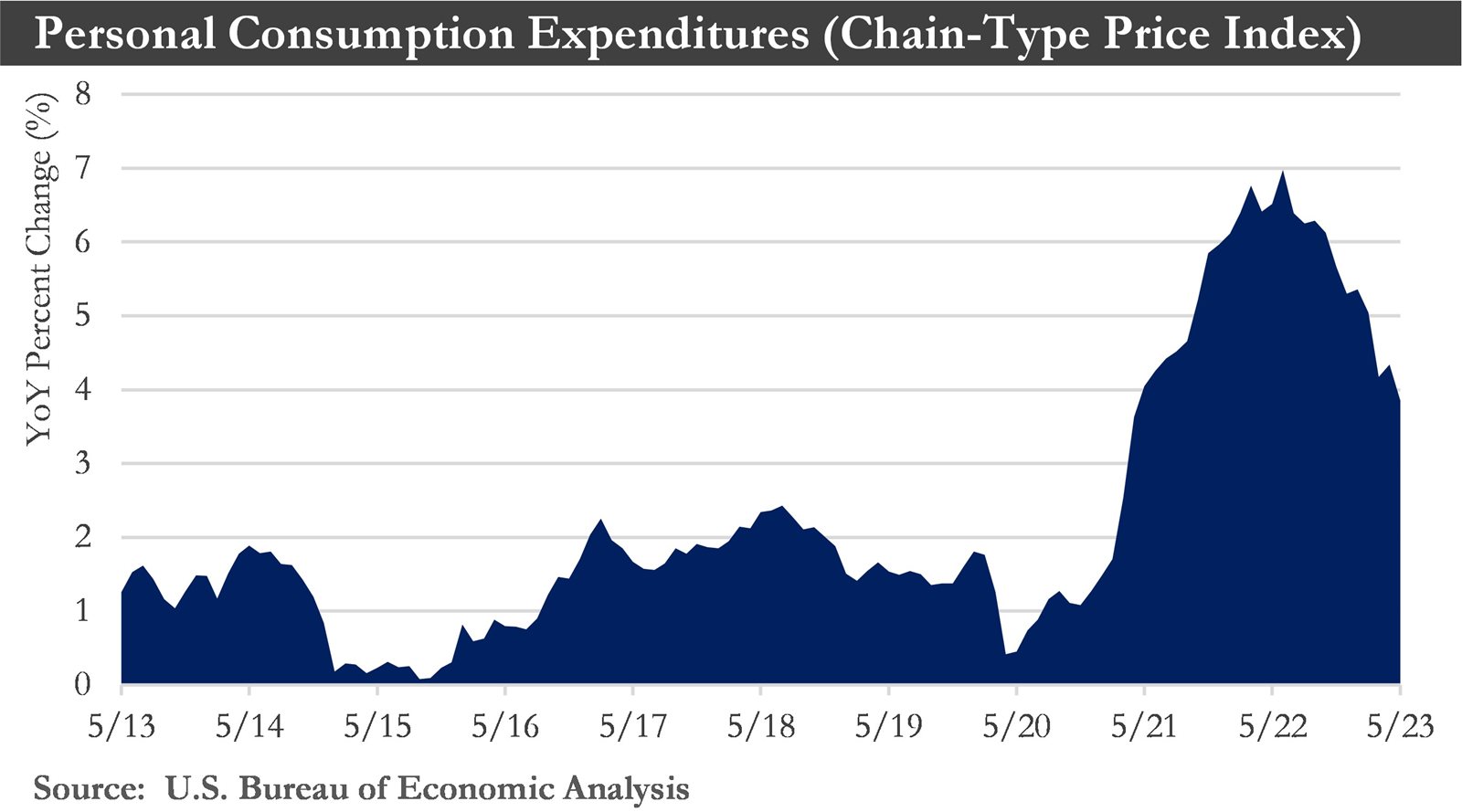

As the tight labor market has boosted real incomes and spending, price pressures have eased only gradually. As a result, slightly higher inflation could occur with the increase in the Personal Consumption Deflator (the Fed’s preferred inflation gauge), averaging 4.5% in 2023.

Nonresidential investment has been bolstered by an influx of new projects in electric vehicle and semiconductor manufacturing; however, a challenging environment for commercial real estate could weigh on nonresidential investment in the quarters ahead. More broadly speaking, higher costs and lower business earnings in recent months could put downward pressure on investment spending throughout the economy.

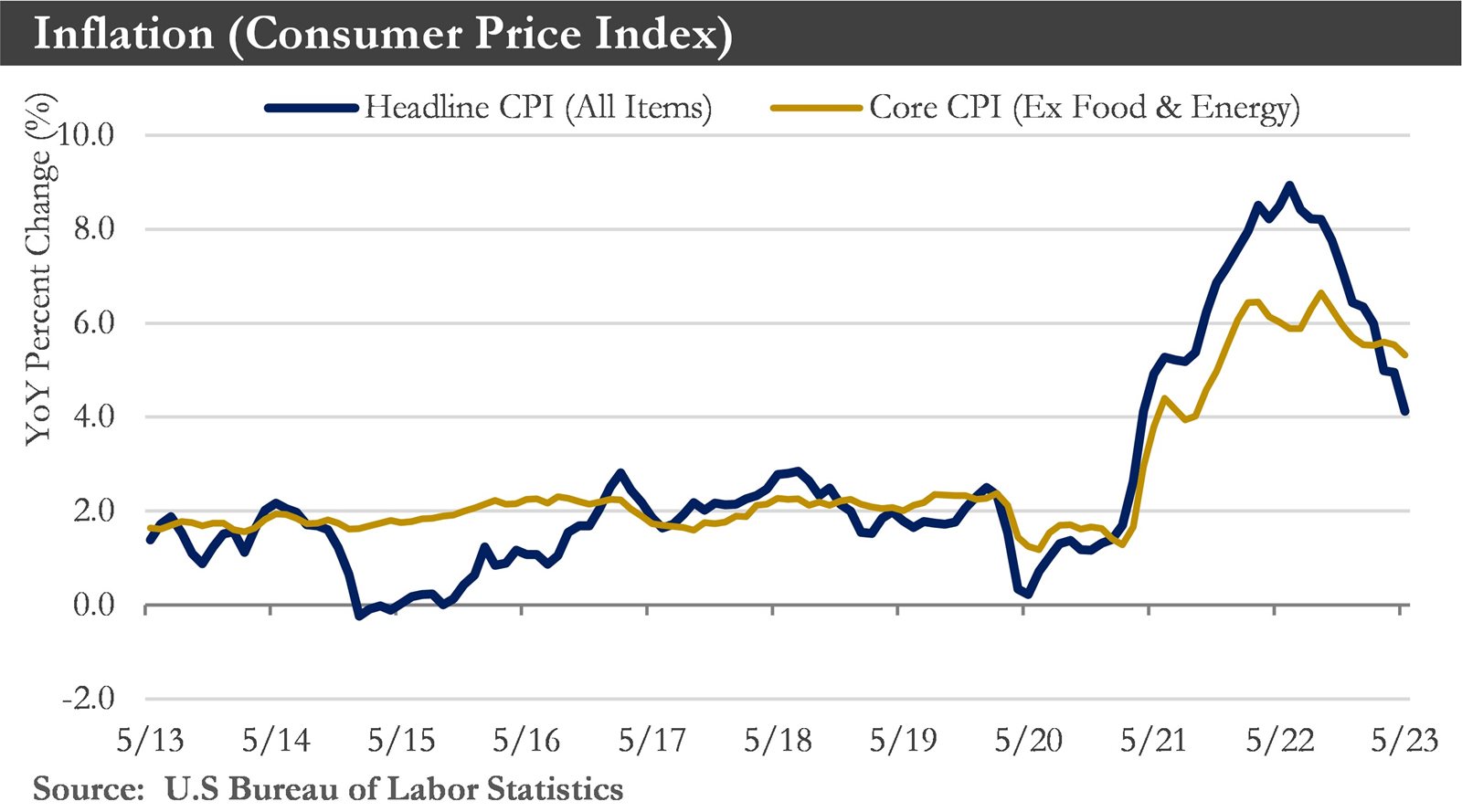

Inflation: The consumer price index rose 4% last month from a year earlier, well below the peak of 9.1% last June and down from April’s 4.9% increase. Housing prices for used vehicles, and food drove inflation last month. Inflation figures showed that the Fed has made progress in cooling price pressures but has remained far above what Federal Reserve officials would like to see.

Headline inflation has shown the most progress amid sharp declines in energy prices and much slower food inflation, but the headline CPI has remained unacceptably high at 4.0% year-over-year. Even more troubling has been the recalcitrance of core inflation. The core CPI increased 5.3% over the past 12 months and 5.0% over the past three months (annualized), a sign that core inflation has slowed, but only marginally.

A more noticeable deceleration in core prices could occur in the coming months. Shelter inflation appears to have peaked and should continue to slow in the year's second half. The recent jump in used auto prices has not been sustainable, and this category should resume its descent soon. Excluding used autos, core goods inflation has shown signs of easing amid normalizing supply chains and moderating consumer demand.

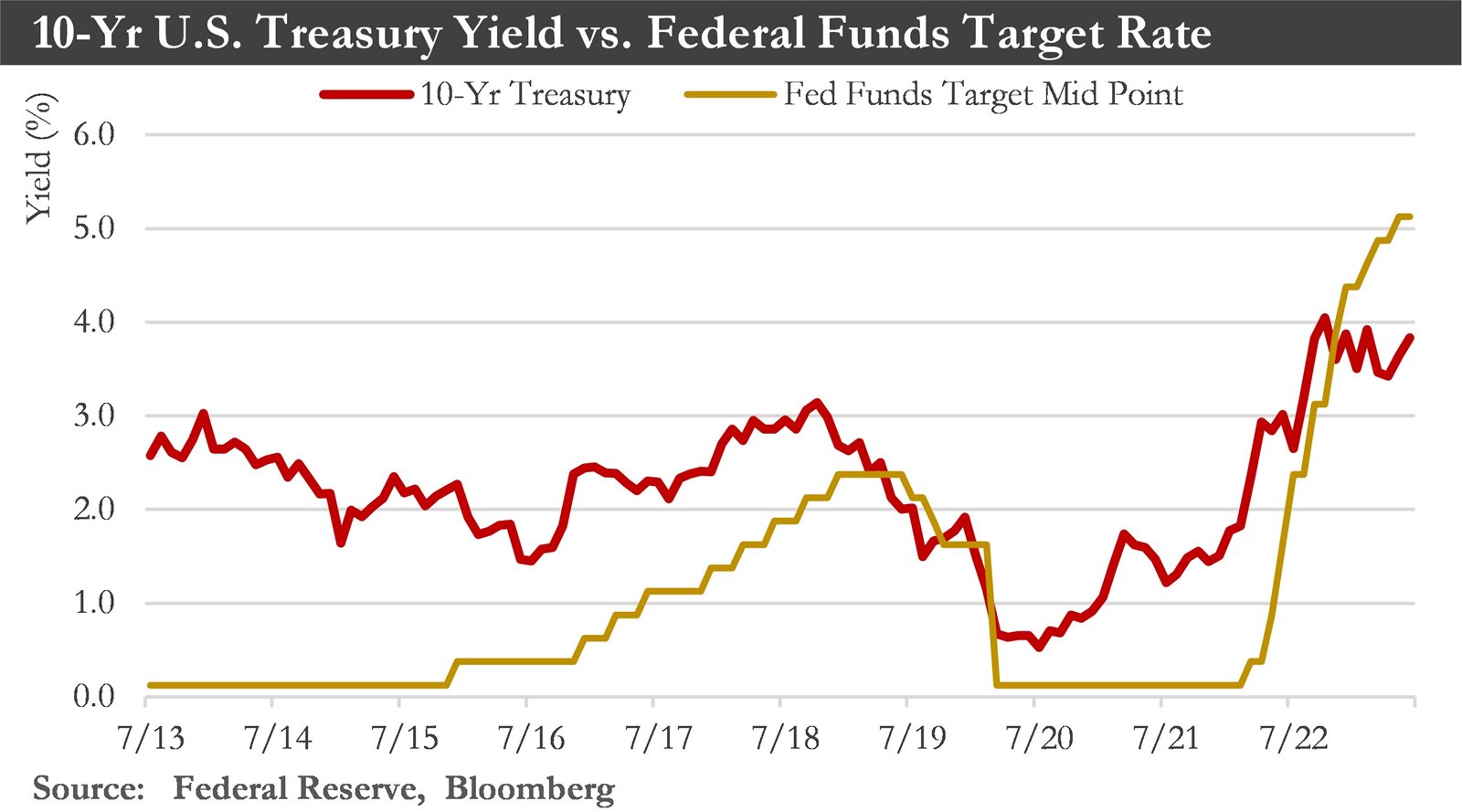

Monetary Policy: The Federal Reserve agreed to hold the federal funds rate steady in the 5.0% to 5.25% range after ten consecutive increases. However, it signaled that they are leaning toward raising them in July if the economy and inflation prevent cooling down.

The Federal Reserve has taken a temporary break after five percentage points in interest rate hikes since March 2022. The labor market has continued to exude strength, and underlying measures of inflation have shown far more stickiness than previously expected.

While Fed members have signaled that more hikes may be in the pipeline, part of the Fed's motivation in signaling tighter policy has been to ensure it locks in expectations for tighter financial conditions. The other factor to consider is that while the lagged effect of when higher interest rates will hit the economy has been lengthened it has yet to go away. The economy could slow dramatically in the second half of this year, preventing the Fed from hiking further.

Labor Market: Nonfarm payrolls have continued to grow at a solid pace in recent months. Other labor market indicators have been less robust but point to a very tight labor market. Layoffs have moved sideways in recent months, whether measured by initial jobless claims, the Job Openings and Labor Turnover Survey (JOLTS) data, or the Challenger Report of job cut announcements. Given this recent momentum, job growth is not likely to slow as much in the short term.

Wage growth has slowed, according to the average hourly earnings numbers. However, these figures could be noisy and subject to compositional quirks. The Employment Cost Index reading for Q2 will be released on July 28, and observers could parse this more comprehensive measure to see if labor cost growth slows alongside average hourly earnings. Slower labor cost growth amid solid job growth and low unemployment would be vital in achieving a soft landing instead of a recession.

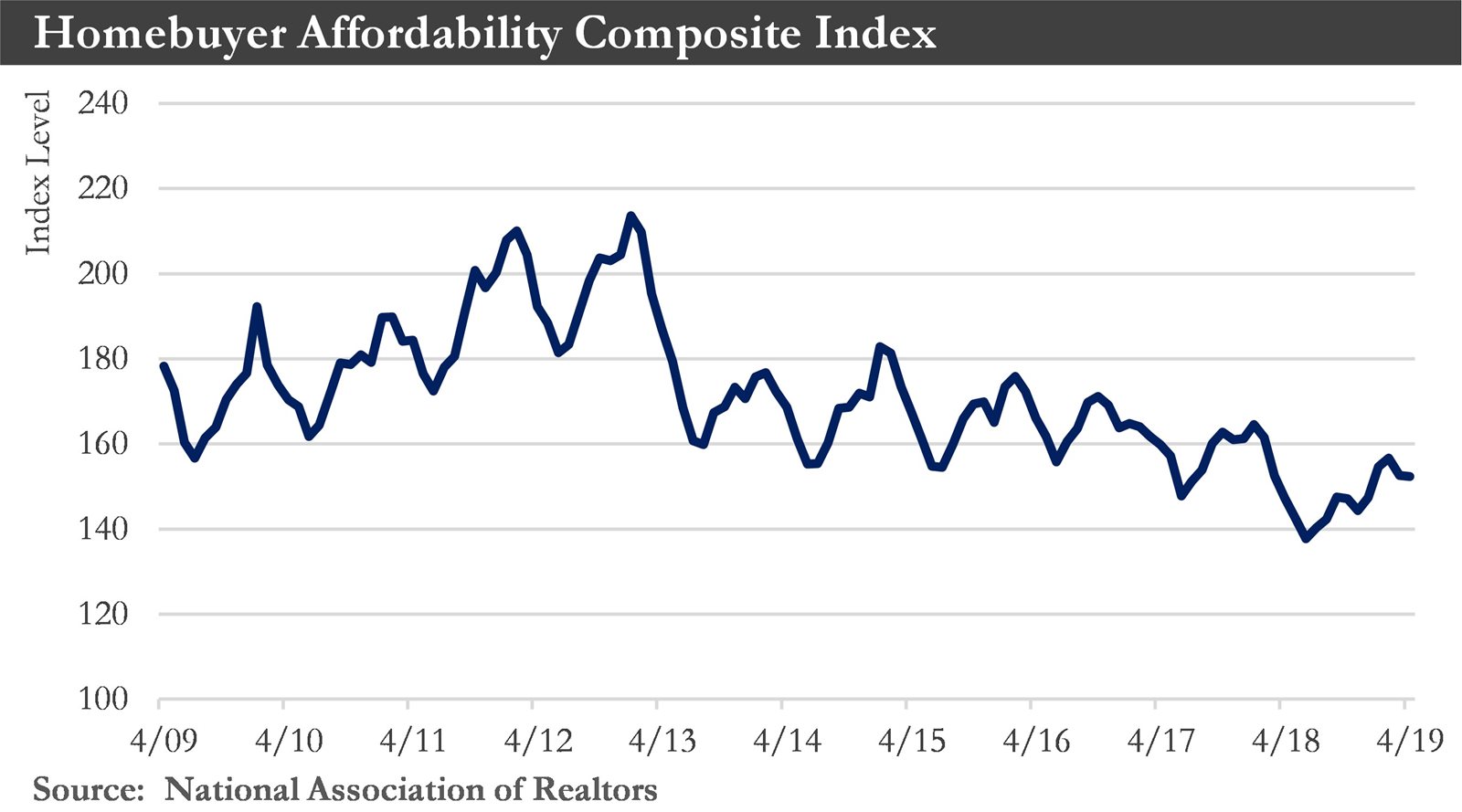

Housing Market: The U.S. housing market has exhibited some early signs of stabilization, with sales activity nearing a bottom on a trend basis and price growth having recently elevated. With housing affordability remaining historically tight, changes in mortgage rates have been a critical factor underpinning sales activity. The roller coaster in mortgage rates has continued.

Existing home inventories have remained near multi-decade lows, in part because homeowners have been reluctant to take on a new mortgage. Supply conditions have been looser in the ‘new’ home segment. As such, this minor corner of the housing market has grabbed a slightly bigger share of overall sales.

While mortgage rates could drift lower over the coming year, there has been some uncertainty over the medium term concerning the economic outlook. Banks have been tightening credit standards alongside rising interest rates – an adjustment that has accelerated in the wake of the recent banking turmoil. Though the labor market has continued to be strong, hiring conditions should cool through the second half of this year, resulting in some upward pressure on the unemployment rate through early-2025. If the labor market backdrop unfolds as expected, home prices will likely turn lower later this year and could fall by 5-7% from the peak.

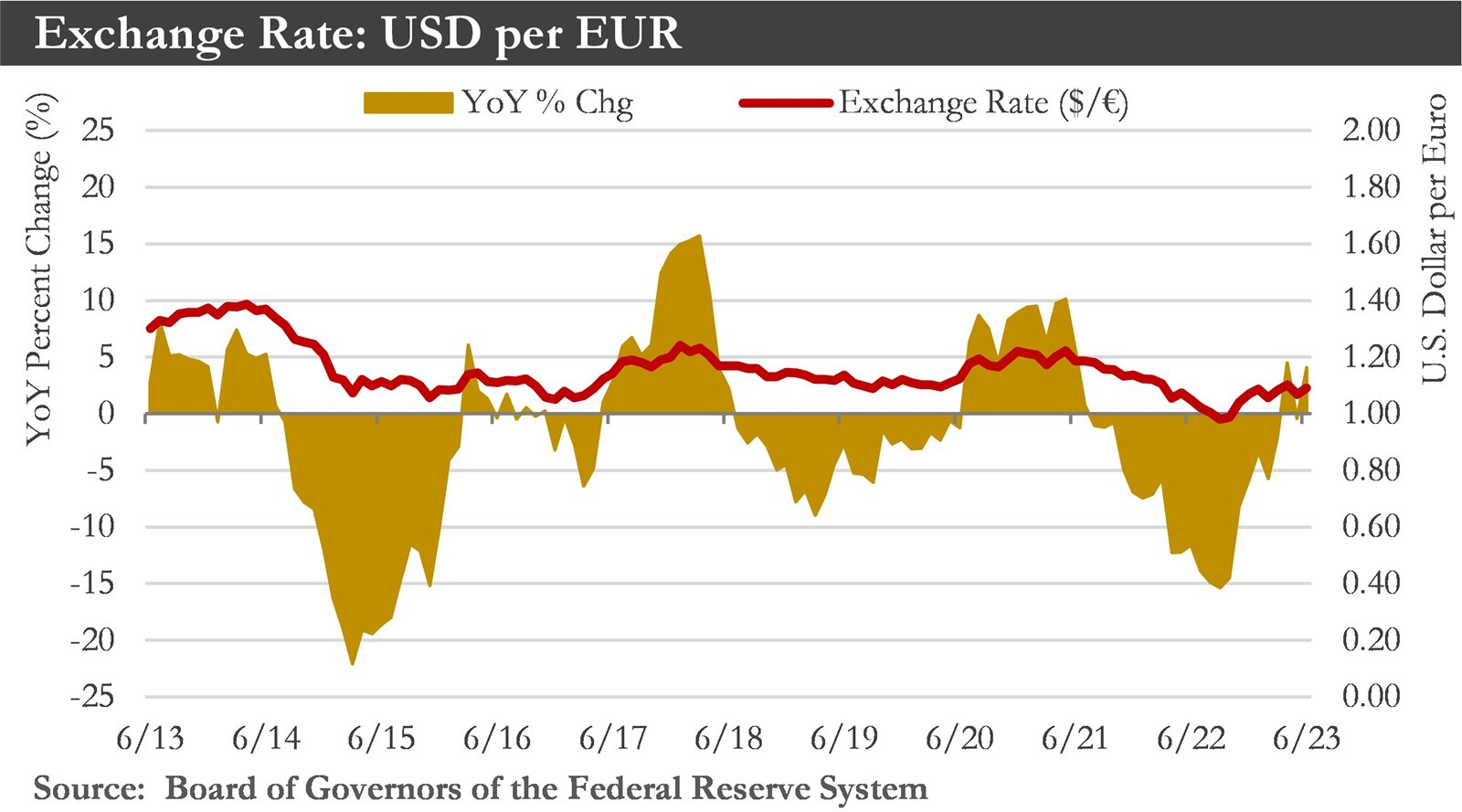

U.S. Dollar: The dollar should trade sideways for the next few months. While another Fed rate hike or two is in the offing for this year and then later easing, foreign central banks have largely matched the Fed's monetary policy path. From an interest rate differential perspective, higher rates from international central banks should offset a hawkish Fed and keep the dollar stable through the end of Q3-2023.

Longer-term, however, the Fed could ease monetary policy more aggressively than foreign central banks. Over time, those same interest rate differentials should move in favor of foreign currencies. As these dynamics unfold, the U.S. dollar could broadly depreciate against G10 and emerging market currencies. The yen may be a key beneficiary from U.S. dollar weakness, with moderate gains expected in the euro. Among the emerging markets, long-term strength should forecast for most currencies relative to the U.S. dollar.

The Global Economy: In June, the central banks of the world’s three biggest economic blocs came to starkly different conclusions, with the eurozone raising rates, the U.S. on hold, and the Chinese cutting.

The conflicting moves were caused by economies increasingly moving to local rhythms. Europe was in a technical recession, but the central bank expected inflation to last. China has no inflation problem but has suffered from the aftermath of its extended lockdowns and property price bubble. The U.S. economy has done surprisingly well, and inflation has fallen, but underlying price increases have remained stubbornly high.

This global divergence has already swung currencies. China’s yuan has weakened this year, which should make its exports more competitive, crimp imports, and help the economy. More importantly for U.S. investors are the moves in Europe, where investors have now seen the European Central Bank and the Bank of England as more hawkish than the Fed. That has driven their bond yields and pushed down the dollar against the euro and sterling.

Roughly a year into the most aggressive monetary tightening in decades, major central banks have entered a new phase: Rather than unveiling jumbo rate increases month after month, central bankers have fine-tuned their policies, poring over recent economic data to gauge the impact of past rate moves.

Economic growth rates have diverged across countries, inflation has fallen at different speeds, and last year’s global spikes in food and energy prices have given way to more local price dynamics. These changes mean the Fed and the ECB have begun diverging their policies.

Inflation has remained high in many advanced economies. The impact of the past year’s interest-rate hikes has ebbed in places, with signs that housing markets have stabilized, and unemployment has resumed its decline. Wage growth in the U.S. and Europe has stabilized at high levels but shows few signs of further declines.

The ECB: The European Central Bank (ECB) nudged its key deposit rate to 3.5%, the highest level in over 20 years, and indicated it would continue pushing them higher. The ECB’s assertiveness contrasted with the Federal Reserve's current decision to keep interest rates steady.

The ECB expects one or two more interest-rate increases over the coming months, followed by rate cuts early next year. The Fed will also unveil at least one more quarter-point rate increase by September and cut rates by almost 1.5 percentage points over the following year. Of course, this outcome would be subject to future official economic data releases and may need to be revised, especially if the strong labor market continues.

The ECB started raising rates later than the Fed, and rates in the eurozone have lagged behind those in the U.S. While underlying inflation in both regions is about 5%, it has fallen noticeably in the U.S. but not in the eurozone. Still, the U.S. recorded solid economic and job growth in recent months, while the eurozone economy entered a shallow recession. That should weigh on inflation in the single-currency area.

China: China's post-COVID rebound has fully matured as the latest activity data batch reinforced the view that a slowdown across the Chinese economy is underway. Waning economic momentum has prompted easier monetary policy from the People's Bank of China (PBoC), and further easing is imminent as authorities lower bank Reserve Requirement Ratios in Q3-2023. Diverging paths for monetary policy between the Fed and PBoC have weighed on the renminbi.

Short-term growth prospects have been under pressure; however, China's longer-term growth potential has also faced robust challenges as structural issues persist and have arguably worsened. These structural hurdles have stemmed from worsening demographic trends, an over-leveraged non-financial sector, and geopolitical developments that could suppress rather than enhance future economic growth prospects. As a result, China's economy is likely to grow just under 6% this year.

Outlook: The U.S. economy showed fresh signs of cooling, with a reading of supplier inflation moderating and applications for unemployment benefits rising. U.S. economic growth slipped in the first quarter, and consumer spending stagnated in April and May. Additionally, the cash stockpiles that consumers accumulated over the past few years have gradually been eroded. Real personal consumption expenditures could decelerate in the coming months, lowering headline GDP growth. The Fed’s expected tightening in July will exert further headwinds on the economy.

Weaker economic growth should soon begin to weigh on hiring intentions – putting upward pressure on the unemployment rate. The unemployment rate should rise by more than one percentage point by mid-2024, reaching a peak of 4.6%, before gradually moving back to its long-run average of 4%.

Inflation has slowed from its multi-decade highs, though more recent data has shown some stalling in the disinflationary process. The fed funds rate should reach 5.25% in Q2-2023 and remain at that level through the fourth quarter of 2023. As higher rates cool demand-side pressures and inflation moves meaningfully back towards 2%, the Fed would likely cut interest rates back to a level more consistent with its neutral (2.5%) rate.

As such, the U.S. economy is likely to slip into a modest recession towards the end of this year, but it is expected to be shallow and short-lived.

Source: Department of Labor, Department of Commerce, Bloomberg, Eurostat, Peoples Bank of China, European Central Bank

Capital Markets Commentary

Recap: June’s equity wins worldwide added to what has already been a successful year for shareholders. The resolution of the debt ceiling standoff and the Federal Reserve standing pat with their interest rate hiking cycle in June were macro wins that the market liked despite softening corporate profits. Investor frenzy surrounding all things artificial intelligence continued to express itself in the strong leadership and multiple expansions for those companies deemed to be beneficiaries of the mainstreaming of this new technology.

Stocks gained more ground as the first half ended. The broad U.S. equity indexes finished June on a positive note, and for the quarter, the large-cap S&P 500 posted an 8.7% return, the Russell Midcap was up 4.7%, and the small-cap Russell 2000 gained 5.2%.

Growth stocks slightly outpaced Value stocks in June, resuming their recent performance dominance, and for the entire quarter, posted a 12.5% return for the Russell 3000 Growth Index and just 4.0% for the Russell 3000 Value Index. Q2 large, mid, and small-cap Growth stocks dramatically outpaced their Value counterparts. Most of the Growth Leadership, and frankly, return for the overall market, has been driven by a handful of mega-cap stocks, including Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVDIA, and Tesla. While their profits have grown, investor enthusiasm has driven these stock prices to significantly expanded price earnings multiples making other parts of the market look much more reasonably priced or downright cheap.

International equities also posted positive returns for June and Q2, except for China which lost almost 10% for the quarter. Returns were significantly lower for international and emerging markets equities than U.S. equities. In Q2, the MSCI All Country World Index ex-U.S. was up 2.4%, the MSCI European, Australian, and Far East Index was up 3.0%, and the MSCI Emerging Markets Index was up 0.90%.

The bond market faced the headwinds of rising interest rates and concerns about the stickiness of core inflation and the increasing probability that interest rates will stay higher for longer.

The Bloomberg U.S. Aggregate Index was down 0.4% in June, and down 0.8% for Q2, the High Yield Index gained 1.7% in June and 1.8% for Q2, while the Global Aggregate ex-U.S. was up 0.3% in June but down 2.2% for all of Q2.

Outlook: The outlook for stock returns remains uncertain given the slowly deteriorating dynamics of the economy, the higher trajectory of interest rates, and the negative impact on corporate profits. The U.S. is likely headed into a period of slower economic growth, if not an outright recession. A recession is the price that will likely need to be paid for the Fed to crack the strong inflationary impulse in the U.S. That recession will likely result in lower consumer and business demand and higher unemployment. However, the equity market seems to be looking past this well-telegraphed recession to a period of falling interest rates and better corporate profit performance.

However, the outlook for bonds has brightened since last quarter mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is coming down, and now bonds offer a respectable coupon rate after years of ultra-low interest rates.

There continue to be downside risks to the capital markets, which should be kept in mind as 2023 progresses. Those risks include the Fed possibly overshooting their rate increases, a deeper-than-expected recession occurring, more stress in the banking system emerging due to the industry’s deposit level declines, an increase in credit defaults as the economy slows, a possible escalation in the conflict in Ukraine with its potential impact on the prices of oil and commodities and of course, other unexpected geopolitical events.

A longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed for the past decade, including massive fiscal stimulus and declining and ultra-low interest rates, will not resurface soon. Securities’ values are more likely to be driven by the organic operational successes of businesses rather than help from the federal government, speculators, or leverage. That will likely result in lower market returns than in the recent past.

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.