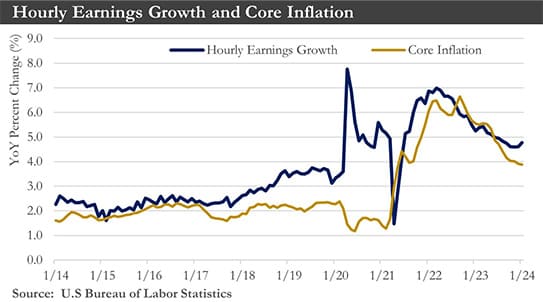

Recap: The U.S. economy entered the year with considerable momentum, as the better-than-anticipated performance for fourth quarter GDP set the economy up for a strong pace of growth in the first quarter of 2024. Specifically, real personal consumption expenditures (PCE) advanced at a 2.8% annualized pace in Q4. This spending growth has put the first quarter’s PCE on solid footing. January’s PCE advanced 0.3% but only 2.4% for the past year. In addition to declining inflation, consumer spending benefits from a sturdy labor market. Employers added over 350,000 new jobs in January, and average hourly earnings rose 0.6% during the month, which was a favorable development for aggregate income growth, up 1% in January.

A firmer hiring environment should remain supportive of consumer spending over the year. When coupled with the anticipated continued downtrend in inflation, real income growth would remain a favorable tailwind for consumer spending this year.

Prospects have brightened, and a recession looks less likely now. Growth should moderate in 2024 relative to 2023, to only about 1.5%.

A few months ago, the primary concern was whether Fed policymakers could achieve a soft landing. In light of the increased momentum in both the labor market and consumer spending, the more significant concern today has been to what extent rate cuts signaled by policymakers would be possible if the economic data should continue to surprise to the upside. Continued gains in after-inflation-adjusted income have been a boon for consumer spending, while more robust demand could run the risk of interrupting the downward trend in inflation.

The timing of rate cuts has thus dominated the economic discussion over the past month, and for good reason. The recent trend in inflation has been promising, with the year-ago rate of the core PCE deflator at 2.8% over the past year for the first time in two-and-a-half years. The annualized core inflation rates over the past three and six months fell below 2% in December. Yet, strong wage gains and robust consumer spending risk disrupting that recent improvement; hence, investor patience would be needed concerning the timing of rate cuts.

Inflation should continue downward in the coming months, and the first rate cut is likely to come in May. However, the path of the Fed’s interest rate policy would depend on how the data evolves in the next few months.

The cracks in the economic picture that materialized in the second half of last year have remained and could cause a more pronounced moderation in growth this year. The financial health of households has been a crucial concern, as delinquencies have risen further in the fourth quarter and interest payments have continued eating into purchasing power. At the same time, activity in interest rate-sensitive sectors has perked up. Rising shipments and new orders for durable goods in December have suggested a possible recovery in manufacturing, and residential investment activity also appeared to be finding a bottom.

Economic prospects have brightened in the past month, though storm clouds remain on the horizon. The Fed’s patience in changing their interest rate policy should continue causing economic uncertainty. Yet, a picture has emerged that the U.S. will likely avoid recession and experience a subdued period of growth this year.

Labor market: Overall, the jobs market appears firmer than was implied only a month ago. In addition to a pickup in jobs added over the past few months, employment gains have broadened across industries, and layoffs have remained low. A solid hiring rate should be maintained in the near term. Nevertheless, while the labor market has started the year in a stronger position than previously indicated, the jobs market should soften throughout 2024.

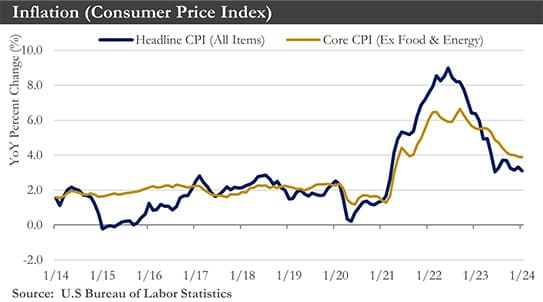

Inflation: Inflation eased again in January but came in above expectations, clouding the Federal Reserve’s path to rate cuts and potentially giving the central bank breathing space to wait until the middle of the year. Consumer prices rose 3.1% in January from a year earlier versus a December gain of 3.4%. That marked the lowest reading since June.

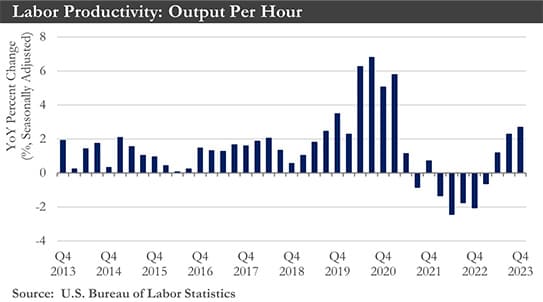

Inflation has continued its downward trend. An improved trend in productivity alongside cooler growth in nominal compensation costs has pointed to a reduction in inflationary pressures emanating from the jobs market.

While there has been a modest upside risk to goods inflation from the attacks in the Red Sea disrupting shipping lanes from Asia, the path of core goods inflation should remain benign. Meanwhile, the slowdown in housing inflation has further to run, while slower growth in employment costs should help keep a lid on services inflation.

Monetary Policy: 2024 should be a year in which the Federal Open Market Committee of the Federal Reserve begins to normalize monetary policy through a fed funds rate cut and a slower pace of quantitative tightening. Treasury yields should decline across the entire yield curve, with the most significant declines occurring at the front end of the curve. If realized, this would lead the yield curve to become less inverted and eventually upward-sloping. Inflation has cooled to the point where Federal Reserve policymakers have begun considering cutting rates.

U.S. dollar: The U.S. dollar should depreciate in 2024 as the Federal Reserve lowers interest rates and a relatively more optimistic global growth outlook potentially leads to some loss of "safe haven" support. Still, given a somewhat firmer outlook for U.S. economic growth and a gradual pace of Fed easing, the extent of U.S. dollar depreciation could be less than previously expected.

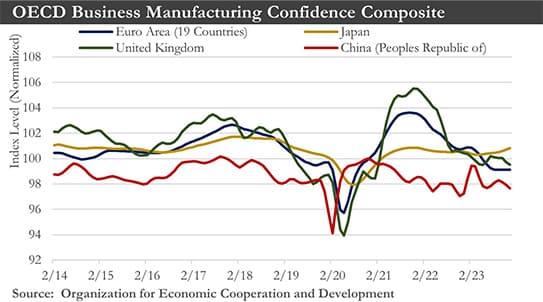

Eurozone: Europe’s economy stagnated in the final three months of 2023, expanding a divide between a strong U.S. economy and a left-behind European continent. The fresh economic data showing higher borrowing costs had compounded the earlier impact of higher energy prices due to the Ukraine crisis. The gross domestic product in the eurozone was unchanged in the final three months of last year. That followed a decline in the three months through September. During 2023, as a whole, growth was just 0.5%.

Europe’s policymakers have indicated the stagnation in output should not extend deep into 2024. Instead, they have anticipated a pickup in activity as wages rise faster than prices, reversing the declines in real incomes that followed the war in Ukraine and a surge in energy and food bills. With inflation easing, the ECB should lower its key interest rate later this year, stimulating growth by easing the pressure on household spending and business investment.

China: The latest data has suggested China faces a growing risk of slipping into a longer-term spell of falling prices that would become harder to reverse the longer it lasts. Deflation has become more entrenched in China, with consumer prices falling in January at their steepest pace in more than 14 years - a stark symptom of deepening economic malaise that could spell trouble for the global economy because of the size of the Chinese economy.

That would present a unique challenge for the rest of the world. While cheaper goods from China might help ease inflation elsewhere, the global economy could also expect a flood of cut-price imports as Chinese factories search out buyers overseas for products unable to be sold at home. That would risk squeezing other countries’ domestic manufacturing, stoking further tensions over trade between China and the U.S.-led West.

China's sinking prices have added to several economic challenges this year. Growth should slow from last year’s underwhelming pace. A drawn-out real-estate crunch has throttled consumer spending. Exports have been struggling, and foreign investors have been fleeing. Chinese equity market declines in recent months have reflected investor concerns.

Outlook: The U.S. economy grew 3.1% over the last year, defying recession projections as a resilient labor market supported strong consumer spending. The expansion should continue in 2024, although significantly slower. With the economy holding up remarkably well and the labor market tightening by historical standards, interest rate policymakers could proceed carefully over the coming months. The highly anticipated pivot from the Federal Reserve toward interest rate cuts should support the economy this year. But any imminent rate cuts would be off the table, and policymakers would remain on hold until at least this summer.

Still, there have been signs that spending - and the whole economy - would not be able to continue at such a rapid clip. Consumer spending should cool under the weight of high interest rates. Other signs of a slowing economy have emerged as manufacturers reported a modest drop in production in recent months, and some large, well-known companies have announced layoffs.

Businesses have determined how much pricing power they could retain after years of steady increases that customers have absorbed. Falling mortgage rates have led to increases in housing activity following the worst year for home sales in decades. The prospect that the Fed could lower interest rates in the not-too-distant future has fueled a stock market rally in recent months, and cheaper financing costs could reinvigorate household and business investment later this year.

Sources: Department of Labor, Department of Commerce, Bloomberg, European Commission, Organization for Economic Cooperation and Development