Recap: Recent data has pointed to economic activity in the United States continuing to hold up surprisingly well in the face of the Federal Open Market Committee's (FOMC) aggressive policy tightening cycle. So far in 2023, robust consumer spending and historically low unemployment have supported solid U.S. economic activity. Interest rates have been high, inflation has remained elevated, and pandemic savings have dwindled. Yet the American consumer has been on a spending binge. The strong display of consumer resilience persisted in the latest retail sales report, which showed spending rose 0.7% in September from a month earlier.

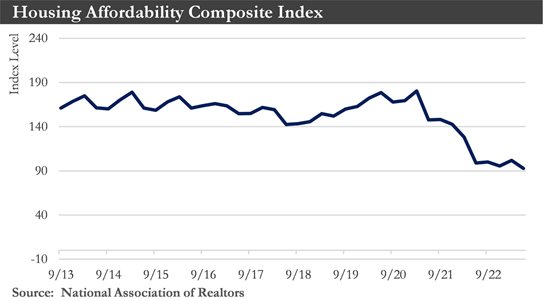

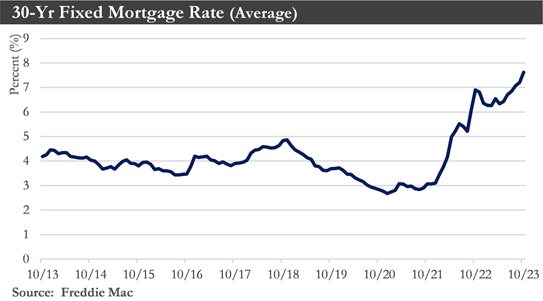

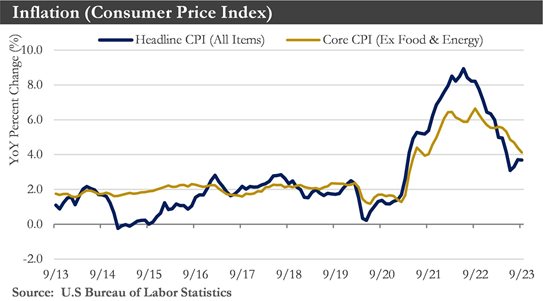

Trailing 12-month inflation has slowed significantly after hitting a four-decade high of 9.1% in June 2022 but has remained elevated by historical standards. The labor market has sizzled, making disinflation a gradual process. The continued strength in the labor market has supported spending, contrary to expectations of a dip in demand. The U.S. consumer has remained resilient, with after-inflation consumer spending growing at an average 3.1% year-over-year in 2023. Growth in the third quarter was the strongest in almost two years. The restart of student loan repayments could lead to belt-tightening by a subset of consumers. Still, the solid gains in employment and real wages should continue to support household finances. The housing market has remained the biggest challenge in the Fed's inflation fight. Decades-high mortgage rates, elevated prices, and sparse inventory have all had a significant impact on the housing market.

The risk of a government shutdown has been postponed, not avoided, until mid-November. Removing Kevin McCarthy as Speaker of the House has meant that an agreement in budget negotiations or a new continuing resolution will take a lot of work, making a November shutdown more likely. The run-up in government borrowing costs would only inflame debates in Washington about the sustainability of fiscal policy.

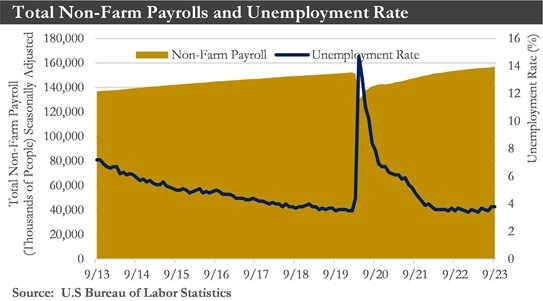

Real GDP grew at a 4.9% annualized pace in Q3, businesses have added 100-200,000 jobs monthly, and layoffs have trended sideways at relatively low levels. A recession has seemed unlikely, but it is unclear whether economic growth has slowed sufficiently to put inflation back in the bottle. Monetary policy has been at a crossroads as a result. Having raised the fed funds rate 525 bps over the past 18 months, the FOMC has signaled the need to move cautiously ahead and carefully assess incoming data to determine if policy is best positioned to return inflation to target without inflicting unnecessary damage on the economy.

Why No Recession Yet? The probability of recession has continued to recede in the U.S. as the banking turmoil subsides, and strong labor market resilience with rising real incomes have supported consumer demand. Fueling the optimism has been three key factors: a continuing decline in inflation, a Federal Reserve nearly done raising interest rates, and a robust labor market with outperforming economic growth. However, headwinds such as depleted savings, tightening credit conditions, slowing income growth, and return of student debt payments could weigh more appreciably over the next year.

Housing: Existing home sales have fallen a whopping 36% since the start of 2022. Mortgage rates have continued to creep higher in recent weeks, rising to the highest level in 23 years.

Higher rates will likely put further pressure on affordability and spur another leg down in existing home sales. The new home market – which, until recently, benefited from the shortage in the existing home market – would not escape unscathed, with early data showing that it, too, could feel the impact of higher rates. New home prices have decreased 7% from their peak at the end of 2022, and homebuilders have been ebbing and flowing the incentives at their disposal to push inventory along. With conditions in the new home market softening, too, builders could make greater use of these incentives in the near term to sell homes.

Labor Market: The labor market has remained far too hot. Non-farm payroll employment rose by 336,000 in September. Hiring over the last three months averaged 266,000 jobs per month. The unemployment rate held steady at 3.8%. The participation rate also held steady at its cyclical high of 62.8%.

While wage growth came in under expectations, Fed officials will not be able to look past the fact that labor force growth has slowed when job openings have remained elevated, which, if left unchecked, could pressure wages higher over the coming months.

Inflation: Inflation has continued to cool but at a frustratingly slow pace. The Consumer Price Index (CPI) rose 0.4% in September, decelerating from August's 0.6% gain. Over the last year, headline inflation held steady at 3.7%. Core inflation rose 0.3% in September, matching August's gain. The twelve-month change continued to edge lower – falling 0.2 percentage points to 4.1%.

September's CPI has demonstrated that progress in lowering inflation ahead would prove slower going than it has been over the past year. However, the downward trend has remained in place, with the core CPI set to recede further over the coming year as shelter disinflation resumes, supply-related pressures continue to ease, and price-sensitive consumers increase in number.

That said, there is still a lot of ground to cover before returning inflation to 2%. Given the continued resilience of the labor market, there could be plenty of opportunities for progress to stall in this fight over the coming months. Moreover, prices could rise again because of the war in the Middle East, which could push oil prices higher.

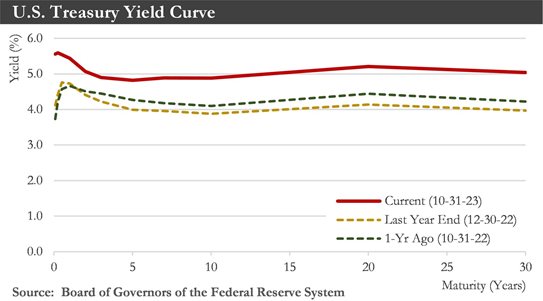

Long-Term Interest Rates: A sudden surge in long-term interest rates to 16-year highs could threaten hopes for an economic soft landing, all the more because the exact triggers for the move have been unclear. The rise in long-term Treasury yields started after July’s Fed rate increase and gained steam after the September Fed meeting. The yield on the 10-year Treasury note has been around 5 percent, the highest level since the subprime mortgage crisis began in August 2007.

The likeliest causes for the increase are a combination of expectations for better U.S. growth and concern that huge federal deficits would pressure investors’ capacity to absorb so much debt.

A sustained rise in long-term Treasury yields could bring the Federal Reserve’s historic rate hiking cycle to an anti-climactic end. The Fed could be done raising short-term interest rates if long-term rates remain near their recent highs and inflation continues to cool.

U.S. Dollar: A greater degree of U.S. dollar resilience could occur over the next few quarters. In the near term, relatively solid U.S. economic trends should be a notable contrast to soft activity trends across Europe and a still-underwhelming performance from China's economy. Safe haven flows could also support the U.S. dollar should the broader financial market backdrop remain unsettled. With U.S. policy rates likely to stay elevated for an extended period, further U.S. dollar strength could materialize through Q1-2024 and the middle of next year. Eventually, an anticipated mild U.S. recession and Fed easing should ensue, though Fed rate cuts would likely be gradual. As a result, any depreciation in the U.S. dollar through 2024 should prove to be relatively moderate.

Global economy: The global economy has grappled with an increasingly fractured economic outlook, as many countries have struggled with the lasting scars of the COVID-19 pandemic while others have powered ahead. Surprising strength in the U.S. economy has threatened the rest of the world, portending higher interest rates for longer and for a stronger dollar that would weigh on other countries' growth. A jump in oil prices since the summer has also threatened to reignite inflation just as many global central banks thought they were at the end of policy-tightening cycles. The outbreak of conflict in the Middle East now threatens to inject volatility into energy markets, harking back to last year's commodity chaos after the Ukraine crisis began.

Global trade has slowed and could mark a new era of deglobalization as nations orient economic policy toward national security rather than growth. Geopolitical conflicts have already upended supply chains. Supply disruptions not only slow growth but also have prompted investors to factor in more future risks from potential geopolitical shocks, driving up interest rates.

Outlook: The U.S. economy has sailed through some rough currents this year but now faces a convergence of hazards threatening to create more turbulence. Challenges this fall would be continued auto workers strikes, the resumption of student loan payments, and rising oil prices. Each on its own would only do a little harm. Together, they could be more damaging, particularly when the economy has already begun cooling due to high interest rates.

The headwinds have become stronger as 2024 comes into view. The recent run-up in oil prices has presented a challenge. Leading economic indicators have also pointed toward a slowdown in the months ahead. The Leading Economic Index (LEI) declined 0.4% in August and has fallen for 17 consecutive months. Shaky consumer confidence, an inverted yield curve, and weak new orders in the factory sector have been the primary components weighing on the LEI. Economic growth should slow in the coming months and contract in the first half of 2024 as part of a mild U.S. recession.

Despite the resiliency of the U.S. economy, the FOMC may still need to raise its target range for the federal funds rate higher in this cycle. The FOMC has made considerable progress in returning inflation to its target of 2%. The FOMC could refrain from easing policy until it is convinced that inflation has returned to 2% on a sustained basis. Consequently, monetary policy will become increasingly more restrictive on a "passive" basis. That is, the effective real fed funds rate would increase in the coming months as inflation recedes further while the FOMC keeps rates on hold.

This rise in the real fed funds rate could lead to a modest contraction in economic activity in 2024. But conviction about an outright recession is not as strong today as it was about a year ago when the FOMC was aggressively tightening monetary policy. The economy would need to grow at a sub-trend rate for a few quarters, if it does not contract, to bring inflation back to 2% on a sustained basis.

Sources: Federal Reserve, Department of Labor’s Bureau of Labor Statistics, Bureau of the Census,, Bloomberg, National Association of Home Builders, Bureau of Economic Analysis

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.