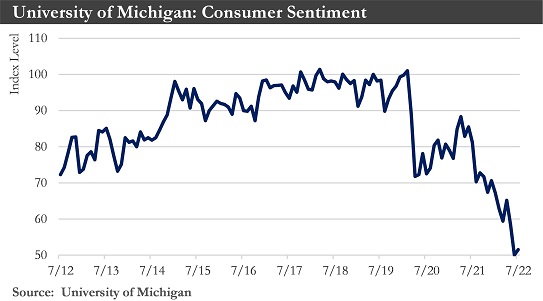

Recap: A U.S. economy that has contracted for two straight quarters to start the year has more recently appeared to be growing slowly. U.S. consumer sentiment ticked up in early September from historically low levels as Americans felt slightly better about the economy, while equally expressing uncertainty about the future. The consumer sentiment index, a reflection of consumer attitudes on the state of the economy, rose slightly in early September but has been down from a year earlier. While consumers were more optimistic about the near-term economic outlook than earlier this summer, when inflation touched a four-decade high, they expressed more pessimism about long-run economic prospects.

Since June, inflation has proven to be persistent, while the labor market has remained strong despite signs of a slowdown in some parts of the economy. While falling gasoline costs held down overall inflation in July and August, climbing housing costs and prices for services have kept inflation elevated.

Other economic data in August and September showed the U.S. economy appeared to be running lukewarm. Retail sales rose in August, largely due to increased spending at auto dealerships. Excluding motor vehicles and parts, sales were down 0.3%. Separately, industrial production declined a seasonally adjusted 0.2% in August, due to a sharp drop in utility output, reflecting weather conditions. A continued bright spot was the labor market. Jobless claims, a proxy for layoffs, fell in August and September. Continued strong job growth - employers added 1.1 million jobs in the past three months - and rising wages have given consumers a tailwind, even as they have grappled with rapidly rising prices for everyday goods.

All of these developments have kept the Federal Reserve on track to raising its benchmark interest rate to slow demand and inflation.

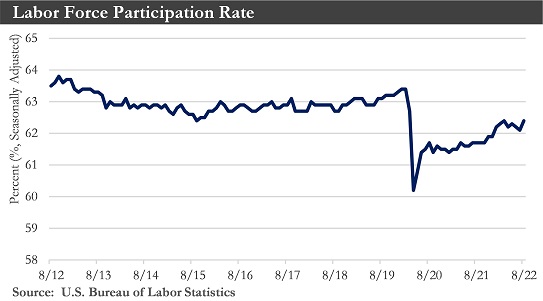

Labor Market: The tight U.S. labor market loosened some in August as employers hired fewer workers, more people sought work, and wages rose at a slower pace. Job growth has been resilient this year, despite a contraction in the overall economy in the first half of 2022 and aggressive interest rate increases by the Federal Reserve.

The U.S. economy added jobs in August at a slower but still solid pace in a tight labor market. The U.S. economy added 315,000 jobs in August, recovering the 22 million jobs lost in early 2020 at the start of the pandemic. The unemployment rate ticked higher by two-tenths of a percentage point, rising to 3.7%, as gains in household employment were far outstripped by a rebound in the size of the labor force. As a result, the participation rate edged higher by 0.3pp to 62.4% –matching its previous cyclical high.

The reversal in the unemployment rate should not be viewed negatively as it was largely driven by an increase in the supply of labor. The participation rate has long been underperforming, and without more workers entering the labor force, employment gains could soon start to fade.

The Federal Reserve has been closely monitoring hiring and wage data for signs of softening in the labor market. If they see evidence that labor-market momentum has begun to wane, it could be a sign that interest rate increases have started to slow demand, which could ease inflation.

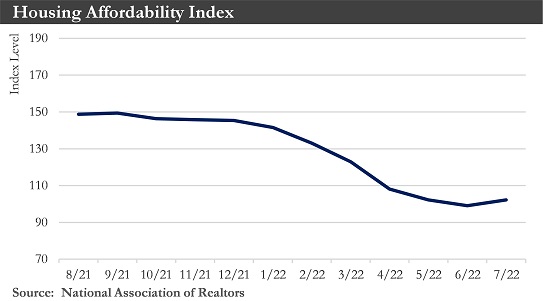

Housing market: The negative impact of the sharp increase in mortgage rates in the first half of 2022 has been reverberating across the U.S. housing market. Existing home sales have decreased more than 20% from the start of the year. The sharp deterioration in housing affordability would point to an extension of this trend. No respite on the rate front over the near term could mean that low affordability would remain a key challenge to higher housing activity for some time. Prices have also seen some retrenchment.

The new single-family home market showed even more weakness compared to the existing home market, with sales down a sharper 30% from the start of the year and prices pulling back noticeably. Builders have responded to these trends by easing off the accelerator. However, construction activity in the multifamily segment, whose product is heavily geared toward the rental market, has continued to hold up well so far.

Home sales should continue trekking lower through the first half of next year, with the housing market finding firmer ground in the second half of 2023 and early 2024 – alongside an anticipated mild downtrend in mortgage rates.

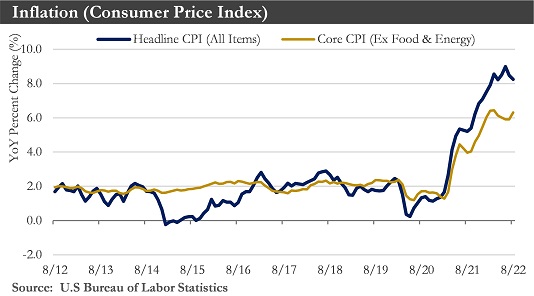

Inflation: Inflation pressures have remained strong and stubborn. Overall annual inflation eased to 8.3% in August from 8.5% in July. That reflected declines from the month before in prices for items such as gasoline, airfares, and used cars, and slower price increases in other categories, such as groceries.

Rents and other shelter costs have emerged as a major driver of overall consumer inflation, keeping it high at a time when many other sources have started to ease. Not only have shelter costs risen, but they have also climbed at an accelerating pace, accounting for a growing share of the overall inflation rate - about 25% of August’s rate, up from about 20% in February. Housing inflation should strengthen further before cooling off in the coming months.

There has remained considerable ground to cover before getting inflation back to a pace that would resemble the Fed's target. Over the past three months, the core CPI has advanced at a 6.5% annualized pace, more than triple the 2% target. Moreover, a sustained return to 2% inflation would remain even more distant at present. The tight labor market has kept compensation, the largest cost for most businesses, advancing well above 2% while consumer and business inflation expectations have remained high relative to the range of recent decades.

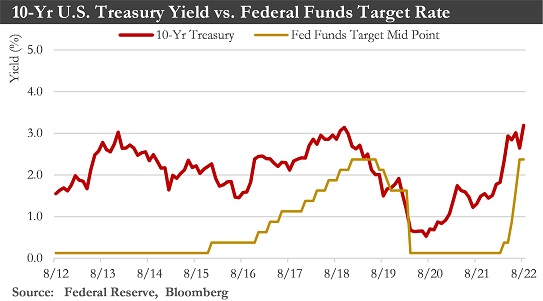

Monetary Policy: The Federal Reserve approved its third consecutive interest-rate rise of 0.75 percentage points and signaled additional large increases were likely at coming meetings as it combats inflation that has remained near a 40-year high. The Fed has raised rates at the most rapid pace since the 1980s and has also initiated a program to withdraw stimulus by shrinking its $8.8 trillion asset portfolio through attrition.

Even though headline inflation has shown signs of peaking, underlying measures of core inflation have yet to turn decisively enough for the Fed to slow the pace of rate hikes. The Fed faces two main questions going forward: How much higher do they expect to raise rates in the coming months, and what steps do they take to get there?

Through these rate hikes, the Fed has demonstrated a willingness to bring rates into a restrictive territory breaking the current inflation cycle even if it means making a considerable sacrifice to economic growth.

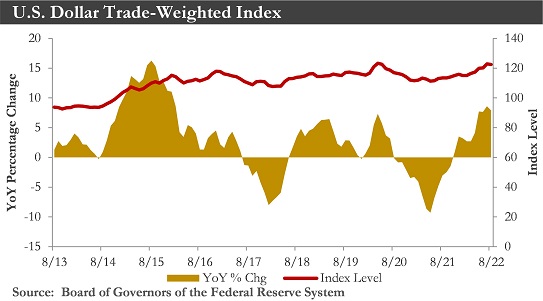

U.S. Dollar and the Global Economy: The U.S. dollar has experienced a once-in-a-generation rally. For the rest of the world, that has been a big problem. The surge has threatened to exacerbate a slowdown in global growth and amplify inflation headaches for global central banks. Attempts by policymakers in China, Japan, and Europe to defend their currencies have largely failed in the face of the dollar’s unrelenting rise.

The dollar’s rise this year has been fueled by the Federal Reserve’s aggressive interest-rate increases, which have encouraged global investors to pull money out of other markets to invest in higher-yielding U.S. assets. Recent economic data has suggested that U.S. inflation remains stubbornly high, strengthening the case for more Fed rate increases and an even stronger dollar.

Dismal economic prospects for the rest of the world have also boosted the dollar. For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world has strained under the dollar’s rise.

A stronger dollar would make the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back. The currency’s rise has compounded pain in smaller nations by making crucial food and fuel imports priced in the U.S. dollar more expensive.

Outside the U.S., a strong dollar has now become a massive negative headwind for central banks. Emerging-market central banks have taken drastic steps to rein in depreciation in their currencies and bonds. In Europe, the euro’s weakness has amplified a historic increase in inflation brought on by the war in Ukraine and a resulting surge in gas and electricity prices.

Eurozone: Inflation in the eurozone rose to a fresh record in August, underscoring the economic shock dealt by the Ukraine crisis. Eurozone consumer prices were 9.1% higher than a year earlier, a pickup from the 8.9% rate of inflation recorded in July. For the European Central Bank, the core rate of inflation—which excluded volatile items such as energy and food—increased to 4.3% in August from 4% in July. That would suggest high inflation rates could linger even if energy and food prices stabilize. The ECB would aim to keep inflation at 2% over the medium term.

In response, the European Central Bank (ECB) raised its key interest rate to 0.75% from zero—its second hike this year following a 50-basis point rise in July. The ECB has moved aggressively to combat record inflation even as an energy crisis has put Europe on the brink of recession.

Rising borrowing costs will likely increase the risk of a slide into recession for Europe’s currency union, which has wrestled with surging energy costs and sagging confidence among households and businesses, driven by the war in neighboring Ukraine.

Still, the ECB’s move should help to support the euro currency, which recently sank to a 20-year low against the dollar, a loss of value that has made imports more expensive and aggravated inflation. There have been few signs that the eurozone economy is overheating, unlike the larger U.S. economy. Instead, eurozone inflation has been driven primarily by soaring energy prices and persistent supply bottlenecks, which the ECB can do little to solve.

Global Economy: Prospects for global economic growth remain dim. The global economy should grow just 2.2% this year. Global growth of 2.2% would mark one of the slowest paces of growth for the global economy in the past few decades and an expansion that is well below the long-term average growth rate.

Persistently high global inflation and aggressive central bank tightening have been the root causes of a more pessimistic view of the global economy; however, a sharp slowdown in China's economy has also contributed to this slower global growth outlook. Another downward revision to China’s GDP is forecast as new COVID-related restrictions are put in place, and the property sector continues to unravel. China is now forecast to grow just 3% this year, and this month's downward revision to China's growth outlook has been the driving force for that revision.

Outlook: Since June, the U.S. economy has been forecast to slip into recession in 2023, and the Fed's firmly stated resolve to bring inflation to heel reinforces the conviction that the U.S. economy is set to contract modestly in coming quarters. The FOMC has raised the target range for the federal funds rate by 225 bps since March, and another 175 bps of tightening is expected by the time the committee finishes its tightening cycle early next year. The combination of continued Fed tightening and elevated inflation, which has caused real personal income to contract in recent quarters, will likely lead to retrenchment in real consumer spending beginning in Q1-2023. Weakness in consumer spending and the continued squeeze on profit margins will then likely lead businesses to cut business investment spending, both fixed investment and inventories, and reduce payrolls. The slowdowns, if not outright economic contractions, forecast in some key U.S. trading partners should also weigh on growth in American exports. U.S. real GDP should contract for three consecutive quarters beginning in Q1-2023.

But this downturn is not likely to be especially deep or prolonged. The underlying fundamentals of the economy, especially the relative strength of balance sheets and the labor market, are reasonably sound at present. Moreover, the Federal Reserve may indeed be able to pull off a "soft landing." However, the Fed's hawkish view and the demonstrated difficulty of actually engineering a "soft landing" make recession next year more likely than not.

Market Commentary

Recap: Many of the major factors that negatively impacted capital markets in the second quarter, continued to play a dominant role in roiling markets in the third quarter. Soaring inflation, rising interest rates, a strong U.S. dollar, declining consumer sentiment, a tight labor market, a pullback in the U.S. housing market, the war in Ukraine, and supply chain issues continued to headline economic news. News out of China, the world’s second-largest economy suggests their economic growth is slowing rapidly and materially as well. And developments in Europe and the U.K. also signaled economic decline and potentially a recession on the near-term horizon. Analysts' forecasts for corporate profits in the U.S. continued to decline during the quarter as the U.S economy slows. And as stock valuations have fallen, like last quarter, securities prices slipped into a sea of first-half 2022 red ink.

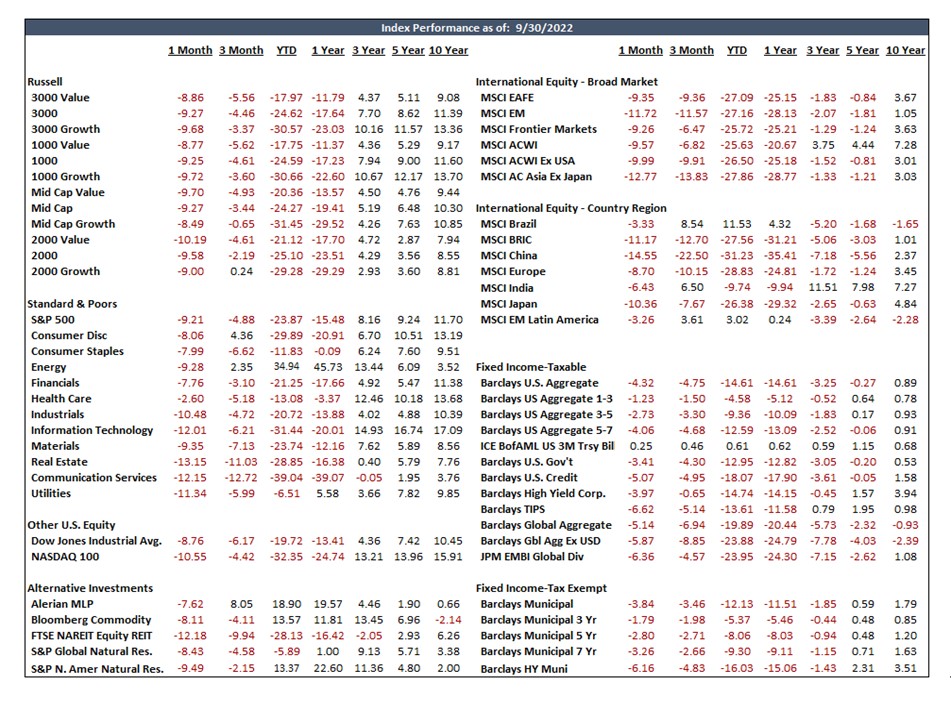

U.S. equities continued to give back some of the liquidity-driven easy gains achieved in the past few years when interest rates were near zero. The declines were less extreme in the third quarter than earlier in the year, perhaps due to greater clarity on the end of the Fed hiking cycle, more attractive relative equity valuations (with the S&P 500 price/earnings ratio lower than the past five and ten-year averages at less than 16 times earnings), and the strength of the U.S. dollar. The S&P 500 was down 4.3% while the broader measure of U.S. capitalizations, the Russell 3000, was down 4.5%. International equities struggled even more with the MSCI All Country World ex-U.S. down 9.9% in the quarter, Emerging Markets equities were down 11.6%, Europe was down 10.2%, Japan declined 7.7%, and China was down 22.5%. The MSCI Emerging Markets Latin America was up 3.6% in the third quarter.

Stylistically there was a reversal of fortune as Growth stocks modestly outpaced Value stocks though both retreated in the quarter. While U.S. stocks overwhelmingly turned in negative quarterly performances, small-cap growth stocks posted a surprising 0.24% positive gain for the quarter.

Bond values continued to retreat as interest rates rose in the quarter. The degree of the decline was driven by credit quality and maturity with lower quality holdings (e.g., high yield bonds) and longer-dated maturities taking a larger hit to prices.

Outlook: In a repeat of last quarter’s comments, the (near-term) outlook for equities does not seem particularly bright confronted with rising interest rates, declining profit growth, and ample uncertainty especially in Europe which still could be further hurt by soaring energy prices and the spread of war. Recessions around the world are definitely in the cards in the near term. Competing factors are likely to play an important role in market behavior, especially in stocks in the months ahead.

Near-term downside risks include what may well be a robust tax selling season as the year ends, souring investor sentiment, declining corporate profits, and what has become the ever-present geo-political risk surrounding the war in Europe.

Near-term positives include still solid business and consumer balance sheets, relatively lean corporate inventories that will need re-building when the economy turns up, and trillions in cash waiting to be invested. Additionally, a provision of the recently passed Inflation Reduction Act (IRA) was a 1% “buyback tax” levied on corporate stock buybacks. Companies planning such stock purchases may well choose to move those purchases into 2022 before the new tax goes into effect in 2023.

A longer-term view of markets suggests the tailwinds stock and bond investors enjoyed for the past decade including massive fiscal stimulus as well as declining and ultra-low interest rates will not likely come to the rescue of the markets. Securities values are more likely to be driven by the organic operational successes of businesses and not because “there is no alternative” to owning stocks. Market volatility could well remain elevated in comparison to recent years which could also help create new opportunities for investors.

Sources: Department of Labor Statistics, U.S. Bureau of Economic Analysis, Department of Commerce, Morningstar, Bloomberg, The Conference Board, Eurostat, Peoples Bank of China

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.