Recap: This summer’s combination of easing inflation and cooling the labor market has fueled optimism that the U.S. could be on the cusp of achieving a soft landing, in which interest-rate increases corralled inflation without causing a recession. But soft landings are considered rare because they are tricky to pull off. The goal would face four threats: the Fed holds lengthy high rates, economic growth accelerates, energy prices rise, or a financial crisis erupts.

Real GDP grew at an annualized rate of 2.1 percent in Q2-2023 due to solid growth in consumer spending and business fixed investment spending. Available data from July and August suggested that real GDP continued to expand in the third quarter.

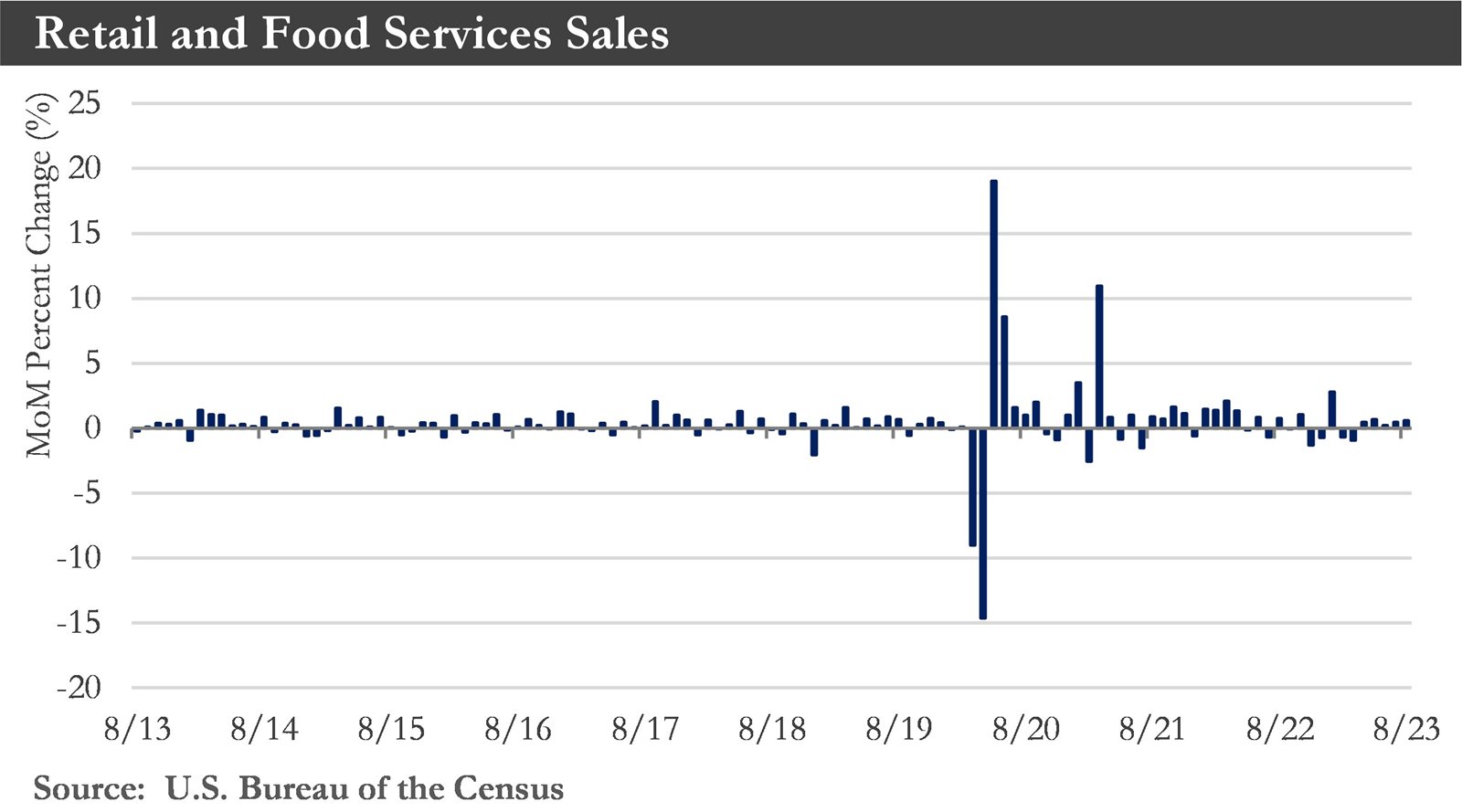

Solid retail sales—a measure of spending at stores, online, and in restaurants—have contributed to a broad consumer spending surge fueling resilient U.S. economic activity. Job and wage growth remained solid, with people seeking work and earning money. The economy has been on track to expand at around 4.0% annually in the third quarter. With unemployment low, real wages growing, and household net worth hitting another record, American households and consumers should be in a good position. Consumer spending should be close to 4% in the third quarter.

.jpg)

Inflationary pressure has eased. The labor market has also become less tight. But some cracks in the economy have started to appear. Households have lowered savings rates and relied on credit card debt to finance strong growth in consumption expenditures. Delinquencies on mortgages, auto loans, and credit cards have recently increased.

No recession? There have been increasing hopes that the United States could avoid recession. Three factors would explain why the U.S. economy keeps defying predictions of recession. First, a growing workforce and slower price increases have boosted Americans’ inflation-adjusted incomes this year, fueling more hiring and spending. Second, the unusual nature of the COVID-19 pandemic has distorted spending patterns, leading to shortages of goods, housing, and workers. These conditions created enormous pent-up demand that has been less sensitive, for now, to higher rates.

Third, the government showered the economy with cash and held interest rates at rock-bottom levels, allowing businesses and consumers to lock in lower borrowing costs. Subsequent legislation, including the Inflation Reduction Act and the $53 billion Chips and Science Act, further boosted federal spending and spurred additional private-sector investment in manufacturing.

None of this would imply the economy will be resilient forever. The Fed raised its benchmark federal funds rate to a 22-year high in July, and officials have kept the door open to further hikes if economic activity should accelerate.

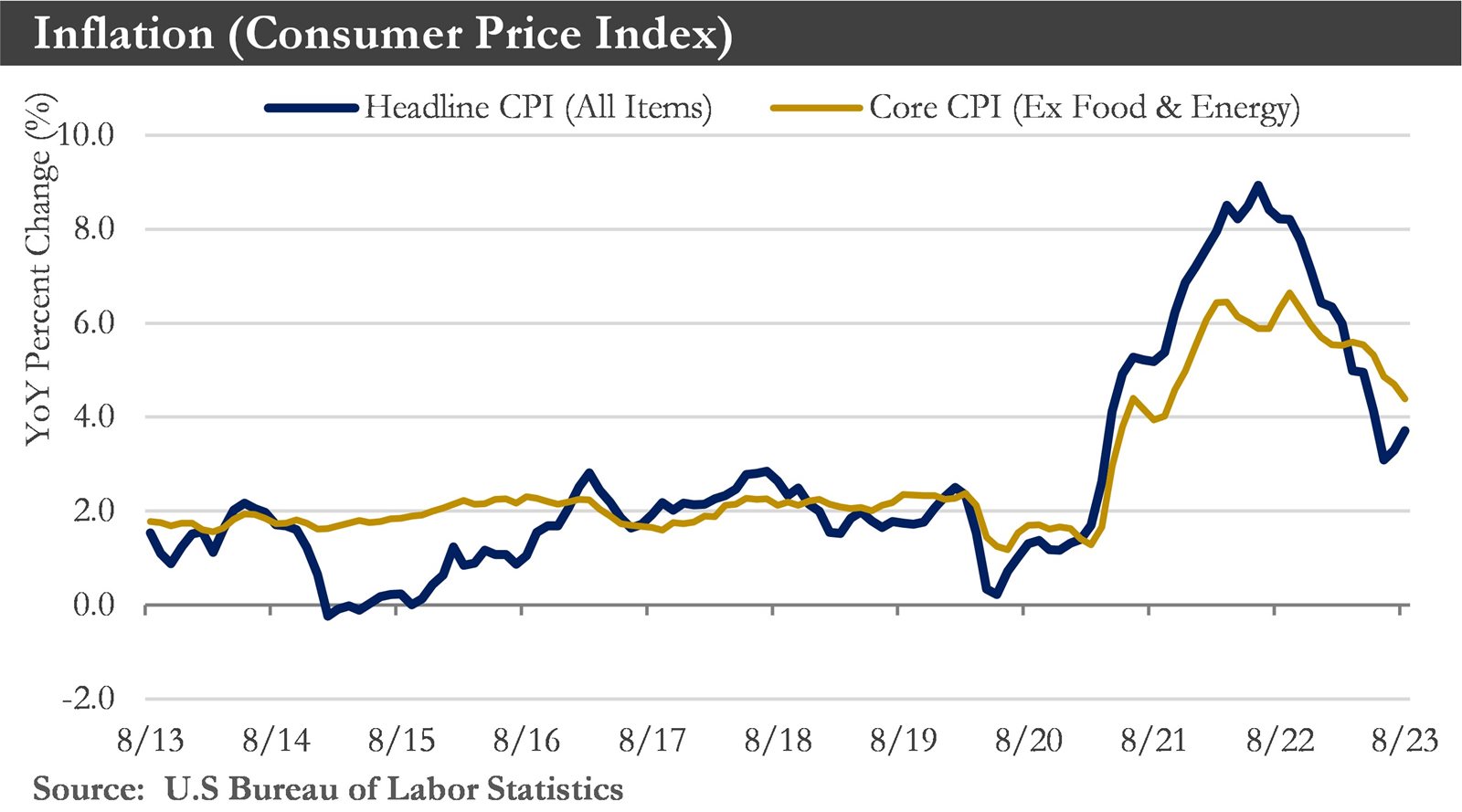

Inflation: The Consumer Price Index (CPI) rose 0.6% month-on-month between July and August. On a 12-month basis, CPI inched 0.4% higher to 3.7% in August. Energy prices significantly drove August's acceleration, rising the fastest since June 2022. Core inflation rose by 0.3% in the past month – accelerating from June and July's monthly gains of 0.2%. The 12-month change on core continued to edge lower, falling 0.3% to 4.4%.

.jpg)

Inflation should continue to trend lower. Smoother functioning supply chains and higher financing costs for big-ticket items like vehicles have reversed the rapid run-up in goods prices over the past three years. The recent moderation in monthly shelter readings has also ensured that official measures of housing inflation will follow private market measures of rent growth and slow sharply through the middle of next year.

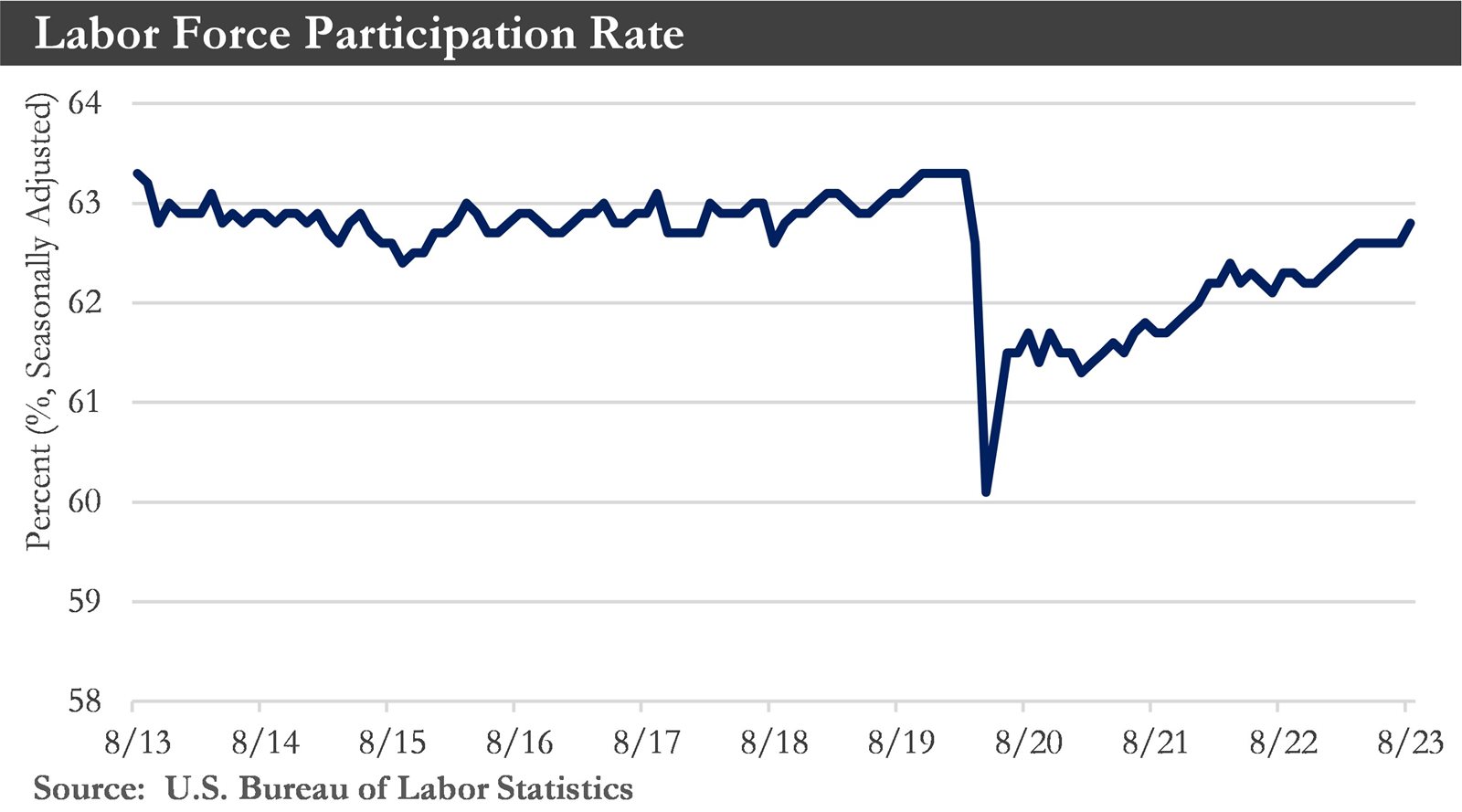

Labor market: Slower summer hiring and the August unemployment rate have shown the labor market is moderating amid high interest rates. U.S. employers added 187,000 jobs last month, while payrolls in June and July were revised down a combined 110,000. Over the past three months, 150,000 jobs were added monthly, down from 238,000 in March through May. Hiring has slowed as job openings have fallen to a 28-month low.

The unemployment rate rose to 3.8% - the highest level in 18 months. The participation rate rose 0.2% to a new cyclical high of 62.8%.

.jpg)

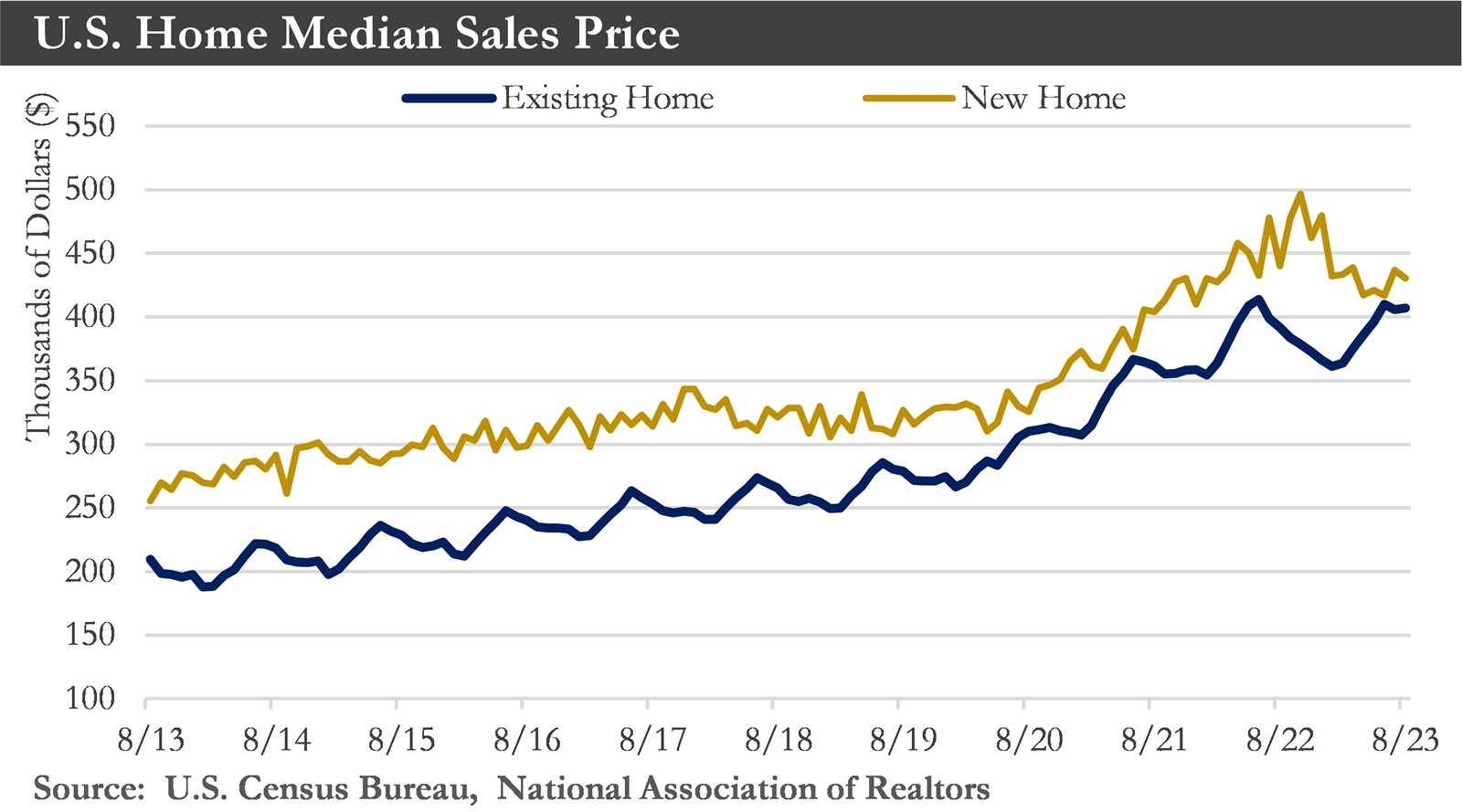

Housing: The housing market has remained under pressure amid elevated mortgage rates and high prices. Single-family construction has continued to be propelled by buyers who have become disenchanted with the resale market, where inventory is low and prices are high. By contrast, a more challenging lending environment and robust incoming apartment supply pipeline would encourage multifamily developers to move forward with new projects. The divergence between solid single-family construction and lagging multifamily should continue.

.jpg)

With mortgage rates increasing, it is no wonder that home sales activity has remained near multi-decade lows. The elevated rate environment has not just held back would-be buyers; it has also posed a hurdle on the supply side, as existing homeowners with much lower mortgage rates have become reluctant to move. The tightness in the resale market has kept a floor on home prices while also pushing more would-be buyers to the "new" home market.

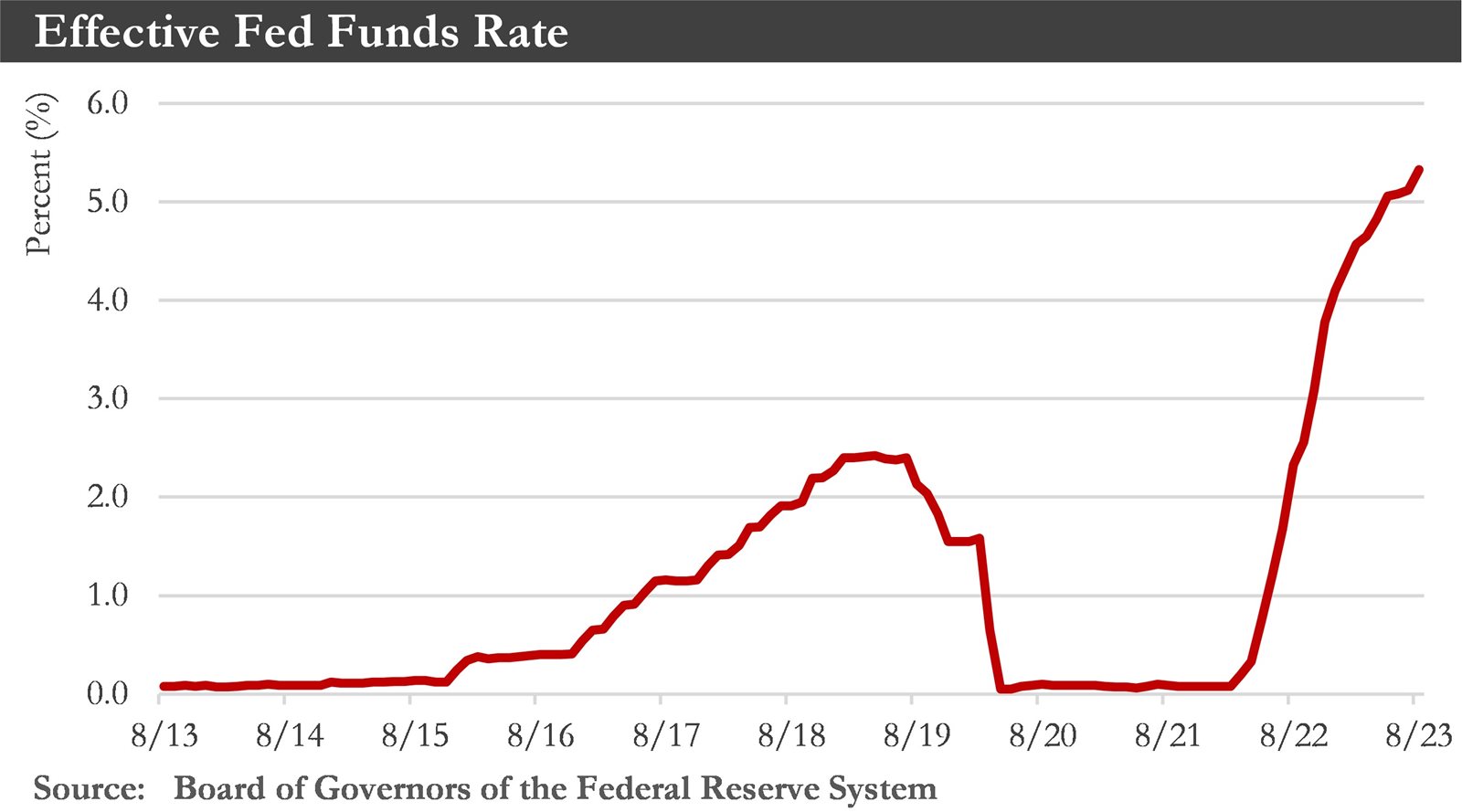

Monetary Policy: At the September meeting, the Federal Open Market Committee (FOMC) maintained the federal funds rate in the 5.25% to 5.50% range and announced a continuation of its balance sheet runoff.

.jpg)

The Fed has now forecast the closest thing to a perfect landing for the economy: real GDP growth would barely move below its trend pace in 2024, while the unemployment rate would effectively land right on its steady-state level, and inflation would grind back to target. At the same time, Fed members have maintained that one more hike is on the table for 2023 while reducing the number of expected rate cuts in 2024.

The September meeting highlighted the 'higher for longer' rhetoric that the Fed has reinforced over recent meetings. This has helped to maintain tight financing conditions, a prerequisite for the economy to slow sufficiently while easing price pressures. Fed projections showed the federal funds rate will be lowered to around 5% by the end of 2024, implying two rate cuts next year if the central bank increases them again this year.

U.S. Dollar: The dollar's prospects for the coming quarters have improved. With a deteriorating global macroeconomic backdrop amid a sharp China deceleration, the dollar could attract haven flows that would boost the dollar through the end of this year.

The resilience of the U.S. economy and the possibility of additional Fed rate hikes should also attract investors toward dollar-denominated assets and support the dollar through the end of 2023.

Longer term, the dollar should weaken. The prospects of Fed rate cuts in 2024 would weigh on the dollar, but with a U.S. “soft landing” a real possibility and inflation likely to hover above the Fed's target in 2024, sharp rate cuts could be less likely. With the Fed likely to deliver a version of a "higher for longer" stance on interest rates, the dollar could exhibit more resilience throughout 2024.

China: Recent data have signaled deepening troubles for China’s economy. The economic recovery in China has been losing momentum because of many problems. First, a drop in exports has been accelerating. China’s exports to the rest of the world tumbled in July, offering fresh evidence that a drying up of Western demand has hurt Beijing’s attempts to rekindle growth. Second, the country’s beleaguered housing market has shown new distress signs. Third, youth unemployment has hit record highs.

Most importantly, China is on the brink of falling into deflation, a scenario that could drag the economy into a downward spiral. The danger would be that if falling prices become entrenched, it could further sap demand, exacerbate debt burdens, and lock the economy into a trap difficult to escape using the stimulus measures Chinese policymakers have traditionally turned to. China’s central bank has trimmed interest rates several times this year. Still, fiscal and monetary policymakers have not launched any larger-scale stimulus measures, partly because of constraints such as elevated debt levels. China’s central bank should lower interest rates further in the coming months, though such moves alone may not dispel deflationary pressures.

The Eurozone Economy: The European Central Bank (ECB) delivered a tenth straight rate hike last week, raising its Deposit Rate from 25 bps to 4.00%. The ECB gave its most unambiguous indication that the peak in policy interest rates has been reached.

Incoming economic news would dissuade the ECB from raising rates further in the months ahead. There have already been some hints of a slowing in underlying inflation trends, and given indications of slower wage growth and a sharp deceleration in economic growth, both wage and price inflation should continue to move in a favorable direction in the months ahead.

ECB policymakers will want to see inflation closer to their 2% target before considering rate cuts. An initial 25 bps Deposit Rate cut might come in mid-year 2024, with further cuts later in the year.

The euro could lag due to a likely end to ECB rate hikes and underwhelming Eurozone economic performance. The risks for the euro have remained tilted to the downside for the balance of 2023.

Outlook: There are increasing hopes that the United States can avoid a recession. The U.S. economy has shown remarkable resilience, including GDP growth of 2.1% quarter-over-quarter annualized during Q2. While softer readings from the ISM manufacturing and services indices portend slower growth ahead, trends in labor markets and consumer spending have remained reasonably encouraging. Finally, while inflation has remained above the Federal Reserve's target for now, enough progress has been made that the peak in the federal funds rate has likely already been reached. Stemming from these trends of ongoing employment growth and receding inflation are important shifts in real household income trends that could be significant for consumer spending and, thus, the overall economy. As paychecks have continued to increase and cost-of-living pressures have diminished, growth in household disposable income has started to outpace growth in consumer spending.

However, while that does offer encouragement for a "soft landing," developments could still unsettle the U.S. economy. With excess savings from the pandemic having been substantially worked through and households perhaps less willing or unable to take on further consumer credit, some factors supporting consumer spending would be less helpful moving forward. More broadly, regional banking sector strains could contribute to reduced lending, the housing sector would face some headwinds, and declining corporate profits could restrain business investment. Finally, the increase could restrain the economy even if interest rates do not rise further. That is especially the case should the Fed maintain its policy rate at an elevated level for an extended time, even as inflation recedes further. A "higher for longer" stance from the Fed could increase real interest rates that would restrain household and business spending.

Overall, there are no clear signals of further rate hikes, but at the same time, it appears the Fed will keep policy interest rates elevated for an extended period. Given that restrictive monetary policy would remain in place for some time, there is still a possibility of U.S. economic recession. That said, the likelihood of recession is getting lower, and the potential economic downturn is getting milder.

Sources: Department of Labor, Department of Commerce, Institute for Supply Management, Bloomberg, the Federal Reserve Bank, European Central Bank

.jpg)

Capital Markets Commentary

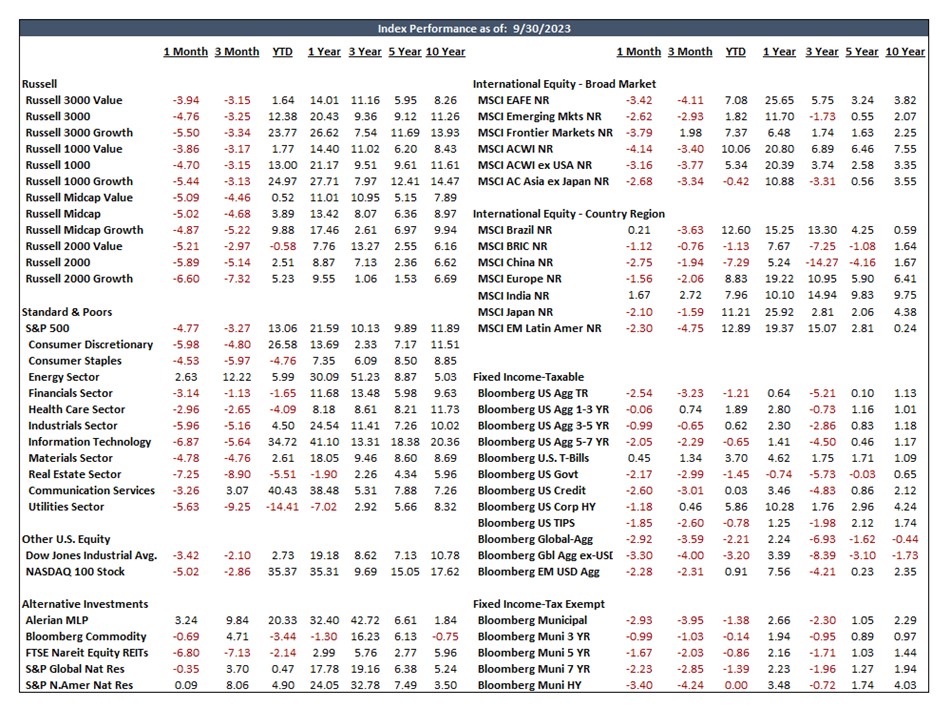

Recap: With a few exceptions, September and the third quarter saw the global equity markets give back some of the gains earned in the first half of 2023. Bond markets, too, delivered red ink for the quarter except for short-term fixed-income instruments. Markets were responding to the rise in the yield curve and the commitment on the part of the Fed to stay the course, holding interest rates higher for longer. Longer bond maturities were especially hard hit as rates on government bonds maturing in 10 years or more climbed to about 4.7%. By the quarter’s end, the grip of tighter financial conditions showed up in sentiment and consumer behavior.

U.S. stocks across the capitalization and style spectrum delivered modest declines in the third quarter. Small-cap and mid-cap stocks lost more ground than larger company stocks. The S&P 500 was down 3.3%, the Russell Mid Cap Index was down 4.8%, and the index of smaller companies, the Russell 2000, was down 5.1%.

There was a modest reversal of fortunes when comparing Value and Growth style stocks. Unlike earlier in the year, Value stocks lost less ground than Growth stocks in the third quarter. This was a small pullback from some of the extreme valuations given to Growth stocks earlier in the year driven by investor enthusiasm over all things artificial intelligence.

International equities also lost ground in the third quarter. The MSCI All Country World Index ex-U.S. was down 3.8%. There were a couple of notable exceptions, with Indian stocks gaining ground up 2.7% for the quarter and companies in so-called Frontier Markets that were up about 2.0%.

Bond prices across the globe also took a hit from rising interest rates and the prospects of rates being held higher for longer by central banks. With a few notable exceptions, bonds delivered negative returns. The broad Bloomberg Aggregate Bond Index was down 3.2%, the Bloomberg Global Aggregate ex-U.S. was down 4.0%, Short-term Treasury bills were up 1.3%, and even U.S. corporate high-yield bonds were up fractionally.

Outlook: The outlook for stock returns remains uncertain given the slowly deteriorating dynamics of the economy, higher interest rates that are likely to stay at these levels or higher longer than expected, and the negative impact this should have on demand for goods and services in the economy. Downstream, this should continue to impact corporate profits, which have been growing more slowly in the past year. The U.S. is likely headed into a period of slower economic growth, if not a mild recession. That recession will likely result in higher unemployment. The equity markets earlier in the year seem to have been looking past this well-telegraphed slowdown to a period of falling interest rates. But some stock prices, especially those driven by more speculative impulses, may have to adjust to the realities of a less constructive longer-term economic outlook.

However, the longer-term outlook for bonds continues to look pretty bright, mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is coming down, and now bonds offer a respectable coupon rate after years of ultra-low interest rates. Bond coupon rates currently provide real competition for investment dollars versus stocks, given the more expensive investment profile of stocks in general.

There continue to be downside risks to the capital markets, which should be kept in mind as 2023 comes to an end. Those risks include another Congressional budget impasse in November, the Fed possibly overshooting their rate increases, a deeper-than-expected recession occurring, more stress in the banking system emerging due to the industry’s deposit level declines, an increase in credit defaults and household bankruptcies as the economy slows, a possible escalation of the conflict in Ukraine with its potential impact on the prices of oil and commodities and of course, other unexpected geopolitical events.

A longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed in recent years, including massive fiscal stimulus and declining and ultra-low interest rates, will not resurface soon to smooth over inevitable hard times. Securities’ values are more likely to be driven by the organic operational successes of businesses rather than help from the federal government. These conditions should favor astute stock and bond selection.

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.