Recap: The U.S. economy entered the second half of 2022 on a less-shaky footing than initially estimated. U.S. GDP contracted at a 0.6% annual rate from April to June, compared with an initial estimate of a 0.9% decline. One factor was an upward revision of consumer spending, which accounted for the bulk of U.S. economic output.

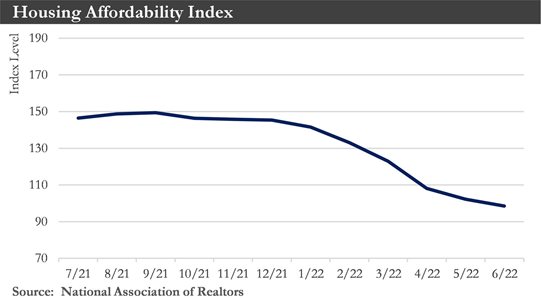

Still, the new GDP figures offered fresh evidence that the housing market has struggled under the weight of rising borrowing costs. Other recent economic figures pointed to a slowdown: An S&P Global purchasing managers index that measures activity in manufacturing and services was 45.0 in August, down from 47.7 in July, indicating a contraction. Business and consumer spending has also cooled. New orders for durable goods were unchanged in July compared with the prior month. Moreover, retail sales were flat in July.

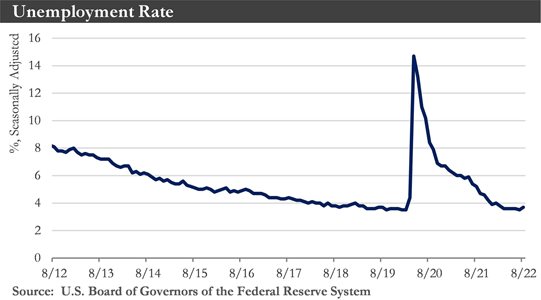

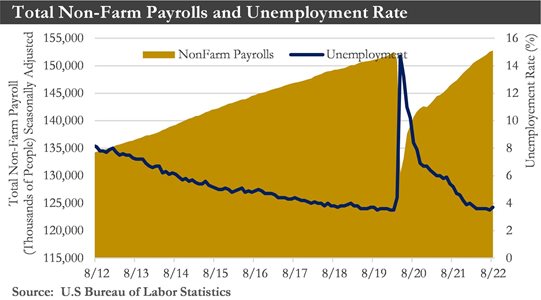

There are signs that the U.S. labor market has remained strong: employers added 528,000 jobs in July and 315,000 in August, completing the recouping of the 22 million positions lost in the early months of 2020. The U.S. unemployment rate fell to 3.5%, matching a 50-year low. The strong labor market - and wage pressures that it has created - will continue to drive inflation.

Meanwhile, sentiment indicators also surprised to the upside. The ISM readings for the manufacturing sector slipped modestly but came in above expectation. Demand has slowed with new orders contracting for the second month in a row. Still, this has come with less pressure on suppliers, as supplier delivery times rose at their slowest pace since before the pandemic. The ISM services index pointed to a broad pickup in services activity, proving again that there is still plenty of pent-up demand. The gap between the supplier deliveries time and the rest of the index’s drivers narrowed in July and August – a month after a similar improvement in the manufacturing sector.

Overall, the U.S. economic recovery has followed an unusual trajectory, with weakening output but strong job gains. The Federal Reserve has been increasing interest rates as it works to curb inflation without severely cutting output.

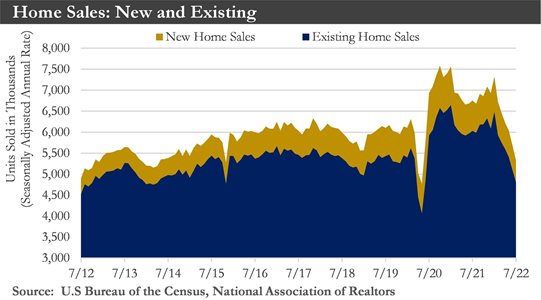

Housing: It has become increasingly apparent that the housing sector is in a downturn. Real residential investment fell 16.2% in Q2, more than any other major sub-component of overall GDP. The plummet in residential investment has reflected the recent pullback in home buying brought on by higher mortgage rates. Aside from May's modest gain, new home sales have fallen in each month of 2022 so far. Continued weakness in pending home sales would suggest that home sales have further to fall.

Existing home sales fell for a sixth-straight month to the lowest level in over two years. The near doubling in mortgage rates over the past year has more clearly started to weigh on prices. With sale prices under pressure, builders have continued to scale back plans for new construction. If there is a modicum of good news for the housing sector, it is that mortgage rates have come down slightly in recent weeks. Builders have also moved forward with multifamily units, limiting the total hit to housing supply from single-family construction declining under the weight of reduced affordability.

Labor market: The labor market has performed better than expected. U.S. employers added a robust 528,000 jobs in July and 315,000 in August, helping the economy recoup the 22 million positions lost early in the pandemic, as hirers clamored for workers despite a slowdown in economic growth. The unemployment rate dropped to 3.5% last month, a half-century low also seen just before the pandemic in early 2020.

Monthly job growth has averaged around 500,000 through the first eight months of the year, while the unemployment rate has continued to drift lower. Labor demand have remained near historic highs, while the pool of available workers has continued to shrink – as evidenced by the core working age participation rate nearing pre-pandemic levels. Combined with slowing economic growth, this should give way to a weaker pace of hiring over the coming months, leading to a gradual increase in the unemployment rate.

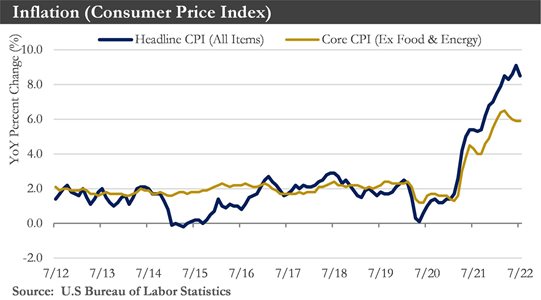

Inflation: U.S. inflation eased slightly but remained close to a four-decade high in July despite cooling energy prices. The consumer price index rose 8.5% in July from the same month a year ago, down from 9.1% in June. Core CPI increased 5.9% from the same month a year ago, a sign that broad price pressures have remained in the economy. The drop in inflation can be attributed primarily to lower commodity prices throughout July. Energy, agriculture, and precious metals prices all softened last month, which alleviated upward pressure on inflation.

Many of the underlying causes of excessive inflation are the same as they have been over the past year or so—supply chain issues, including those related to China’s COVID containment policies, constrained housing supply, ongoing conflicts in Ukraine, fiscal stimulus, and limited domestic energy production.

With the FOMC dropping its forward guidance and moving to a data-dependent "meeting-by-meeting" assessment, July’s inflation data alongside the strong employment report will give policymakers incentive to raise rates by 50-75 bps at its next meeting in September.

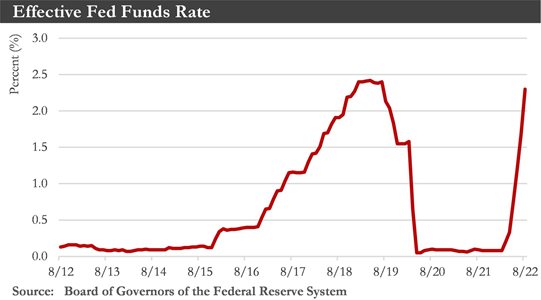

Monetary Policy: The Federal Reserve has been confronted with the challenge of tightening monetary policy enough to reduce inflation without quashing growth. July’s job report showed the economy still firing on many cylinders, making it more likely central bank officials would raise rates to higher levels and keep rates at those levels for longer to cool the economy. The behavior of wages has been particularly important to the Fed right now because of concerns that companies are raising wages because they can pass higher labor costs onto consumers as a result of the current inflationary environment.

A slowdown in inflation in July, following recent indications of a robust labor market, has complicated the Federal Reserve’s decision on how much to raise interest rates in September. July’s inflation report kept the Fed’s door open to a half-point rate increase in September if subsequent data confirmed price pressures were easing. But a 0.75-point rise could remain possible after recent reports of accelerating growth in jobs and wages have pointed to significant income gains that could sustain stronger spending and higher prices.

Eurozone: The eurozone economy has been hit by the fallout from Russia’s invasion of Ukraine as higher energy and food prices have weakened household spending power and threatened business profit margins. Business activity in Europe fell in August pointing to a sharp slowdown in global economic growth as higher prices have weakened consumer demand and the war in Ukraine has scrambled supply chains.

The second month of declining activity in Europe has come amid a renewed rise in energy prices and uncertainty about Russia’s willingness to maintain its already reduced supply of natural gas ahead of the heating season.

Manufacturing output fell for the third straight month, while the services sector narrowly avoided a contraction. Businesses in both sectors reported a decline in new orders, which pointed to weakness in the months to come, while factories reported a buildup in inventories as goods remained unsold.

For now, however, the jump in inflation has yet to derail the eurozone’s recovery from the pandemic, which has been slower than in the U.S. partly because government restrictions were lifted later.

The eurozone economy will likely have a contraction in the final months of the year as high energy prices take a bigger bite out of household budgets. The duration and severity of that contraction will depend on the scale of the hit to household spending, and whether energy rationing that would directly reduce factory output would become necessary.

Global: Global growth has been marked down in 2022 to 2.9%. The outlook for 2023 has also deteriorated, with output expected to advance 2.7%. The downward revisions have mostly been attributed to the ongoing supply shock from the war in Ukraine. The combined effects of supply chain pressures and high commodity prices have compressed margins and fueled inflation. The tremendous geopolitical uncertainty underlying these strains is unlikely to be resolved in the coming months. Consumer sentiment has soured around the world as surging costs for essentials e.g., food, energy, and shelter, have cut into household budgets. Rapidly tightening financial conditions have raised debt burdens and clouded prospects, especially for 2023. Although the summer months are likely to bring a burst of activity with fewer public health restrictions allowing for access to more services, the growing squeeze on disposable incomes and less optimism about the future will see household purse strings tighten come fall and winter.

In China, COVID has continued to dictate the economic trajectory. The target of roughly 5.5% growth in 2022 looked to be out of reach as the Zero-COVID policy led to lockdowns in multiple cities in the spring. Moreover, the risk of another wave of infections has loomed as the virus continues to circulate globally. The current gloomy mood has naturally placed the focus on downside risks to the global outlook.

However, some meaningful upside risks are notable. European nations have enacted fiscal measures to offset the cost-of-living crunch – thereby insulating real incomes. As monetary policy has continued to tighten and demand for core goods have eased, this could set in motion a “bull-whip” effect whereby goods inflation would ease substantially more than anticipated. This in turn could mitigate the likelihood that policymakers would resort to truly restrictive interest rates. As labor markets have continued to be very tight, a scenario of slowing core inflation and insulated real incomes could set the stage for a rebound in consumer sentiment and a less severe slowdown in spending.

Outlook: Both the U.S. and global economic outlooks have dimmed over the past quarter. U.S. inflation is running close to a 40-year high, while unemployment is at half-century lows. Global economies are reeling from the effect of multiple shocks—the coronavirus pandemic, a massive fiscal and monetary policy response, and the fallout from Russia’s war in Ukraine. Central bankers could soon confront difficult trade-offs between bringing down inflation and preventing a large rise in unemployment.

The higher interest rates required to fight inflation will further cool demand. The U.S. could see substantial downgrades to economic growth, as interest-rate-sensitive sectors bear the brunt of the markdowns. Growth is expected to fall meaningfully below its long-run trend pace, and unemployment rates would rise from their current low levels. A recession is not necessarily in the cards, but with growth close to stall speed, there is a very thin margin for error if another shock hits economies. Higher interest rates are needed to control inflation from getting out of control throughout much of the world, fanned by the knock-on effects of the war in Ukraine on commodity prices. The path of the conflict could remain highly uncertain, but, six months in, it is clear that Russian energy will be constrained on international markets for quite some time, prolonging high energy prices. With all this uncertainty, monetary authorities have their work cut out for them trying to reduce excess demand for goods and services as well as labor, without snuffing out the economy’s growth entirely.

U.S. growth is expected to slow towards year-end as the monetary pendulum swings from accommodative to outright restrictive by later this fall. Growth is expected to decelerate to 0.9% on a Q4/Q4 basis and average 2.2% for 2022 – a marked slowdown from last year’s 5.7%.

Sources: Department of Labor, Department of Commerce, Morningstar, Bloomberg, Institute for Supply Management

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.