Woodbridge Branch Now Open with Some Special Offers

Earn a $200 bonus* with a new checking account. Enjoy a 4.00% APY** with a new savings account.

OPEN A NEW CHECKING ACCOUNT

$200 Welcome Bonus

When you open a new Checking Account with Atlantic Union Bank before June 30, 2025, and complete qualifying activities within 90 days of account opening, you’ll get a $200 cash bonus.

Three easy steps:

Open a new Checking Account online or in person. Be sure to mention the Promo Code 2004U if you open your account in a branch.

Set up qualifying direct deposits totaling $1,000 or more within 90 days of account opening.

Receive your $200 Welcome Bonus within 30 days after all requirements are met.

Watch your savings soar

4.00% APY Personal Savings Account

Put your money to work when you open a new Personal Savings Account offering a competitive Annual Percentage Yield (APY), currently at 4.00%.

Offer available only for Personal Savings Accounts opened at our new Woodbridge Branch.

Round Up Savings

With Round Up Savings, every transaction you make with your debit card will be rounded up to the nearest dollar – and then the extra money will be deposited straight into an Atlantic Union Bank savings account of your choice.

You can open a new personal savings account with a current 4.00% APY** as a great option for your round-up to go to.

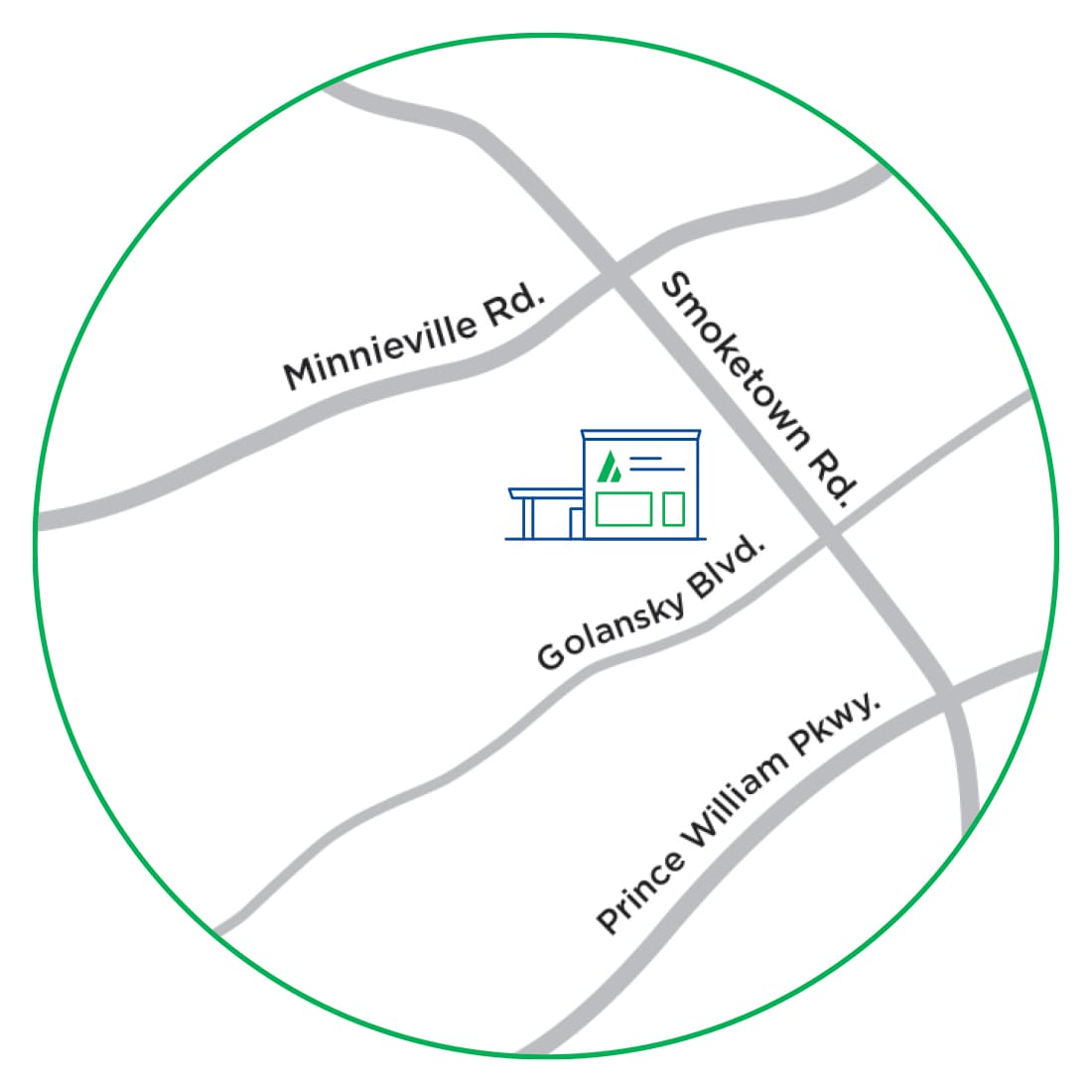

WOODBRIDGE, VIRGINIA BRANCH

Our new branch is now open to serve you.

We're so excited to be in your neighborhood. Stop on by at 13794 Smoketown Road in Woodbridge to say hello and open your new account.

CHECKING ACCOUNT FEATURES

Which checking account is right for you?

Explore the options we offer in the chart below. All accounts come with free Online and Mobile Banking, plus a contactless Visa® debit card. Access thousands of ATMs nationwide through the SUM® ATM Network. Plus, all accounts are FDIC-insured up to applicable limits.

Want to open a checking account and unsure of where to start? We have a variety of options available to suit your needs. Use the links below to open an account and have your 2004U promo code automatically applied!

|

|

|

|

|

|

|

|---|---|---|---|---|---|

| Available for | Customers that want a low-cost checking account with no overdraft fees. (Not eligible for Overdraft Privilege Services) | Customers that don’t want monthly service charges or minimum balance requirements. | Customers that want to earn interest and enjoy enhanced account benefits. | For customers that want to experience our highest level of checking, access unique benefits and enjoy higher rates paid on higher balances. | Current or retired Teachers/administrators, Local, State and Federal Law Enforcement, Fire Fighters, First Responders, Healthcare professionals and members of the US Armed Forces. |

| Minimum to open an account | $25 | $25 | $25 | $25 | $25 |

| Monthly maintenance fee | $5*** | $0 | $10 | $25 | $0 |

| Requirements to avoid monthly maintenance fee | Waived if you’re under 25 or 62 or older*** | N/A | Receive at least 1 qualified monthly direct deposit or maintain a $2,500 min. daily balance or $10,000+ combined1 | Maintain a $25,000 min. or $50,000+ combined2 | N/A |

| Interest | N/A | N/A | Tiered | Premium Tiered | Tiered |

| Free transactions from non-Atlantic Union Bank ATMs |

|

|

5 / Cycle | Unlimited | 5 / Cycle |

| Deluxe personal checks |

|

|

|

|

|

| Cashier's checks | $5 each | $10 each | Free | Free | Free |

| Free eStatements |

|

|

|

|

|

| Free safe deposit box3 |

|

|

|

Free on sizes up to 3x5 or 50% off larger boxes |

|

| Installment loan discount (w/auto draft of loan payment)4 | .25% | .25% | .25% | .35% | .25% |

| LifeLock by Norton Identity Theft Protection5 | 35% discount off first year | 35% discount off first year | 35% discount off first year | 35% discount off first year | 35% discount off first year |

| Additional benefits |

|

|

|

|

|

| Get started! | Open Account | Open Account | Open Account | Open Account |

Discounts on Personal Loans & Lines of Credit

Disclosures

*Eligibility. Offer is available only to individuals who received direct communication with the qualifying Promo Code from Atlantic Union Bank. Receiving this disclosure on its own does not entitle a customer to the offer. All eligible account owners and co-owners must be at least 18 years old and have not owned or co-owned an Atlantic Union Bank personal checking in the last 12 months. Business, fiduciary, estate and trust accounts are not eligible for this offer. Bonus offer cannot be paid to non-resident aliens signing IRS Form W-8. Offer is non-transferable.

Required activities to qualify for the $200 Bonus.

1. Open a Checking Account. Open your first new eligible Atlantic Union Bank checking account between March 3, 2025 and June 30, 2025 (the “Offer Period”) using the Promo Code 2004U. Eligible checking products include: PRISM Checking, Free Checking, Loyalty Checking, Preferred Checking and ThankU Checking. A $25 minimum opening deposit is required. Accounts can be opened in any Atlantic Union Bank branch or online using the URL provided to you in the direct communication. You must provide the Promo Code to a banker at account opening when you apply for a checking account to be eligible for this offer. When opening online using the QR code provided, the Promo Code is automatically applied.

2. Set up Direct Deposit. Set up and receive qualifying direct deposits totaling $1,000 or more in your new eligible checking account within 90 calendar days of account opening. A qualified direct deposit is an electronic deposit of regular monthly income, such as your salary, pension or Social Security benefits, which are made by your employer or other payer. Non-qualifying deposits such as wire transfers, person-to-person transfers, online and mobile deposits and bank transfers between your Atlantic Union Bank accounts or accounts you have at other financial institutions or brokerages do not qualify.

Bonus Payment: Your Bonus will be deposited into your new Atlantic Union Bank checking account within 30 calendar days after all requirements are met. Your account must be open and in good standing up to the date the bonus is deposited. If you open more than one Atlantic Union Bank checking account during the Offer Period, your bonus will be deposited into the first checking account opened. This offer cannot be combined with any other offer and is limited to one bonus per new customer and new account.

Important Tax Information: The Bonus will be reported to the IRS as interest earned on IRS Form 1099-INT in the year received as required by applicable law. Customer is responsible for any applicable taxes and consulting a tax advisor.

Atlantic Union Bank reserves the right to revoke, restrict or change this offer at any time. All accounts subject to applicable terms, fees, programs, products and services which are subject to change. Accounts subject to approval and must be funded with money not currently on deposit with Atlantic Union Bank. Participation and enrollment in a promotional offer does not guarantee eligibility or fulfillment of the promotional offer.

To print and view the full $200 bonus details please click here.

**Limited time offer. $25 minimum opening deposit required. The Annual Percentage Yield (APY) and interest rate is accurate as of April 15, 2025. Rates are subject to change without notice, before and after account opening. Fees may reduce the earnings. Personal Savings requires a $300 minimum daily account balance or receive at least one Round Up Savings transfer credit each month (enrollment required) into account to avoid $5 monthly maintenance fee. Offer available only for accounts opened in our Woodbridge branch.

***The maintenance fee is not charged if an owner on the account is age 13 through 24 or age 62 and older. To open a PRISM Checking account, at least one owner must be 18 or older. Joint owners must be 13 or older.

****To qualify for a PRISM Savings account, at least one owner of the PRISM Savings account must also own a PRISM Checking account. View the Truth in Savings for PRISM Savings for more information or talk to your Banker.

1A maintenance fee of $10 will be imposed every statement cycle unless you maintain one of the following requirements: Maintain a $2,500 minimum daily balance in the account, or a $10,000 minimum daily combined balance in personal deposit, installment loan and line of credit accounts (business accounts are excluded), or receive at least one qualified monthly direct deposit into this account. A qualified direct deposit is an electronic deposit of regular monthly income, such as your salary, pension or Social Security benefits, which are made by your employer or other payer into this account.

2A maintenance fee of $25 will be imposed every statement cycle unless you maintain a $25,000 minimum daily balance in the account or $50,000 minimum daily balance in combined balances in your personal deposit, installment loan and line of credit accounts (business accounts are excluded).

3Subject to availability.

4This is not a commitment to lend or extend credit. All loans, credit and collateral are subject to approval.

5By subscribing, you are purchasing a recurring subscription which will automatically renew. The 35% off discount price quoted is valid for the offered introductory term of one year.